Source: WSJ

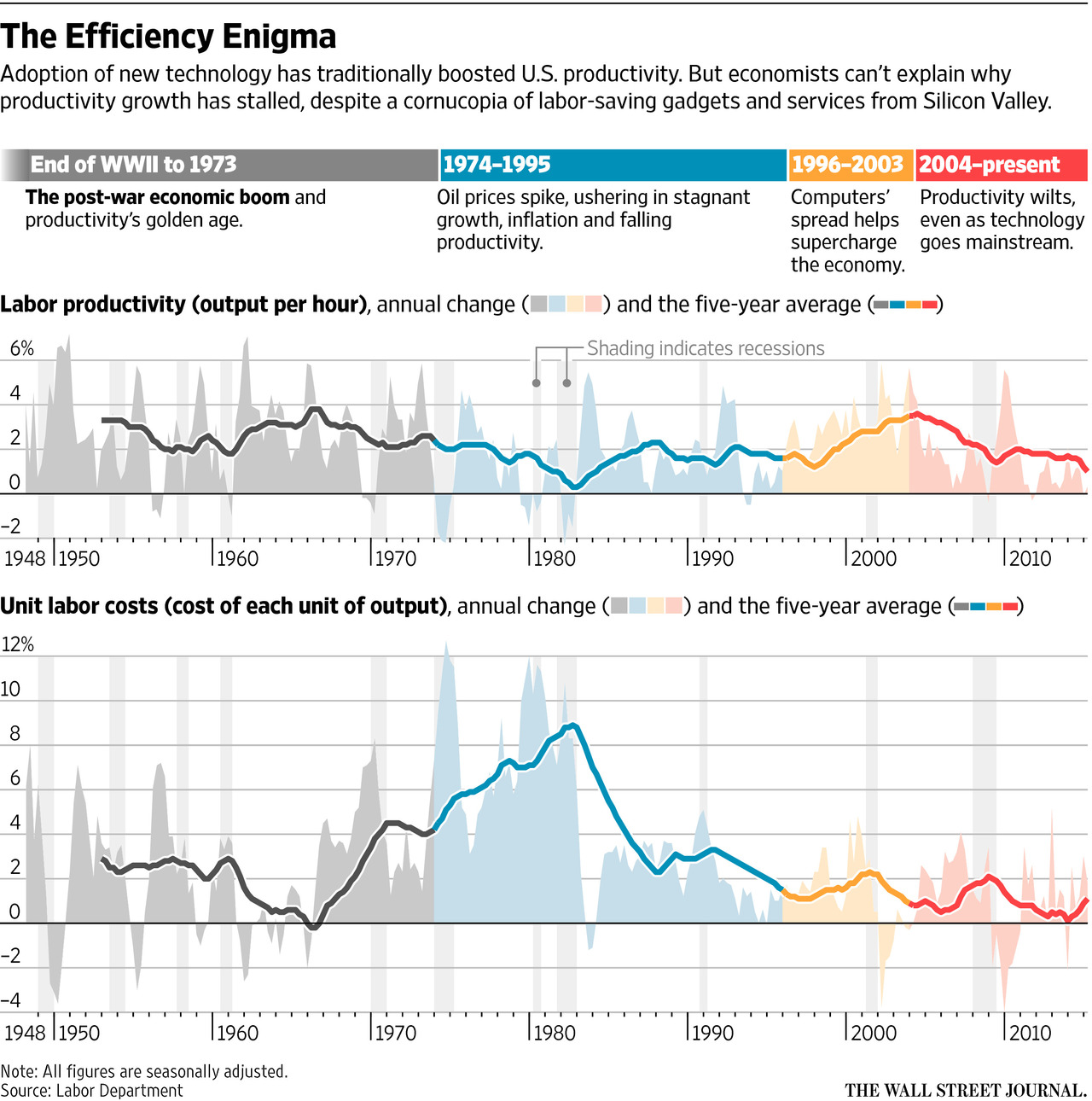

Stalled Productivity Growth Despite Cornucopia of Labor-Saving Devices and Services

July 22, 2015 4:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

When Your City Became Unaffordable

The solution is to repeal Parkinson’s Law and make Dilbert cartoons obsolete by firing the pointy-haired boss.

Corporate management is too focused on short-term cost cuts and stock buybacks while government uses sequester-style meat aces to manage budgets. Many organizations have lost the capability to effectively plan for the future and then work the plan.

