Source: World Property Journal

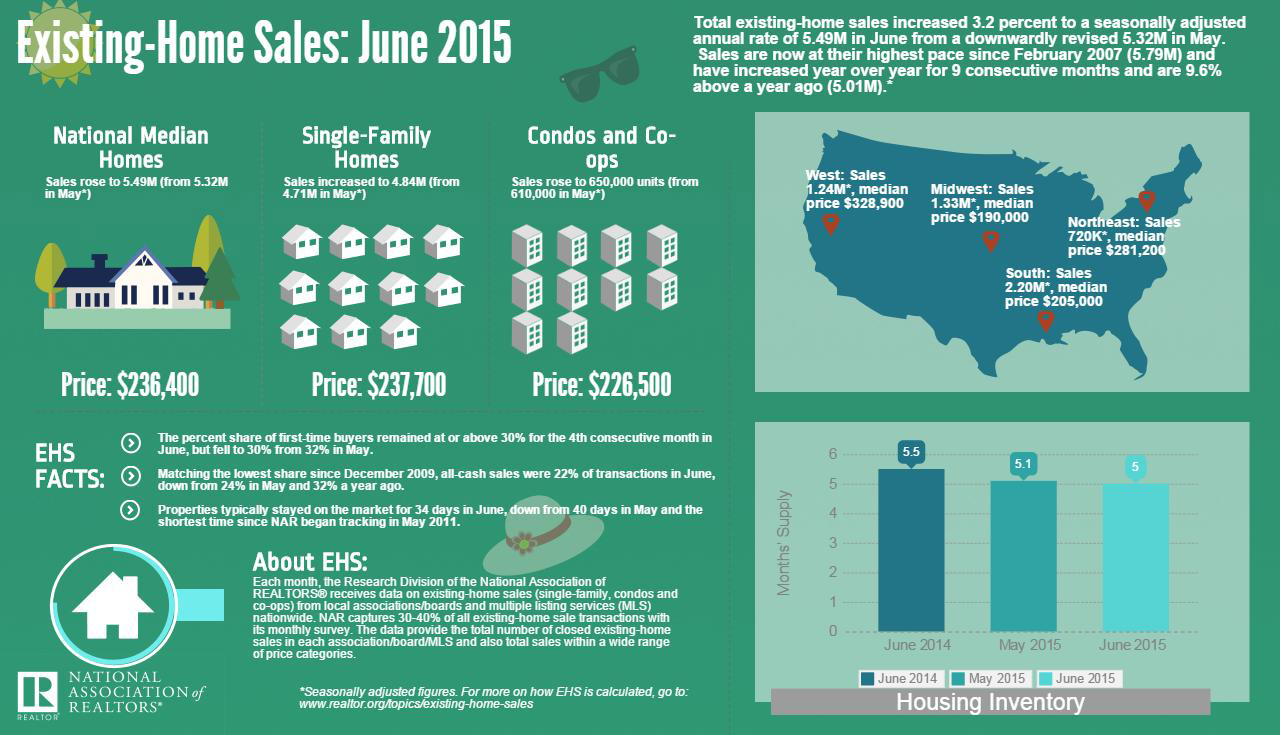

Existing Home Sales: June 2015

July 23, 2015 12:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Gold Miners Are No Longer a Proxy for the Metal

Any concern that housing data trends are being presented as “the best since -insert date here-” and that date is, generally, 6-24 months before the housing bubble burst? Or that we are 6 years clear from the last recession and have never achieved “escape velocity”, from a GDP growth standpoint? What about the continuing stream of downward revisions on economic data? What about the effect of increasing interest rates on the housing market? Or the stock market? Or consumer confidence? Great chart porn, though…

Except housing starts keep on getting upwardly revised and the permits are blowing up. GDP may have already broken escape velocity, revisions are cruel.

From a RE perspective, existing home sales have been solid for months. From the production side of it, emergence from recession is becoming clear.

Since it is half of my net worth – from your lips to the Easter Bunny’s ear, futuredome.

Impressive that Yun is still at NAR 7 years later.

” NAR Denies Recession

Says Home Sales and Prices Will Pick Up in Second Half of 2008

National Realty News WASHINGTON, D.C. – Home sales and prices throughout most of the country are poised for improvement in the second half of 2008, and the recovery will vary by market, Lawrence Yun, chief economist for the National Association of REALTORS® said during NAR’s Midyear Legislative Meetings & Trade Expo. ” From May 16,2008.