How to ruin your financial life, #badadvice

Barry Ritholtz

Washington Post, September 13 2015

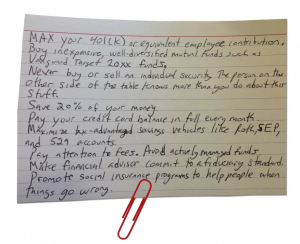

About two years ago, Ezra Klein wrote in The Washington Post about University of Chicago social scientist Harold Pollack, who “managed to write down pretty much everything you need to know on a 4×6 index card” about investing.

I thought that approach was worthwhile for many reasons.

Most weeks, I try to give similar good advice: Keep it simple. Watch your costs. Do less. Tune out the noise, etc. Still, there are only so many times you can offer the same plain vanilla advice, even if it’s the right thing to say, before people begin to tune you out.

Sometimes people need a bit more to keep them on the path to financial security — the sort of thing that lands like a two-by-four to the head, if only to a) grab their limited attention and b) make them focus on what really matters. That index-card trick certainly inspired people to rethink the virtues of simple, basic financial advice.

This week I am going to shamelessly steal the idea of offering advice so simple it fits on an index card, with my own twist: I will offer you really awful investing advice.

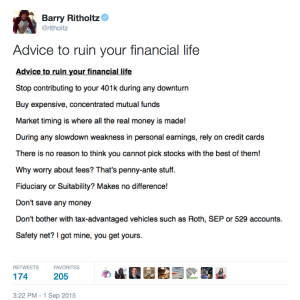

I played with this idea on Twitter in a post I called “Advice to ruin your financial life.”

Let’s see if any of this “advice” makes people rethink their financial strategy. Remember! It’s all tongue-in-cheek:

• Buy expensive, concentrated mutual funds: These funds are expensive because they are worth it! The guys who run these funds are the best — they are pros, stock-picking experts who didn’t get to where they are today by accident. Besides, how could an entire industry exist if all it did was overcharge and under-deliver for services? Accepted economic theory about the efficiency of markets teaches us that’s practically impossible.

• Buy expensive, concentrated mutual funds: These funds are expensive because they are worth it! The guys who run these funds are the best — they are pros, stock-picking experts who didn’t get to where they are today by accident. Besides, how could an entire industry exist if all it did was overcharge and under-deliver for services? Accepted economic theory about the efficiency of markets teaches us that’s practically impossible.

• Stop contributing to your 401K during any market downturn:Hey, I get it. Market volatility is increasing, and drawdowns like those we saw in August are really scary. Who knows how bad China is going to get? Who can guess when the FOMC is going to raise rates? For all we know, this could easily be another 2000 . . . or 2008! Right now, you are probably uncomfortable with the headlines you see each day. So it’s best to sit tight and not risk any fresh cash in the markets right now? At least not until we have some clarity about the state of the economy, right?

• Market timing is where all the real money is made: Imagine how much more money your investments would make if you avoided the big sell-offs? Think about missing the almost 80 percent drop in tech stocks in 2000. Or better yet, imagine selling those stocks short and making money on the way down. How sweet would that have been? Same thing in 2006 for the homebuilders, 2007 for the banks, 2008 for the investment firms – there was a killing to be made.

You might also imagine what it would do for your returns if you added some leverage to ride the bull market up. You would become a millionaire in no time at all!

•During any slowdown or weakness in personal earnings, rely on credit cards: Look, your setback is only temporary. You have a very specific lifestyle you are comfortable with, and that’s what you need to maintain. Don’t for a minute think you can tell your wife or the guys down at the club about this — they would lose all respect for you. How other people perceive your status and prestige is an important aspect of who you are. You certainly don’t want to risk that by lowering your standard of living. After all, that’s what credit cards are for!

• There is no reason to think you cannot pick stocks with the best of them! Picking stocks is not all that hard. You do some research, pay attention to the latest gadgets, keep your ears open for the occasional good stock tip, and you are golden. Besides, you have a good network of people who often share great investing tips with you — I bet you can buy shares in companies before blowout quarters or takeovers are announced. Worst-case scenario, all you need to do is watch that crazy guy on TV each night and buy whatever he suggests.

• Why worry about fees? That’s penny-ante stuff! Seriously, dude, you are after the big fish, not the minnows. You cannot waste time and effort focusing on these piddling details. Look, you already figured out that market timing and stock selection are where the big money is made. Let’s not worry ourselves about all that small stuff. Besides, what does compounding have to do with investing anyway?

• Fiduciary or suitability standard? Makes no difference to me:More distracting nonsense from the nanny state! The regulatory standards that govern the advisers you work with are not all that important. You are a big boy, you can make informed, intelligent decisions without the Uncle Sam looking over your shoulder. Besides, you trust “your guy.” Its not like the big firms would ever steer you into their own overpriced, underperforming products just to pick up a few extra bucks in commissions, right?

• Don’t save any money: Why should you deny yourself the simple pleasures of life just because of an outside possibility that things may go awry one day? For all we know, a meteor could destroy Earth tomorrow! The worrywarts who spend time and energy stressing about all of the things that could go wrong are missing out on all of the things that could go right! Life is short, and you work hard for your money — go spend and enjoy yourself.

• Don’t bother with tax-advantaged vehicles such as Roth, SEP or 529 accounts: Why would you want to tie up all that money and not have access to it for 40 years? Retirement is way, way off in the future, and you have opportunities here and now. Whatever advantages there are to putting all that cash away tax-free are offset by losing access to it for decades. No, thanks.

• Ignore process, focus on results! All of those advisers discussing things like process and philosophy and belief systems and investment policy statements make your head hurt. Just look at how well the fund did in the past, and that’s all you ever need to know!

• Safety net? I got mine, you go get yours! Why are you suddenly your brother’s keeper? The elderly, the impoverished, the disadvantaged are someone else’s headaches, not yours.

That’s the worst advice I could think up. If you have any to add, tweet me at @Ritholtz, with the hashtag #badadvice.

Thanks, Barry, for having a sense of humor about it all. I carefully copied-&-pasted, with the index card’s rules (another website), put it on the car seat to go talk with someone, “hand-holding” about their investments & whether or not to sell-out-all-now, etc. (He didn’t.) Sadly, my neighbor stopped me as I started to drive off, at her mailbox, and she picked up the paperwork through the open window, “What’s this?” I told her briefly, told her I’d gladly send her a copy by e-mail, etc. She appeared to be reading, and then announced, “I don’t have to worry about any of this, I’m in annuities.” She’s the same person who insists on “doing-it-all-myself” repairs and maintenance, and only goes out to eat at restaurants that offer coupons. I suppose cognitive dissonance / dissidents are going to be the ruin of us all, should they ever get any power—like Trump.

My brother-in-law, who’s always telling us how well he does in the market (and he’s really frugal driving that 98 Bonneville) gave me a hot tip on a company that’s going to the moon and you can get a ton of it because it’s selling for $0.59 a share. I’ll let you in on it after I have mine.