Our story so far: Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap...

Our story so far: Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap...

Read More

The transcript from this week’s, MiB: Jim O’Shaughnessy, O’Shaughnessy Ventures, is below. You can stream and...

Read More

This week, we speak with Jim O’Shaughnessy, founder and CEO of O’Shaughnessy Ventures. He is also chairman of...

Read More

The transcript from this week’s, MiB: Joanne Bradford, Domain Money, is below. You can stream and download our full...

Read More

She was previously president of Honey, where she orchestrated the company’s sale to PayPal Holdings Inc. for $4 billion. She...

Read More

A century of tech adoption in less than 30 seconds: Blackrock: “The key to harnessing mega forces and their...

Read More

The transcript from this week’s, MiB: Sarah Kirshbaum Levy, CEO Betterment, is below. You can stream and download our...

Read More

This week, we speak with Sarah Kirshbaum Levy, chief executive officer of Betterment, an independent digital investment...

Read More

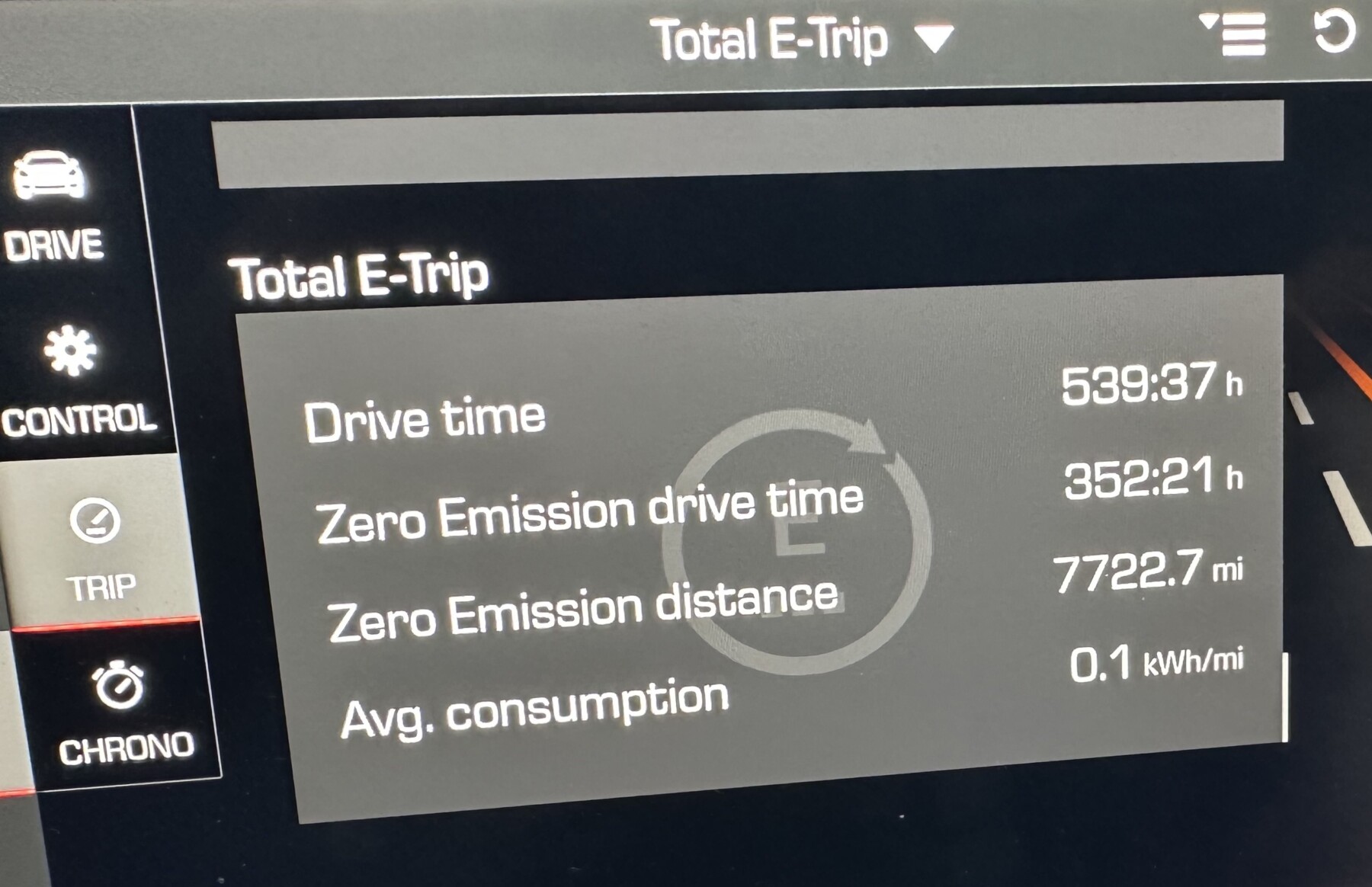

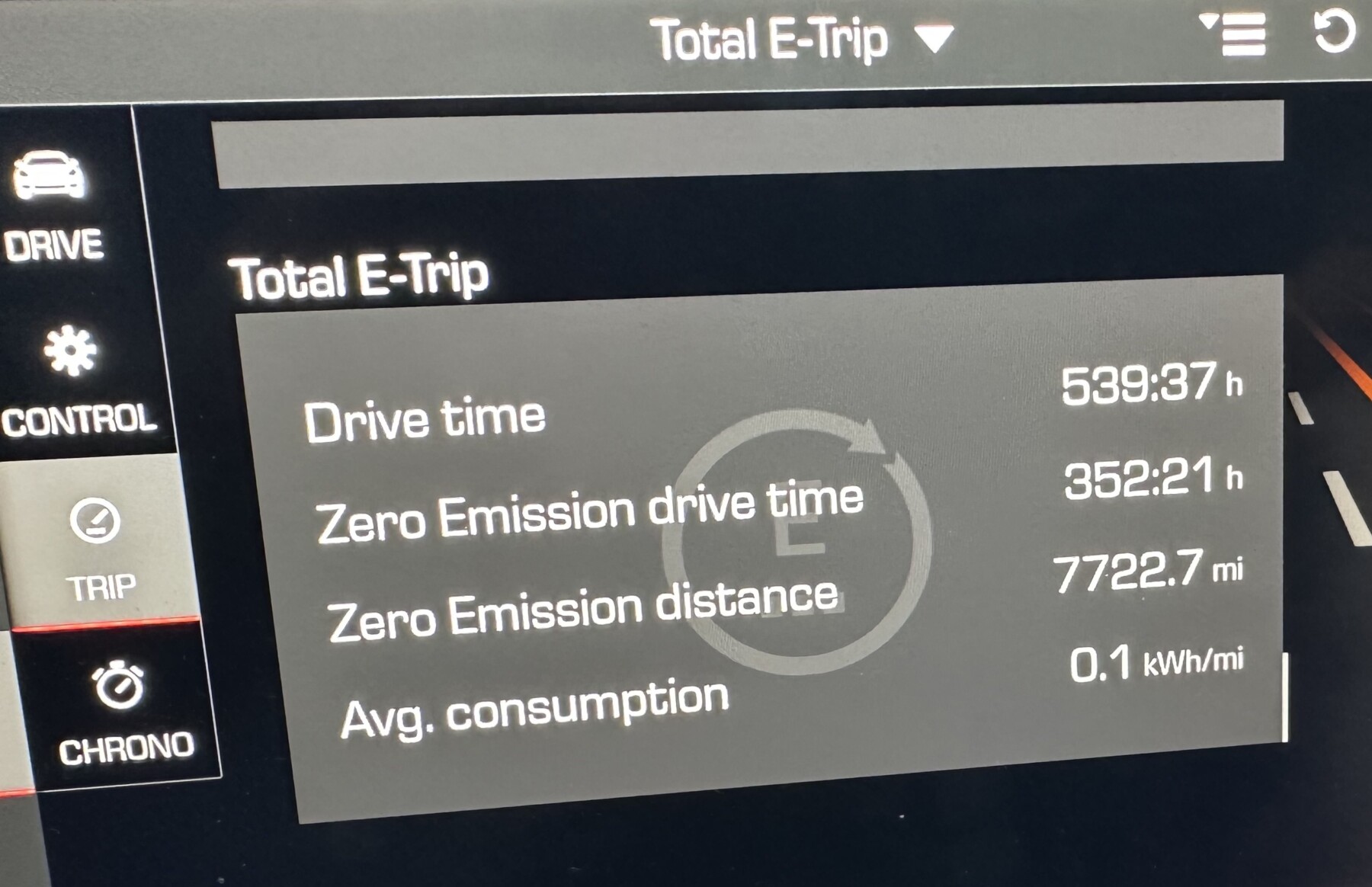

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Read More

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first...

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first...

Read More

Our story so far: Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap...

Our story so far: Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap...

Our story so far: Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap...

Our story so far: Stuck at home over the pandemic, it was a perfect time to revisit a pastime of my youth – buying cheap...