Postmortems for Startup Failures

A new website autopsies the flops.

Bloomberg, June 10, 2015

There has been relentless coverage of the boom in technology startups. Think about the blasé way the word bubble gets tossed about. Big Wall Street banks and Silicon Valley venture capital firms are wooing geek talent, and investors seem willing once again to ignore the widespread use of unconventional financial accountingthat makes a start-up’s finances look much better than they really are. Please don’t get me started on the term unicorn — the year isn’t even half over yet, and this is already the most overhyped phrase of 2015.

What about the companies that don’t make it, the 95 percent that fail?

Autopsy, a new website — please don’t call it a startup, it’s just a side project — is looking into just that by offering what it calls “Lessons from Failed Startups.” The site launched a week ago, and quickly racked up more than 100,000 page views.

The folks who run Autopsy call themselves “undertakers.” They are Maryam Mazraei and Matthew Davies, founders of remote web studio Milc, and Niral Patel a marketing manager for a chat hosting service called Sameroom.io. The three founders are from London, though Patel is now in Krakow, Poland, and Mazraei and Davies are in Berlin.

The site allows founders and others to say a few words about the deceased before they are put to rest. The goal is to impart wisdom from failure.

Brilliant! http://t.co/Saef5t7lbY “Autopsy ⚰ Lessons from Failed Startups” — aka “Catalog of Future Successful Startups”. Well done!

— Marc Andreessen (@pmarca) June 6, 2015

Patel explained further: “Most startups fail — everyone accepts that, but you never really hear about them — so the focus is on learning from other startup mistakes. It would be great if Autopsy became the place founders came to share their stories and I would hope it would prevent others from making the same mistakes.”

As in many tech firms, there is already a FAQ to explain the thinking behind the site.

The site has no plans to get venture funding. Autopsy’s creators were pleased that “People resonate with the simplicity of the website and we’d like to keep it that way” Patel wrote in an e-mail. The site has a very simple interface, a simple Google spreadsheet that was exported as a HTML page. Total site development time: two to three hours.

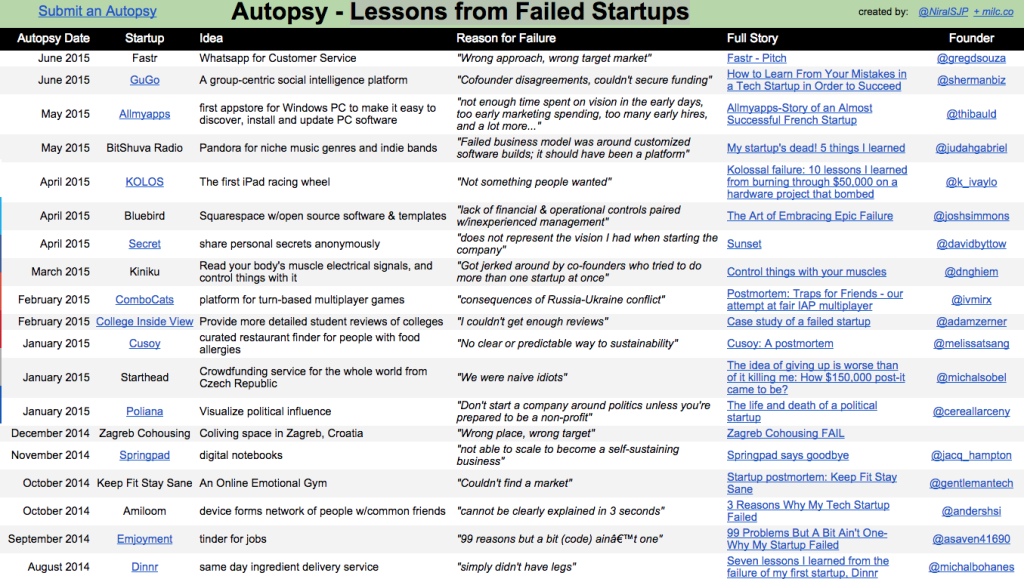

The spreadsheet has six columns: Autopsy Date, Startup, Idea, Reason for Failure, Full Story and Founder. Clicking on Full Story provides a link to a news article about the company or its demise. Many of these are confessionals or what-I-learned posts from chastened entrepreneurs.

Readers can submit a postmortem. The trio is in charge of filtering out spam and what they call “bitter posts,” then publishing. They spend a half-hour or so a day adding new submissions to the site, which now has more than 100 autopsies.

It has resonated with the tech community. It began with 70 autopsies, and a steady stream of new submissions keeps coming in. Hacker News covered the launch, and Marc Andreessen tweeted about it, generating more interest.

I found much of this insightful. Many of the items under Idea are pure elevator pitches for funding: Tinder for jobs, Whatsapp for Customer Service, Squarespace w/open source software & templates. Reading these suggests the search for funding influences the way startups feel compelled to describe themselves.

The greatest value of Autopsy is likely to be derived from Reason for Failure. These are the founders’ explanations about why each of their businesses eventually died: Lack of capital, a bad business model, an inability to attract clients, competition from Google and Apple, no profits and fighting co-founders are the main themes. The explanations are blunt, honest and refreshingly self-critical: “lack of financial & operational controls paired w/inexperienced management”; “Failed to generate enough revenue”; “We didn’t obsess over it and we didn’t love it.”

We need this for finance.

How badly are you underperforming with your entire portfolio versus your risk-adjusted target?

How badly are you being ripped off by banks trading bonds off exchange? Swaps? Why are we still doing that anyway (aside from the fact that the Republicans don’t like exchange-traded options, bonds, swaps.)