“A gold mine is a hole in the ground with a liar standing on top of it.”

— unverified quote attributed to Mark Twain

A few weeks ago, we discussed how gold can’t seem to catch a break. Despite a parade of potential market–roiling news, the reaction of the shiny yellow metal has been one of benign indifference.

After Federal Reserve Chair Janet Yellen’s testimony about the likelihood of an interest rate increase sometime this year, gold fell for a fourth consecutive day. Gold now trades at about $1,142 an ounce. Aside from a three-day stretch in November 2014, gold hasn’t been below $1,150 since 2009.

This isn’t going to be a goldenfreude column, gloating over other people’s losses. I have addressed issues in the gold-bug complex repeatedly (see this, this, this, this, this, this, and of course this). Instead, I want to consider the gold miners to determine if, after the fall in the price of gold, there is any value to be found there.

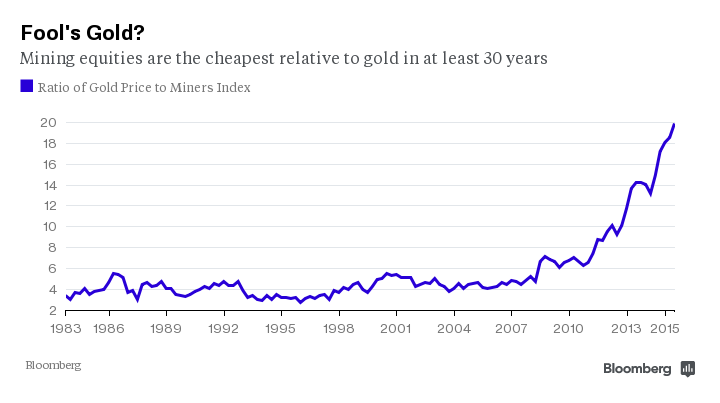

What got me thinking about this was a fascinating chart above, courtesy of Isaac Arnsdorf yesterday at Bloomberg News.

Despite the strong dollar and subsiding geopolitical tensions, gold as of yesterday was only down 3 percent so far this year. That compares with a drop of almost 17 percent during the same period for shares of miners, as measured by the Philadelphia Stock Exchange Gold and Silver Index.

That makes the miners the cheapest they have been relative to gold in at least three decades. (Gold and the miners began going their own separate ways not too long after the SPDR Gold Trust was introduced in November 2004. Whether that’s a significant factor or merely a coincidence has yet to be determined, but I suspect it’s the former.)

Does this make the gold miners a buy? To answer that question, you have to make three correct guesses.

They are:

1) Where are gold prices headed?

2) Will the longstanding ratio between mining share prices and the price of gold revert to the mean?

3) If the ratio does return to historical norms, will that happen because of price changes in the metal, price changes in the shares of the miners or both?

My answer to all three is: “I have no idea.”

Are the miners leading gold down? Maybe. Of course, gold could also be signaling that the miners are cheap; maybe the miners’ shares will rise, sending that ratio toward its historical average during the past 30 years. Or maybe the miners could indicate that gold remains pricey, and the ratio could shift by gold going lower still. Or perhaps the ratio is a broken indicator and no longer meaningful.

The trouble with valuing the gold miners is a derivative of the issue with gold itself: I simply don’t have a reliable way to value the metal. I suppose we could try to value the miners by looking at traditional metrics, such as the price-earnings ratio or book value. However, two highly random, unknowable inputs — the price of the metal and the accuracy of total reserve estimates — are so critical to valuing the miners that the usual valuation measures become slave to these data points.

Owners of the gold miners need to recognize exactly what they are doing — making multiple speculative forecasts, not investments based on probabilities.

Originally published here: Are Shares of Gold Miners a ‘Buy’?

The miners usually lead the metal?

I have no idea how gold mining shares will perform against gold going forward, but I do not believe that the historic gold price/gold miners ratio is likely to be reestablished.

The classic reason to own stocks of gold extraction companies was because it was the only traditional way to gain exposure to gold without having to store coins and bars in a safe behind the family Rembrandt.

With the advent of gold ETFs, that has changed. Now the underlying asset can be acquired without exposure to the risks and travails of the mining business.

Gold extraction is a risky venture; mines are often located in areas of labor unrest and/or unstable governments. Due to the value of the mineral, security costs are high, and gold mining generates significant amounts of toxic waste. Like any commodity producer, miners are unable to differentiate their product in any way, and have no pricing power.

Gold Bugs will protest that ETF shares are mere “paper gold,” but the same claim could be levied against the stock certificates of any gold mining concern.

~~~

ADMIN: That exact premise is discussed in the full column

Gold stocks can do very well in short periods but they are highly volatile and especially difficult to time with any reliability. I held a good chunk of the gold ETF starting in early 2004 and have no complaints although I stayed with it long enough to give some of my profits back. Gold stocks, on the other hand, never worked for me. Even the gold-mining “experts” are mostly talking out of their asses.

I subscribed to Fleck’s daily commentary for years. While gold was doing well, it seemed to be worth the time and the small cost (although his stock picks were, at best, hit-and-miss). Eventually, it became clear that he was out of step with the market and unable to adjust (I got tired of reading that “the market is stupid and prices are wrong” and why the market would eventually succumb to the bulletproof logic of Austrian economics). Speculating in gold is not that different from speculating in a lot of other things but it does seem to attract its share of true-believers and other loons.

I’m holding onto about $500 of Mongolia Growth Group as a reminder every time I check my Scottrade account.