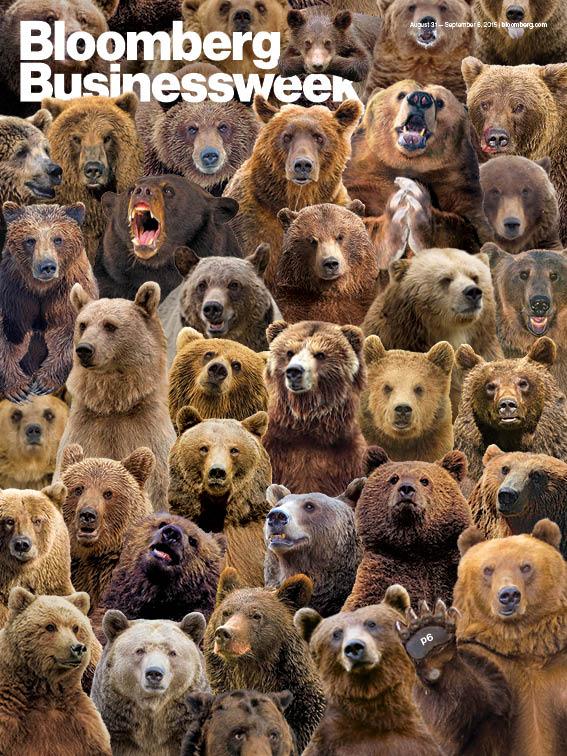

I know a bear on the cover is bullish, but what about 37 bears?

Oy!

Previously:

• Uh-Oh: Time Magazine on Housing (June 6, 2005) BEARISH

• Uh-Oh: Facebook’s Zuckerberg is Time Man of the Year (December 17th, 2010) BEARISH

• Uh-Oh: Gold on the Cover of NYT Magazine? (May 15th, 2011) BEARISH

• NYT Sunday Business: Magazine Cover Indicator? (January 1, 2012) BULLISH

• Barron’s Cover: Don’t Lose My Money (January 28th, 2012) BULLISH

• Magazine Cover Indicator: New York “End of Wall Street” (February 6th, 2012) BULLISH

• Best Investment According to the Public? Gold (May 3rd, 2012) BULLISH equities BEARISH Gold

• Uh-Oh: NYT’s Front Page Cover Indicator (January 26th, 2013)

• World’s Biggest ETF/Contrarian Indicator: GLD > SPY (April 15th, 2013) BULLISH

• The Bubble in Bubbles (November 19th, 2013) BULLISH

I guess it bears repeating.

So hard to get them all to smile at the same time.

37 bears? OMG, that’s a prime number! And that must mean …uh, something.

Markets either negative or close to negative for the year – traders, mutual funds and hedge funds only have 2-4 months to show glowing eoy numbers – Bullish…

Feh!

But not a one is shown feasting upon a bull!!! Those are circus bears!!! Go long & strong (well, after Veteran’s Day)!!!

V-shape recovery #283498372398 in progress. Correction over. Central bank puts still firmly in place. I’ll see everyone back here in 2020 at DOW 50K for the next correction. Just don’t blink or you’ll miss that one too.

Over the last 7 years everyone seems to have turned into 0% Fed rate forever cheerleaders.

In fact one wonders why we didn’t have 0% rates prior to that point in time. It is clearly an amazing stimulant and jobs creator in the economy.

The emperor clearly has no clothes, all this talk of recovery whilst clinging to a mantra where the fed can’t ever raise rates without a complete market meltdown.

Huge gyrations this week on the Dow/S&P with little guys unable to execute trades on retail platforms.

A free market …. ??? Yeah right.