Source: JP Morgan

S&P 500 Performance and Valuation

July 14, 2015 12:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

US-Iran Treaty Can Send Oil to $40Next Post

Nebula NGC 604 Gas Clouds

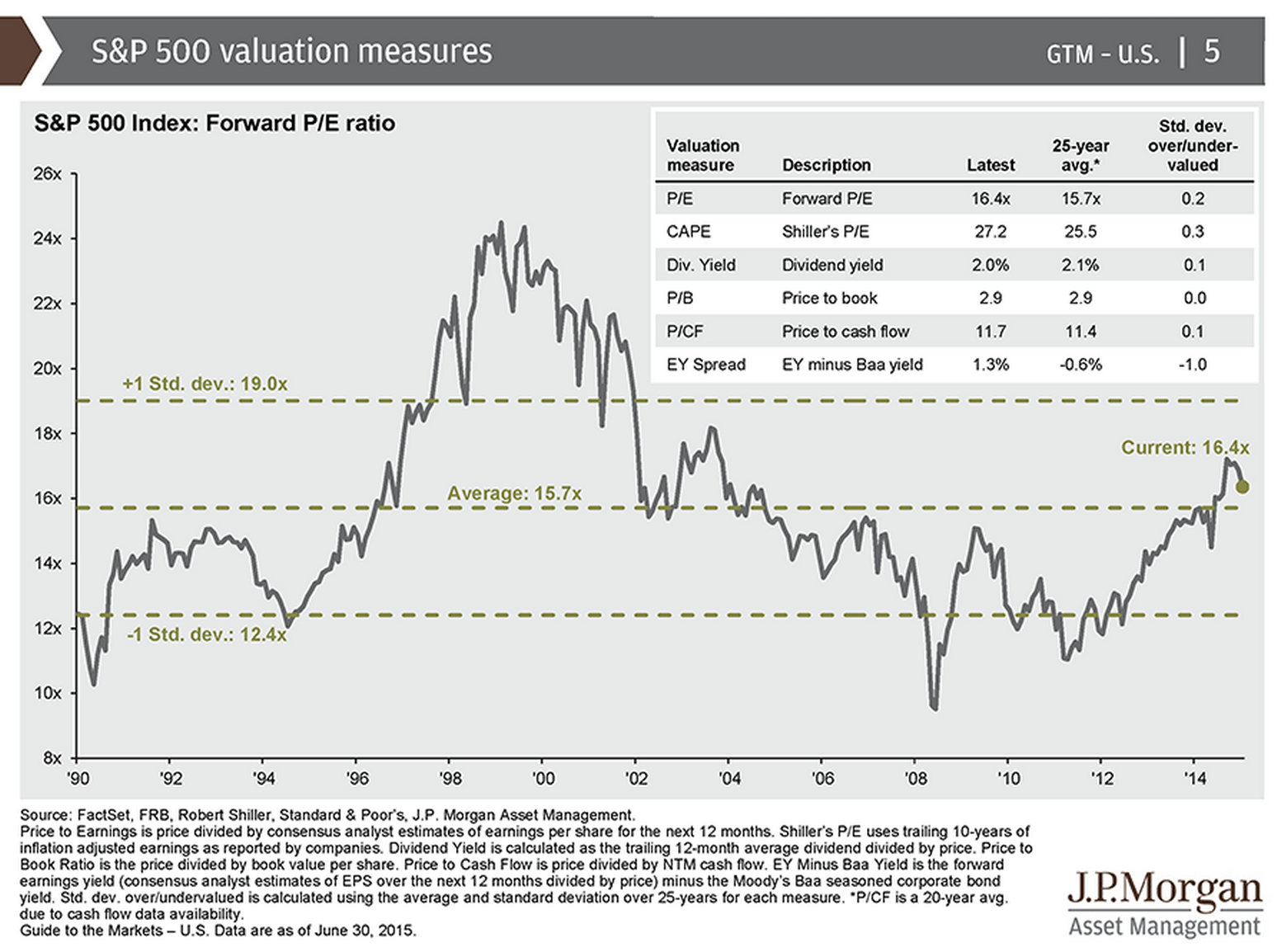

I am always distrustful of valuation averages based on recent periods. It is pretty clear that stock market valuations undergo long periods of relatively high or low valuations. These periods can last 10-30 years. We have been in a high one over the past 20 years, so a 25 year average shows a high average, much above the historical norm. http://www.advisorperspectives.com/dshort/updates/Market-Valuation-Overview.php

However, I have not seen anybody able to accurately predict when the valuations turn over and flip to the opposite trend. I think that is the big question about valuations right now – do we stay in the high zone or flip to the low zone in the near-future.

In addition to rd’s point above re: recency bias in the dataset (a period largely characterized by central bank pumping/puts), I believe these earnings are based on non-GAAP accounting. The GAAP P/E is higher, over 20 I believe.

It is incredibly difficult, nigh on impossible to find good value anywhere in the US “market”. The central banks have done an excellent job at inflating just about everything. Value investing is dead until “markets” are no longer policy instruments, which I don’t expect to happen for years, perhaps decades.

The central bank? lol. The central bank is irrelevant. I can find good value all the time. If you want to play it cheap, get out. You want to play it cheap and create intellectual fantasies.

What a ridiculous comment.

The central bank is irrelevant? Is this meant to be a satirical comment?

As for your ability to find good value, I encourage you to try and find Graham stocks in the S&P 500. Have fun with that.

I further encourage you to read this short article on median stock prices:

http://www.wellscap.com/docs/emp/20150108.pdf

Then, just for kicks, read Doug Short’s latest on market valuations:

http://www.advisorperspectives.com/dshort/updates/PE-Ratios-and-Market-Valuation.php

In short, not only is the broader “market” significantly overvalued, but there are few if any pockets of value, either.

If your definition of “good value” are stocks with 20+ P/E’s, P/B > 3, and declining revenues, we’ll agree to disagree. For surely there are plenty of those out there right now.

If anyone is creating intellectual fantasies, it is you.

This is an excellent example demonstrating the only ‘constant’ is change…