From Torsten Slok:

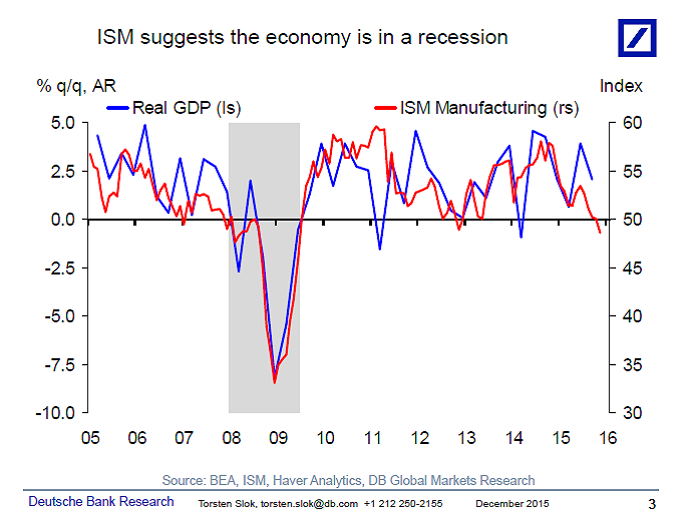

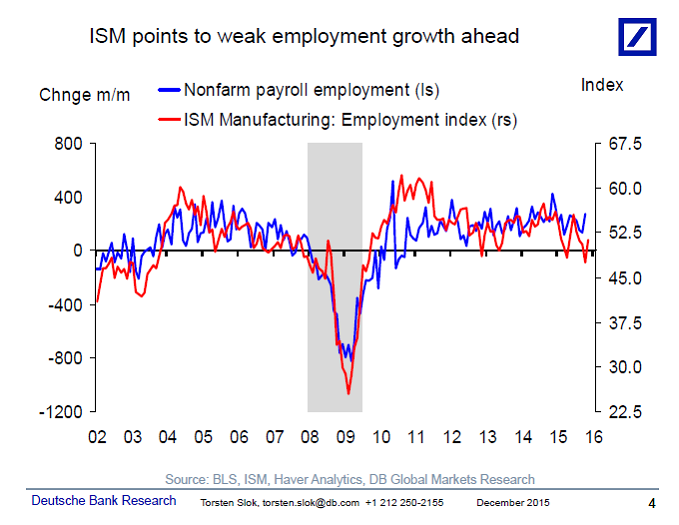

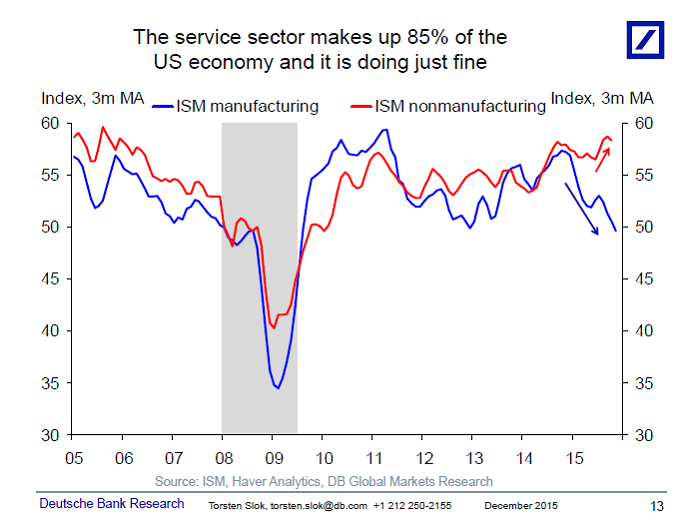

I’m getting a lot of emails and phone calls from clients following the recession-level ISM number that just came out. It is indeed worrying that manufacturing continues to weaken and it does make us more cautious about Q4 GDP and Friday’s employment number, see the first two charts below. That being said, the service sector still accounts for 85% of the economy, and we still think that the manufacturing sector will not be able to drag down the service sector, see the third chart, but for the Fed, a lot is now riding on the employment report and nonmanufacturing ISM later this week.

Source: Torsten Slok, Ph.D., Deutsche Bank

ISM services at 55.9%. Not so good.

ROLF!!! that is above average

Hike? How much? 25 bp? If they did 50 the world would go into shock. It’s a joke. The only reason we even need to fret and froth about this trivial, in the offing rate hike is that the entire world economy is living in a massive financial bubble where even 25 bp make a difference.

Is there a real interest rate that the market would set by itself? Possibly. Not sure what it is, but I am guessing it’s between 5 and 7% for the best borrowers. Would the market swoon over changes from 6.50 to 6.75 or 6.25? Not likely.

It’s all one big charade. A joke. An elaborate scam that has allowed the richest 0.1% to perform the most spectacular theft in history. And we are still wringing our hands over bogus ISM, unemployment, or GDP numbers as if they are real or useful.

Indeed. The equity “markets” are priced for perfection in a world far from it. Seldom in the last 100+ years have we seen stocks so expensive. Naturally greedy CEOs – and their incompetent/negligent boards – are taking this opportunity to leverage their balance sheets to buy their own expensive stock. I’m sure this can only end well.

The only reason to raise rates today is due to rampant asset price inflation. I agree the underlying economy is still fragile and can’t handle it. The funny thing is that even if they raise and it causes a meltdown in the real economy, asset prices could continue skyrocketing because participants have been so conditioned by the “emergency, temporary” Fed put in perpetuity. I find it hard to believe the Fed would allow all their hard work of price discovery destruction to go to waste even if the real economy tanks.

BTW, with all the financial engineering tools available today, who thinks the Fed doesn’t at least indirectly own stocks (as they aren’t allowed to directly)? I’d be shocked if they didn’t. It’s not exactly unheard of for central banks to own stocks; many significant central banks are allowed to and publish their holdings.

“…the service sector still accounts for 85% of the economy…”

It’s like saying the coal industry is going away so the Fed can’t hike.

The Fed will hike Shorter term rates will be at 2% in two years. Get ready. If you refuse to get ready, recall your equity-selling mindset in 2009 and how wrong you were then.

They should have hiked one year ago. It would have been simple and a no brainer in the long run. Now, it’s too late IMHO. They’re going to hike and now it’s going to hurt.

ISM is negative. Non Mfg ISM yoy is negative. Monthly MACD is negative. Monthy NH/NL negative. ECRI LEIgr -2 though ticking up. Commodity inflation is nil.

After learning about the Yellen intervention in the infrastructure bill and the 6% dividend kerfuffle, I’m not convinced she’s the leader I thought she was.

And I was hoping. Now, I’m disappointed.

I thought manufacturing doesn’t matter anymore.

Auto sales are at a cycle peak.

Ex-Commodity it Barry. It is already above 50. Sure they will hike. Yellen is a reach for yield believer. The time has come.