Hard to be productive when you are unemployed…

Mr Ritholtz, nice piece. Imho simply because (my) digital revolution changed the shape of employment, shifting (relative) man-hours from high level activities to baristas and potato fryers. Output per hour is a bit different from an highly skilled mechanic tuning up turbines at Pratt & Whitney and a person pushing buttons on a soda fountain at your favorite luncheonette, but both are one number in averages. If you lay off the mechanical and make him go at soda fountain, even if cumulative output is the same in value, labor productivity fall. You can see it clearly putting both graphs together, seeing that unit hour cost fell more than unit productivity The game is changing, and recessions have the accelerating effects that once had wars. I don’t like recessions, but between recessions and wars, I love recessions. BTW I can’t but remind myself that my generation is the first generation of Europeans since ever not having heard a shot (or an arrow or …) fired (thrown …) in anger against by a fellow European under a different flag (except civil wars, the worst of wars, but that’s a different story)

Lack of public investment is probably a big issue. Businesses are always thinking about the short term, public investment thinks about the long term. Little surprise the recession of 74-75 was the beginning of the public investment pullback and outside the computer boom, productivity has decelerated.

The wealthy don’t want public investment. They just want more concentration and dismantle national institutions for their own control.

The internet, meetings, and push for more productivity. There is no longer time for the kind of lose creative interactions that make a real difference.

Just a theory, but could it be that more recent technological advances have been more distracting than productive? As computing moves to small, mobile devices, it seems that productivity has become secondary to communication and entertainment. People create things on desktop computers, but they generally only consume things on mobile devices. And it’s clear that many people are no longer buying desktops. I read this recently: http://www.forbes.com/sites/timworstall/2015/07/18/googles-hal-varian-on-where-all-the-productivity-has-gone/ , but it seems that the distracting nature of much of modern tech is being ignored.

Totally agree with Jason – everyone ia running around with their smart phones in constant browsing/on mode and people are checking their facebook , websites, games, utube all the time – of course they don’t get anything done. Do you not have teen agers and see how they are completely distracted?? The worst thing I did was get my son a smart phone. He had a dumb phone and itouch before which made him have to switch to do things. Now he is constantly on the iphone and can’t get anything done.

So it is no mystery and will only get worse.

Spent 2 weeks out in the wilderness with no technology and it was heaven – I actually talked to people.

When our lease is up in a Class A Newport Beach Office Tower, we are letting it go because of our mobile devices can communicate very effectively with our Class C space operations Center in Nevada. Our owner is going to save 30K a month, and drop that all to the bottom line. Our customers do not come to the office anymore, they want us to come to them. I don’t think mobile devices are the problem

My view is that companies have hit an inflection point where every cut to labor cuts productivity, and the rise of the machines is not mature enough yet to reflect that new tidal wave labor savings.

I’m much better navigating with my smartphone now compared to the days I used paper maps.

I’m far more informed now with online information sources when I make decisions compared to the days when I made ill-informed decisions

I’m much better keeping up to date with far flung friends and family now, compared to the days without social media

Such comparisons are endless, but I don’t think they get measured.

I have found that the expectation that you can get hold of anybody at anytime to get them to do anything has virtually eliminated planning for many people. They are then shocked when they get told “No. I will not drop everything I am doing at the moment to solve your problem that you have failed to address for four weeks and needs to be resolved by the morning.”

One additional thought on productivity changes that I think is often overlooked. Beginning with Truman desegregating the military, the next 30 years had huge societal changes where minorities and women had doors opened to them that were never open before. More of them began going to college or working in careers that were not open to them before. This allowed many of the best and brightest of large swathes of the population to become more productive than they could ever have been before in history. The rate of change in this was very high during this period. I find it hard to believe that it did not contribute to a significant percentage of the increase in productivity.

And it may be that now when we have switched from the best and brightest going to the top universities to the offspring of the rich going to the top universities – that may have moved us in the other direction.

The real answer is that productivity rates have varied a great deal during different decades and eras, for multiple reasons.

From 1900 to 1920 the average annual growth rate was approximately 1%

It doubled to 2% in the 1920’s,and hit an historic peak of 3% annually in the 1930’s.

It slipped slightly during the 1940’s to 2.5%, then 2% from 1950-1973, to just under 1% from 1973-1990.

Edged up a little over 1% during the 1990’s, to 1.5% during the first decade of this century.

