Earlier this summer, I tweeted a wonderful line from Brett Arends column, 25 things I wish I knew when I graduated from high school:

3 simple rules will explain 99% of human behavior 1: Most people don’t think. 2: Some people are jerks. 3: Everyone is selling something.

— Barry Ritholtz (@ritholtz) June 15, 2015

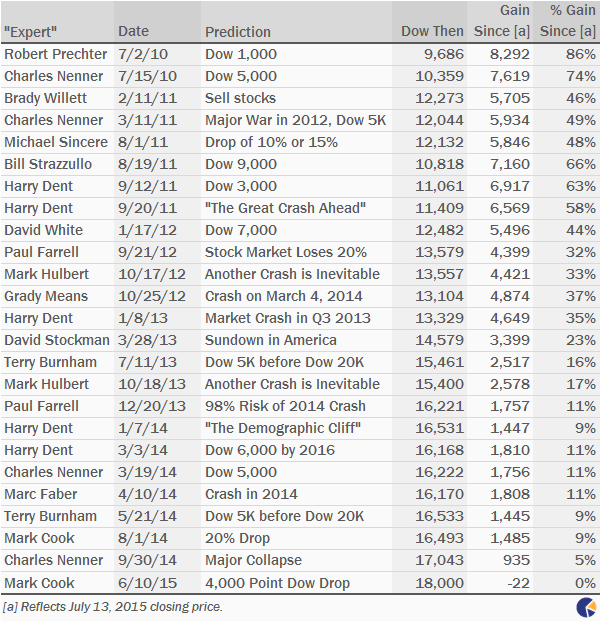

That led to a delightful column last week from Michael Johnston’s A Visual History of Market Crash Predictions.

Here are some of the more egregious calls, but the entire article is well worth your time to read:

Source: Fund Reference

Source: Fund Reference

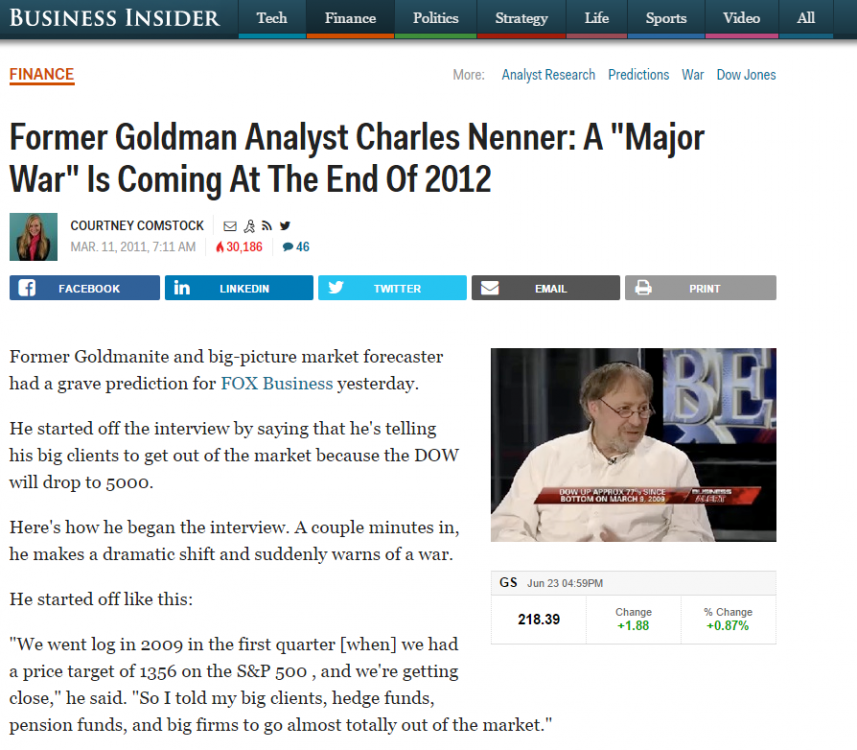

Eventually Harry Dent and Charles Nenner will be right. “Eventually” is sometime between now and 100,000 AD.

crash is always just around the corner. or next year or the year after that. never mind that they have been wrong so far. all it takes its one time to be right. sort of like those who predict the end of the world (last seen about 2-3 years ago.). course in that case being wrong just means you can do it again, being right means no one knows you were right

Were you fully invested in 2000? In real estate in ’07?

If not, what is the difference? How was that not a forecast? Was it random luck on your part? Or you were a better forecaster?

~~~

ADMIN: Just lucky . . .