Investor Education Slips Into Reverse

Research suggests that teaching consumers about finance just doesn’t work.

Bloomberg, July 29, 2016

Amid all the hoopla and theater of the national political convention you might have missed a noteworthy report about the financial literacy of the average American adult. It’s worth taking a look during the weekend if you want a break from the presidential race, which seems like it begins again as soon as the election results are in.

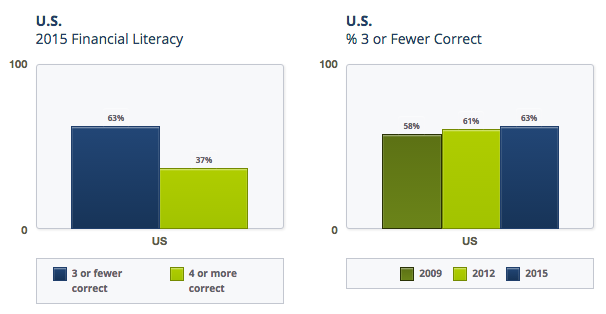

There’s not much in the National Financial Capability Study to suggest that people are getting smarter about their finances. “Only 37 percent of respondents are considered to have high financial literacy, meaning they could answer four or more questions on a five-question financial literacy quiz—down from 39 percent in 2012 and 42 percent in 2009,” according to the study.

This is a troubling development. You would think that after the financial crisis, when so many individual investors got badly burned, that they would make a greater effort to understand investing. But the academic evidence suggests that investor education is at best an uphill battle, and at worst a big waste of time.

As the Brookings Institution observed, “None of the four traditional approaches to financial literacy – employer-based, school-based, credit counseling, or community-based – has generated strong evidence that financial literacy efforts have had positive and substantial impacts. “

Indeed. When a broad analysis was done looking at all of the research, the results were deeply disappointing; even when consumers do manage to learn a little, those gains “decayed over time . . . with negligible effects on behavior 20 months or more” after.

What does this mean to those who work with individual investors, helping them to manage their investments and financial plans? I believe there are several takeaways:

- Efforts to increase financial literacy haven’t done much — and probably never will — to improve investor knowledge.

- However, some highly motivated people can and do gain some measure of financial literacy; they make up a minority of individual investors;

- Focused attempts to nudge investors in the right direction — auto enrollment in 401(k) plans — can be effective in producing positive outcomes;

- Regulatory changes such as mandating a fiduciary standard — in which advisers must put the interests of the investor first — are more likely to have a positive impact than financial literacy campaigns.

You may note my obvious self-interest and bias, since I am the chief investment officer of a financial advisory firm. If people can’t develop financial literacy on their own, they will need to pay people like me. In other words, financial illiteracy is my cash cow. But I’ve been making these same points for a decade or more, long before anyone cared to pay me for my opinion.

That said, this much should be clear: Preventing the worst sorts of investor behavior is probably where advisers offer the most valuable service. The bigger challenge is changing investor behavior. Experience has shown that for most individuals, this is the single biggest way to improve long-term performance.

There is some evidence that this is happening. Just note how much money these days is flowing into low-cost index funds and away from active managers with high fees.

It would be nice if investors had a better understanding of markets and the investment process. In lieu of that, improving behavior and getting investors to stop making money-losing mistakes will have to do.

Financial Knowledge and Decision-Making

Originally: Investor Education Slips Into Reverse