Welcome back to the workweek. Let’s kick it off right with our expertly curated morning train reads:

• U.S. Money Managers Turn Cautious, reining in their optimism since the fall (Barron’s) but see Why This Old Bull Market May Not Be Ready to Die (MoneyBeat)

• The remarkable life — and investing lessons — of Ronald Read (Washington Post)

• 3 Valuable Lessons From the Nasdaq Bubble (Pragmatic Capitalism) see also Nasdaq record reflects markets stuck in time warp: Highs reinforce the lesson that valuation is a poor guide to short-term moves (FT)

• The Timeless Nature of the Herd Mentality (A Wealth of Common Sense)

• Is Obama the Most Deflationary Force in America Right Now? (Reformed Broker)

• The Death of Cash: Could negative interest rates create an existential crisis for money itself? (Bloomberg)

• Drone revolution hits the high seas (Fortune)

• Migrant boat crisis: the story of the Greek hero on the beach (Guardian)

• Will Florida’s coastal economy adapt to rising sea levels? (Quartz)

• Astronomers just detected light bouncing off an exoplanet. Here’s why that’s so exciting. (Vox)

What are you reading?

Continues here

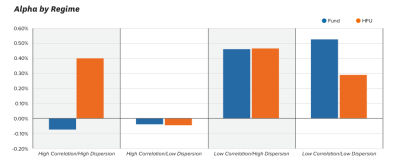

Correlations Affect Hedge Fund Managers Performance

Source: CIO

Josh Brown says…

”…I’ve been watching his performance at this event every year and have always noticed the same thing – no matter how funny the line he delivered, and no matter what the subject matter, there are always large pockets of attendees who simply refuse to laugh. Or even smile. They sit there in the audience with a look of utter disgust or hatred on their faces, an implacable disdain regardless of the mirth unfolding throughout the ballroom. The determination to hate this man and his ideals is stronger than ever – even now, in what Obama himself describes as “the fourth quarter” of his presidency…”

Well, VennData is laughing at them. And bought their stock in ’09, ’10 and ’11.

From Joe “YOU LITE!” Wilson to the Birthers like Trump, and the 47 Senators. They’re on the wrong side of history.