Close But Not There Yet: Getting to Full Employment in the United States

By Ravi Balakrishnan and Juan Solé

iMFdirect April 28, 2015

Last month’s report on U.S. jobs was disappointing, with far fewer jobs than expected added in March. A longer-term look at trends yields a different picture, however. Over the past year, U.S. job creation has been impressive. Payroll gains have averaged 260,000 per month—well above the 160,000 monthly average seen throughout the 2010–13 recovery.

As a result, the unemployment rate has plummeted to 5.5 percent in March 2015 (see Chart 1). And this level is just above many estimates of the current “natural” level of unemployment—the rate of unemployment that would prevail once cyclical factors have played themselves out and the economy is growing at trend. Some argue that a negligible difference between the unemployment rate and the natural rate—the so-called unemployment gap—is equivalent to full employment.

So, is the U.S. approaching full employment? It’s close.

The answer to this question has crucial policy implications. How close the U.S. economy is to full employment will guide the Fed’s decision on when and how fast to increase interest rates. And as the “taper tantrum” of 2013 illustrated all too well, changing perceptions of Fed policy have major implications for the global economy and financial markets.

In this blog, we argue that notwithstanding signs of improvement in the labor market, slack remains. This points to a still important role for accommodative macroeconomic policies. And we shouldn’t forget about policies to expand the quantity, and improve the quality, of the labor supply.

More slack than meets the eye

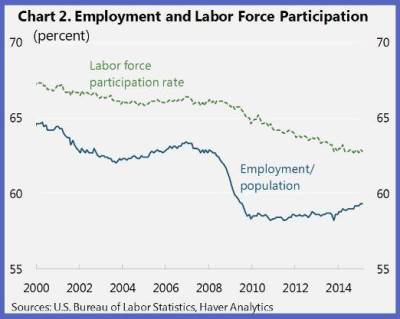

While a shrinking unemployment gap suggests that we are approaching full employment, the employment-to-population ratio paints a different picture (Chart 2). Indeed, this ratio, which measures how many of those able to work are actually employed, is still more than 4 percentage points below its level on the eve of the Great Recession.

What could cause such a disconnect? Well, to begin, there are workers who want and are available for work but did not search for jobs in the last 4 weeks and hence were not classified as unemployed (these are the so-called “marginally attached” workers). Moreover, there are still numerous part-time workers that would like to work more hours but cannot as businesses continue to face difficult conditions. Adding these components to the unemployment rate suggests that some labor market slack remains (Chart 3).

As Fed Chair Janet Yellen has emphasized, a fuller picture of the labor market requires looking at other factors beyond the unemployment rate. These include gauges of labor market dynamism such as job openings, hires, and quits, which have recovered to precrisis levels (Chart 4). The growing number of quits is particularly encouraging as it signals that people are more confident to leave their current job in pursuit of higher-paying, better-fitting opportunities.

A comprehensive measure of slack

To recap, by some important measures (like the unemployment rate), the labor market has made a phenomenal comeback from the depths of the Great Recession. Yet, there remain key areas where the crisis legacies are being slowly worked through (such as the outsized ranks of the involuntary part-timers or the current labor force participation rate that is below its trend).

To bring all these elements into a single measure of slack, our recent study computes a broadly defined “employment gap” that includes deviations of unemployment and participation rates from their trend or natural levels, and adjusts for the large number of involuntary part-time workers.

As one would expect, our measure shows the emergence of a substantial employment gap in the aftermath of the Great Recession, largely driven by bulging unemployment and part-time gaps. The participation gap, in turn, started to grow from 2010 onwards, as the prolonged recession led many to become discouraged and abandon the work force (Chart 5). It is this legacy that the labor market has been working through. Today, with an unemployment rate that has fallen to well within 1 percentage point of most estimates of the natural rate of unemployment, the remaining slack stems mainly from the participation gap, and to a lesser extent from the part-time gap. Looking ahead, we expect that overall labor market slack will disappear by 2018.

However, some uncertainty surrounds the underlying structural components of our estimate. Different assumptions could extend the date of full labor market recovery by up to one year. For instance, a lower natural rate of unemployment, a higher participation rate trend, or a lingering part-time gap would push the closing of the gap to 2019.

How to reduce the slack

Our measure of the employment gap suggests that labor market slack remains and will only decline gradually, pointing to a still important role for accommodative macroeconomic policies to help reach full employment.

In addition, given the continued decline of the participation rate, policies to expand the labor supply are vital to boost potential growth in the medium term. Key measures range from enhancing job search and training programs—to raise human capital and productivity —to targeting benefits for low-income families (for example, childcare support). Finally, immigration reform ought to be part of the solution. To counter the effects of an aging population, the United States should augment its visa program for high-skilled immigrants. This would not only enhance the size and productivity of the workforce, but also help shore up the government’s fiscal position.

Chart 3 is very informative. Just knowing U6 doesn’t tell you exactly where the problems are. Very nice to see each component.

Obviously blacks, and especially black youth, have not been rioting to celebrate this great news.

“Finally, immigration reform ought to be part of the solution. To counter the effects of an aging population, the United States should augment its visa program for high-skilled immigrants. This would not only enhance the size and productivity of the workforce, but also help shore up the government’s fiscal position….”

I’d rather hold H1B visas at the current level. They tend to depress medium and highly skilled works salaries further eroding the critical middle class income segment. If tech companies want to manage their labor expense, they should look to get out of the bay area and other typically high salary/cost areas were less salary will provide a better standard of living as opposed to importing a 10 contract engineers and having them live in a studio apartment for 11 months…

“Finally, immigration reform ought to be part of the solution. To counter the effects of an aging population, the United States should augment its visa program for high-skilled immigrants. This would not only enhance the size and productivity of the workforce, but also help shore up the government’s fiscal position…”

Are you effin’ kidding me? Increase H1-B visas, so even more companies can do what Disney

just did:

http://www.computerworld.com/article/2915904/it-outsourcing/fury-rises-at-disney-over-use-of-foreign-workers.html

The H1-B visa program should be ended immediately!

got my vote. if companies really really need the h1b workers, they should be paying them a premium, like maybe double or triple the highest average rate in the US. and pay fees to the US every month for every month worked. and those fees are for the length of the visa, not how long the worker is in the US, or how long they work for the employer. and while we are at it, make it so that paying for work done by others in other countrys for work done in the US as no longer a tax deduction.

of those who are not working and not looking how many are retired because of business choices? how many are retired because of disability? and how many have just retired?