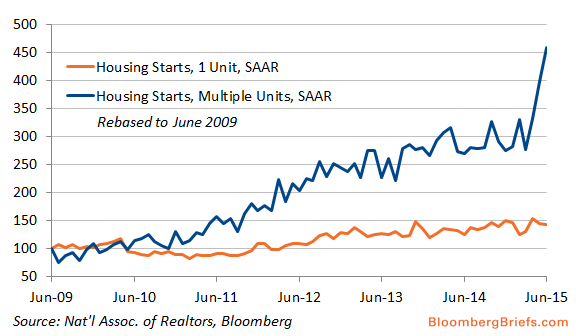

Friday’s U.S. housing starts data showed new-home construction last month rose to its second-highest level since 2007, with much of that gain being driven by apartment projects. While that’s good news for the growing number of Americans eschewing homeownership, it could also mean the housing market improvement packs a slightly smaller economic punch, according to Ryan Sweet, a senior economist at Moody’s Analytics Inc. Each multifamily housing start creates about two jobs over the course of the year, while each single-family start creates four or five, he said. Apartments are usually smaller than single family homes, and less building materials are often needed. There’s also a trickle-down effect involved when people buy a home because they have to buy all the things that go into it. Smaller spaces theoretically mean less stuff bought to fill them, which means relatively less demand for that stuff, which means fewer people needed to make that stuff.

Source: Victoria Stilwell, Bloomberg News

The headline reads: “Apartment-Led Housing Recovery May Pack Smaller Punch.” Really?!

I guess it depends on what you’re measuring. Higher-density housing typically means increased localized retail sales activity, as well as more need for shops and restaurants, professional services, etc. No, everyone in apartments aren’t running out to buy new Bosch dishwashers, slate countertops, and new washers and dryers, but it’s hard to imagine four to six units in the same footprint as a single famly home NOT affording fiscal benefits to the community in which its situated. It’s also far more “green” in relation to economic and ecological efficiencies.