Source: Calculated Risk

We interrupt this crash and recovery for a brief word about the economy, in particular residential real estate and new home sales. This is an area of the economy I have been studying and writing aboutfor decades.

New home sales were reported earlier this week; they are a component of gross domestic product (existing home sales are not). We learned this morning that second quarter GDP was revised to 3.7 percent. So new home sales are especially important, even though they make up less than 15 percent of total housing sales.

A few things you should know about this data: Month-to-month, it is a very noisy series. It is self-reported by builders, and I always have gotten the sense that they get around to doing the paperwork…eventually. Quarterly figures are more or less accurate, but each month comes with a high double-digit probability of statistical error.

I want to draw your attention to two of my favorite charts, courtesy of Bill McBride of Calculated Risk. He uses data in a way that is most informative.

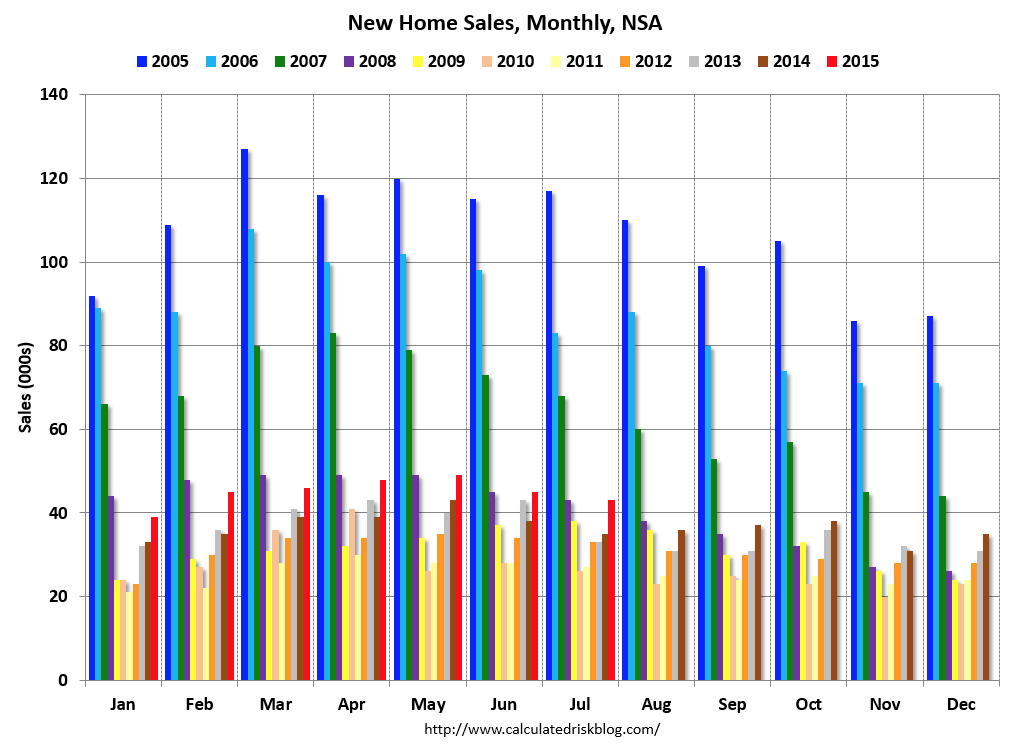

The chart above is new home sales, presented as a monthly series on an annual non-seasonally adjusted basis. Each colored bar represents a different year. Looking at new home sales this way allows us to easily see the “Seasonal Homes Sales Trend.” Home buying occurs on a very specific annual cycle, rising in the spring, peaking in the summer (got to get the kids enrolled in the new district before school starts) then tailing off in the winter.

By omitting the seasonal adjustments, we get a cleaner look at the actual sales data. We also see how strong or weak any given year is. Note that for the longest time, much of the media got this wrong, misreporting month-to-month data as a recovering housing market, instead of as part of the usual annual cycle.

Let’s take a look at July: Last month — shown as a red column — had 43,000 new home sales, the highest July sales figure since 2008. In July 2014, the number was 35,000. It pales, of course, to the all time July high in 2005 — that was 117,000 — but it’s a lot more than the recent July low of 26,000 in 2010.

