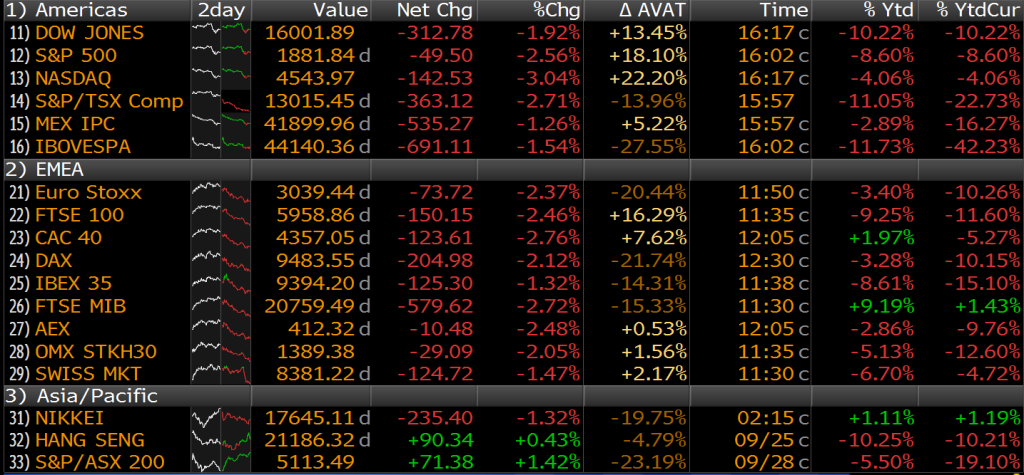

Ugly Day

September 28, 2015 4:15pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

Issues at

New 52 Week High 5 14 1

New 52 Week Low 493 357 37

Share Volume

Total 4,308,310,332 2,380,471,345 71,551,642

Advancing 227,164,972 229,870,036 3,970,144

Declining 4,072,852,622 2,139,613,072 67,258,385

Unchanged 8,292,738 10,988,237 323,113

And to think the Bears punted more times yesterday than they had completed passes…

Months from now, of course, people who bought at an ugly time will be bragging.

ZeroHedge is in its full glory:

http://www.zerohedge.com/news/2015-09-28/stocks-battered-black-monday-lows-amid-credit-crash-biotech-bloodbath-commodity-carn

Further confirms the market is oversold.

UGLY is right! The problem is that the S&P 500 is still 20% over it’s long term PE average so either earnings per share need to go up 20%, the price needs to come down 20% or we need to through out the idea of mean regression.

Maybe there will be a combination over the next 18 months of X% more stock buy back, Y% earnings growth, and -Z% correction so that this all makes sense again. It seems like earning growth is harder and harder to find so that leaves the price, and the stock buy back variable.

If interest rates are below long-term levels I would expect PE to “naturally” be above long-term trends.

I have not abandon my S&P positions and have nibbled here and unfortunately even a little on the way down so I am also looking/hoping for positives. To your point It may take a very long time for interest rates to adjust to their mean and one could accumulate yield while that adjustment takes place so it is possible that the price to earnings may be somewhat justified until then (Hint not +30% justified on PE). The truth remains that mean reversion for stocks and interest rates is considered by most people that know this business to be a certainty. The other positive is that the books are cleaner with all the information technology in play and that would also support a higher PE. These two variables obviously don’t support the previous +30% valuation, maybe low interest rates and clean books support a +15% or even +20% where it is now, we will see.

One of the worst volume days of the year. The buyers are sucking in the suckers. This tells me the market is oversold.

So here is where things get interesting. I haven’t seen much meaningful thought put to the ETF issue that was brought to light on August 24th. Media has been lax on its watchdog mandate and has produced some really weak followup. “Don’t try to buy or sell ETF’s in the first half hour”–really? That’s the answer? That’s like when I’d tell my dad “It hurts when I do this…” and he’d respond, “well, don’t do that!”… So here are some thoughts, questions, what-ifs:

Way back in the day when there was largely only SPY, the lowly ETF was simply an solution used by a small, mostly retail cohort. Then the cottage industry grew around it…DIA, QQQ, then the Sector Spyders came in the very late 1990’s/early 2000’s…all largely unnoticed, untraded, and mostly bought and held. But ETF’s have this great feature of being able to be bought/sold anytime during the trading day, and different types of investors entered into the fray. Tactical retail investors, institutional types, hedges, etc… And the product that is/was infinitely scalable grew.

Those who buy and sell the creation units of ETF’s and are the liquidity makers make razor thin margins for their service (but make it up on volume) But when the market goes for normal, to fast moving, to raging torrent, I suspect their risk for the service provided increases at an exponential rate. And the tight arb spread they are suppose to be making increases–dramatically. The problem seems to compound as many ETF’s stay open to trade when the underlying stocks involved are halted or slowed by NYSE rules. And I’m only speaking of equity ETFs at the moment. So yes, that beautiful tracking instrument does a crappy job the worse the market acts. Because no one is incented to stabilize it. In fact, there are few stabilizing forces in existence in the markets at all today other than good old greed and fear. We’ve torn down all these things that buffered. Market makers, Specialists, prop desks, inventory… why? For the sake of efficiency, price, fairness, transparency… Oh, we will let a HFT firm “sniff” bids, post fake quotes, and hundreds of other things that are far worse than the world we shut down. But that is ok because they are the liquidity makers and takers that make the market work now.

There are costs to an environment with no safety devices. They just aren’t seen until the accident happens. In ETF’s you get the stripped down exposure of the market with not much else. And it feels great. Until it doesn’t. There are no airbags, bumpers, crush zones, or seat belts on this vehicle. Enjoy the ride.

Great comment. The combination of a large % of the markets “locked in” for the ride in ETF’s with the reckless HFT robots in charge of actually making the prices is a disaster waiting to happen. All the warnings so far have been ignored and all the future warnings will be ignored. Then we will get the big whammy-whack-slap disaster, and they will all go “nobody could have predicted”. Only after that will they crack down on these HFT robots. Future generations will look back at the whole thing shaking their heads that we allowed these clueless nerdy math geeks go play with the explosives of market panic forces. If nothing else civil society is an interesting experiment.