The real risk in the market is staying out of it

Barry Ritholtz

Washington Post, June 19, 2016

What is the next subprime?

This is an urgent question among a certain class of investors who seem traumatized by a stream of negative market events. First the dot-com bubble destroyed their 1990s vision of easy riches; then the housing boom and bust in the 2000s hurt their single biggest asset. The credit crisis and Great Recession next wreaked havoc on their collective psyche; the commodities bust, which began in 2011, was perhaps the final straw.

Along the way, there were lots of missed warning signs: ridiculous tech valuations, booming inflation, unsustainable home prices, EZ No-Doc mortgages. The Great Recession may have been inevitable.

Along the way, there were lots of missed warning signs: ridiculous tech valuations, booming inflation, unsustainable home prices, EZ No-Doc mortgages. The Great Recession may have been inevitable.

Some investors, having been repeatedly mangled by events not of their making, never fully recovered from that 57 percent crisis collapse in the stock market. They are now dedicated to not letting any of that ever happen to them again. No more drawdowns! Every market twitch is a sign! No part of the economy is safe from another collapse — and it’s coming!

This risk aversion has led them to miss a huge run-up in U.S. equities.

“Ignore the market recovery,” they exhorted almost as soon as it began in March 2009. “We are going to get shellacked even worse,” they said, 207 percent ago.

They are suffering from a financial variant of post-traumatic stress disorder.

On the lookout for the next derivative-enhanced, subprime mortgage disaster, they keep missing opportunities. It’s not just equities: Bonds have been in a monster rally since the crisis, as have REITs. Emerging markets are probably the next big thing that they probably won’t participate in.

Instead of cultivating a diversified, balanced portfolio, they bought “safe” assets. Their fears and trauma have kept them in cash and gold for six years. Those are feel-good assets, with complete narratives attached. The problem is they haven’t so much underperformed as they have actually lost value.

The cognitive issues in this approach are instructive: risk aversion, recency effect, trusting narrative over data, lack of self-awareness, over-confidence in one’s stock-picking skills, optimism that the market can be timed or the best asset class can be identified. Let’s consider some of their worst fears — what the next subprime might be — to see whether they’re valid concerns:

• Student loan debt crisis: Google that phrase, and you generate 1.5 million hits. In mainstream journalism and on websites dedicated to the topic, there’s a glut of information about student debt — and debt-relief programs. Most of it lacks context or insight.

The reality is that 40 million Americans carry student debt totaling $1.2 trillion. Those are big, scary numbers. However, student borrowers owe an average of $35,000, and the majority are not behind on their payments. And unlike mortgages, if they default, well, they default — it does not cause a giant cascading effect, tearing apart neighborhoods, banks and the global economy.

Because U.S. taxpayers are on the hook for some of this debt, it’s worth noting that given today’s low interest rates, there is an opportunity to refinance all of this debt at more affordable rates – reducing the chance of defaults.

• Subprime auto debt: Auto sales are at multiyear highs, with a big increase in lending to people with poor credit. A surge in subprime auto-loan defaults has some people concerned. However, unlike defaulted mortgages, which can take as many as three years to foreclose upon, car repossessions are swift. The modern repo man uses devices to find, track, disable and reclaim automobiles. Lenders who make loans to people with low credit scores have even put in kill switches — miss a payment, and your car is immobilized. If you default on a car payment, you should expect your car to be repossessed immediately. It is nothing like the mortgage collapse of 2005 to 2008.

• Hyperinflation: This was a big one in 2010. A group of savvy hedge-fund managers and economists published an open letter in the Wall Street Journalwarning the Federal Reserve that its quantitative easing and zero-interest-rate policies would lead to runaway inflation.

They could not have been more wrong: The issue has not been too much inflation, but rather, too little.

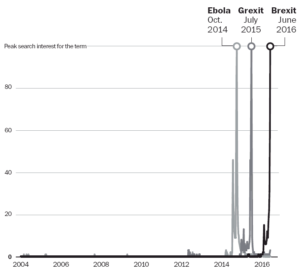

• Brexit: Last time, it was Grexit — the Greek exit from the European Union. This time, it’s the British exit from the E.U. Pardon me for not getting all worked up if Britain decides that keeping jobs is less important than keeping out immigrants, but that is the choice it’s making.

I’ve said it so many times, but it bears repeating: Decisions made from emotional distress rarely work out well financially. If a Brexit comes to pass, I expect it will have negative economic consequences for the British Isles — but make less of a splash beyond.

• China debt: International Monetary Fund officials visited China. They warnedofficials there to “address soaring levels of debt” to avoid “serious problems down the road.”

Sounds serious. Then again, the same warnings sounded serious in 2010, 2011,2012, 2013, 2014, 2015 and 2016.

Perhaps China has too much debt and will cause the next economic crisis; I do not know. But what we do know for sure is that people who were burned by bad debts in the last crisis are now seeing bad debt everywhere they look.

• Stock buybacks: It’s been a while since warnings about stock buybacks were making the rounds. The hand-wringers noted how unnatural these buybacks were: debt-financed, driven by the Fed’s low rates, artificially propping up prices and keeping down share counts.

Although I prefer dividends to buybacks, I am not so quick to brush off what amounts to a return of capital to shareholders.

• Federal Reserve crisis: We keep hearing that the Fed has screwed up the economic rescue from 2008 and onward. Meanwhile, the usual fiscal remedies have been MIA as an incompetent (or worse) Congress refuses to do its job.

I have been critical of the bank rescues, much preferring bankruptcy to bailouts. But I will admit that the Fed unfroze credit and kept a deep recession from becoming a depression. Warnings about a Fed-induced collapse have grown old and clichéd.

• Earnings recession: We have been warned that corporate earnings are peaking since oil began its historic collapse two years ago. Energy accounted for about 11 percent of the S&P 500 before then. When the price of oil dropped from more than $100 a barrel to less than $50 in two quarters, profits for the sector were all but eliminated. Then oil fell to $25.

Earnings have been sharply (but not exclusively) affected by energy prices. Those who have called this fall the new subprime have a fundamental misunderstanding of what goes into S&P 500 profits or what went into the old subprime.

We have cycled through each of these fears over the past six years. Time and again, it seems as if a new fear was created, market-tested and then discarded.

One day, the expansion will end, and investors will feel some temporary pain. But playing a guessing game as to when that will happen and from whence will it come is a money-losing proposition.

Having a well-diversified portfolio is a better approach than maintaining a fearful, concentrated one.

~~~

Ritholtz is chief investment officer of Ritholtz Wealth Management. He is the author of “Bailout Nation” and runs a finance blog, The Big Picture. On Twitter:@Ritholtz.

What's been said:

Discussions found on the web: