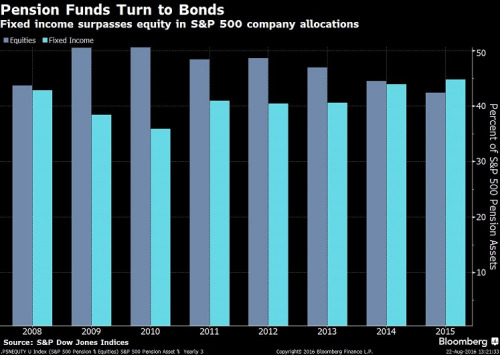

The companies in S&P 500 prefer bonds to stocks in their pension-fund assets, 44.8% to 42.4%. That was as of the end of 2015. How much of this is due to price appreciation or allocation changes is hard to discern.

When I write that This Bull Market Is Powered by Your Indifference this is exactly what i am referring to.

Here is Dave Wilson:

Companies in the S&P 500 Index are beginning to rely more heavily on bonds than stocks to meet obligations to retirees, according to data compiled by S&P Dow Jones Indices LLC. Fixed-income investments amounted to 44.8 percent of S&P 500 pension-fund assets at the end of last year, while stocks’ weighting was 42.4 percent. The increase occurred as the funds added to bond holdings and sold shares, Tobias Levkovich, Citigroup Inc.’s chief U.S. equity strategist, wrote Monday in a report that cited the figures.

Source: Dave Wilson

What's been said:

Discussions found on the web: