It’s Pointless for Stock Investors to Fixate on Fed Liftoff Date

By David Wilson

The timing of the Federal Reserve’s first interest-rate increase since 2005 may have little effect on U.S. stocks, according to Ehiwario Efeyini, a senior research analyst at U.S. Trust, Bank of America Private Wealth Management.

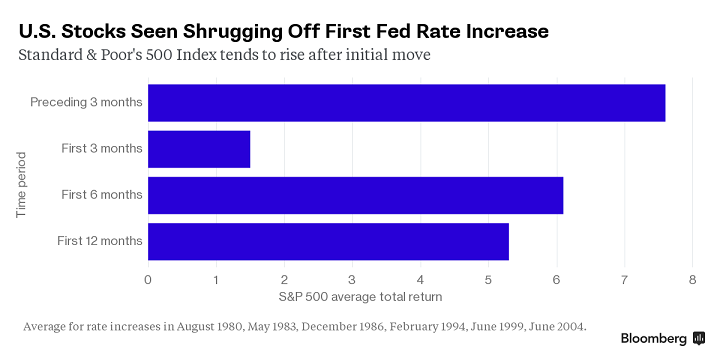

As the attached chart shows, the Standard & Poor’s 500 Index rose in the first three, six and 12 months on average after half a dozen initial rate increases from the Fed in the past 35 years. The gains amounted to 1.5 percent, 6.1 percent and 5.3 percent, respectively.

Higher rates don’t represent “a major headwind for the broad market,” Efeyini wrote three days ago in a report which cited the figures. Their effect may be limited to the shares of utilities, telephone companies and others with relatively high dividend yields, the New York-based analyst wrote.

The track record is just one reason to expect the S&P 500 to resume a bull market whether the Fed raises rates next month or in December, Efeyini wrote. Stocks’ history of rising amid currency shocks, most recently China’s efforts to reduce the value of the yuan, and a higher dollar are among the others.

Indicators pointing to sustained U.S. economic growth are another plus, he wrote. He highlighted yield differentials on Treasury securities, which have yet to narrow as much as they typically do before recessions. Ten-year notes yielded 1.46 percentage points more than two-year notes as of yesterday, according to data compiled by Bloomberg.

“Equity valuations still look attractive relative to bonds,” Efeyini wrote. He drew that conclusion by comparing the S&P 500 earnings yield, derived from the index’s price-earnings ratio, with the yield for the Treasury 10-year. The gap favored stocks by 3.3 percentage points as of yesterday.