The long term average 1950-2010 is between 1.2 to 1.5%

Source: Total Factor Productivity Growth in Historical Perspective – Congressional Budget Office paper 2013

By the way, productivity output growth matters very much as it’s the crucial number in total economic growth: Productivity percentage growth + percentage increase of workers = GDP growth rates.

(Basically).

Technological changes, methodology and organizational changes (think assembly lines, and modern management), improvements in transportation that is non-tech (better and more roads). Rising wages seem to contribute to higher productivity, but only up to a certain point.

The health and average age of workers are known to be significant factors – it’s been found that the optimum workforce is employees in their 30’s to 40’s, they have the energy, experience, and generally good health to be peak producers, in almost all fields.

One factor that many overlook: a general decline in the growth rate of workers, often leads to an offsetting increase in productivity per worker (kind of obvious if you think about it).

The thing is, unless you can explain growth rates in earlier periods, you really are just guessing about explaining what is happening now. (And, please explain why the 1970’s were so slow in the United States, but not in Europe?)

One final note: the two biggest contributions to accelerating the growth of productivity in American history were the transportation revolution in the 19th century, and electric power in the 20th. By comparison, nearly everything else we’ve developed, pales.

Sometimes there are smarter ways to do things “innovation” that creates productivity, sometimes you just need to work more to achieve productivity, and some times working hard yields innovation. It does not seem like the United States is well suited for hard work these days, change has come.

well, it seems that digital revolution has attracted interest. I would like to sum up the question with a (bad, very bas) calembour, that is digital revolution made a lot of workers move from chips (integrated cirquits) manufacturing to chips (potato) frying or to unemployment checks. Man-hours statistics, based on number of individuals working and their output, suffered. I have two middle aged daugthers in law and one 13 years old granddaugther, and I think they have the most powerful thumb musculature ever seen in human evolution. They do waste a lot of time they had better use boiling tomato sauce for winter. But, if I goon checking my power bills, I noticed that electricity one went down by an hefty 30 % in few years, and natural gas (in Italy we use ng for heathing) halved. Why, and how ? simply I have taken my home to 2015 standards (led lightning, hi insulation window panels, condenasation boiler, low temperature radiators, last but not least new PCs …) None of this was available 10 years ago, and all and any are side effects of digital revolution. I work at home, and do not travel that much, but a simple dashboard GPS licked away quite some miles per year, and this with a new car that guzzles at least 1/3 less than my old, beloved, Lexus. Of course then I was operating a car, now I’m taken about by a computer with four wheels and an engine disguised as a car. The core of digital revolution is, I think, not easily seen in design and manufacturing procedures. Engineering has been turned upside down, and dramatically improved. You can grow your thumbs musculature as you like better, but what you’re wasting is an epsilon (as we say in math) vs the overall profit. I think that in a not so long run, working will be somehow an option, not available to anybody. Option … one could be free to chose if work or do something else, not our unemployment

It seems that digital revolution is a sensible matter. In order to grasp some details, I think that it is necessary to take into account that in many instances it is not easy to locate its effects. Most of these, in fact, lie in improved engineering, higher robotics employment, reasearch fall down. The car I’m driving is a computer with 4 wheels and an engine, but feels and looks close to the one it superseded, even if has dramatically improved road handling & safety and 1/3 more mpg. Manufacturing it, moreover, requested far less man-hours, most supplied by less qualified personnel. So the unit of wealth, one passenger car, came to have quite a lower cost, and thus for the man-hours side, falls into Mr. Ritholtz graphs. One fact is surfacing, the unit of wealth is no longer the value in currency of the product ? this opens way to a lot of consequences. Let’s do the process mathematicians do when researching, draw phenonomen under investigation to the extreme. Let’s admit that any manufactured item has a small cost, an epsilon as small as you like, like it’s habit to say, what are consequences ? I do not know, but I deem that the whole model of society and economic would no longer be applicable. So I strongly suspect that it would advisable reverse engineer the matter starting from there back to real situation: some true world consequences will follow, and help decode Mr Ritholtz graphs.

well it seems that there has been some confusion in posting, I thought that the 2.49 am post was lost, and so I rewrote (more or less) it. I’m sorry

Like the drunk staggering under the streetlamp vainly looking for his keys, the WSJ is looking in the wrong place:

https://twitter.com/CrocodileChuck/status/623200053293916160