The good news is that the Census Bureau reports new home sales so far this year at 316,000 — again not seasonally adjusted — up 21.2 percent from the same period last year. The bad news is that, despite record low mortgage rates, these numbers are still close to what we used to think of as cyclical lows.

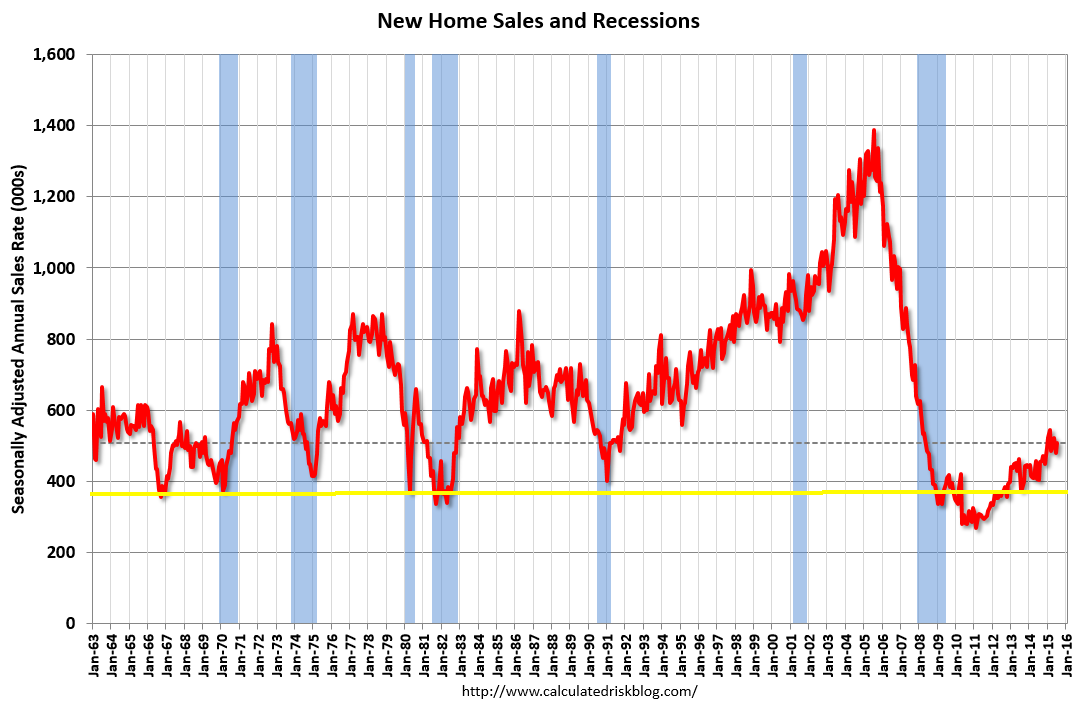

That brings us to our second chart: 50-plus years of new home sales and recessions. As you can see from the yellow line, new home sales are now just above the lows of earlier recessions as shown by the light blue bars.

There are a couple of reasons why new homes sales are trending so much below their historic averages. First, the post-credit-crisis recovery has been (as expected) modest at best. This includes weak wage gains combined with tightened standards for extending credit to buyers. That alone accounts for much of the weakness in both new and existing home sales.

Second, and more specific to new homes, that giant decade-long boom from 1998 to 2007 created a huge oversupply of new construction. That fulfilled (perhaps “exhausted” is a better word) much of the demand for new homes.

Third, maybe most significant to new home sales, the aftermath of the financial crisis created a huge number of distressed sales — foreclosures, short sales and owners desperate to sell and reduce debt. Losses taken by banks and homeowners acted as net discounts to buyers, which functioned as price competition to new construction.

So it’s not too much of a surprise that the recovery in new home sales is lagging the recovery in existing home sales. Builders should be happy that sales of distressed properties have been falling to the point where competition for new homes is waning.

Will this weak recovery in new home sales continue?

I expect that will be a function of the health of the economy at large, in particular employment and wage gains; how soon credit availability swings back toward normal; amd how fast and high the Federal Reserve takes interest rates.

Originally published as: A Real Estate Recovery That’s Not Quite There