Nice showing from our team in Become a Better Investors review of best investment blogs with Josh, Mike and Ben all landing in the top 5:

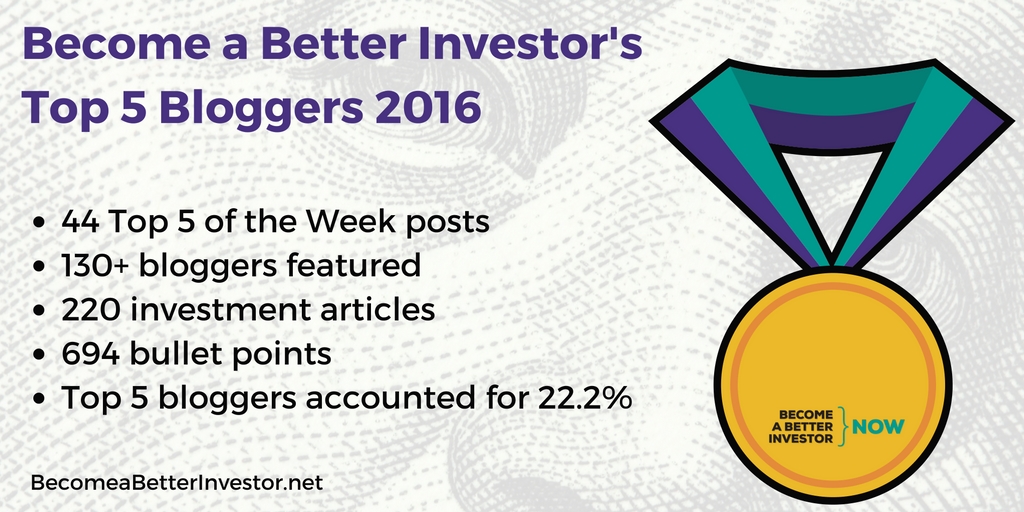

Become a Better Investor’s Top 5 Bloggers 2016 is our list of the five most noteworthy investment bloggers this year from around the world. We began publishing in January, with our first ever post breaking ground as Top 5 of the Week of January 18. As of November 18th, we have published 44 Top 5 of the Week posts and featured 130+ investment bloggers. That adds up to 220 investment articles summarized in exactly 694 bullet points. Phew

Josh:

- Beware of ‘financial advisors’ coming out of the woodworks in your various social circles—they do not have your financial interests at heart; only theirs (Read Full Article)

- Good financial advisors are here to save us, as investors, from ourselves; safeguarding us—their clients—from making misguided emotional decisions that may risk millions (Read Full Article)

- Complex investing should hold no appeal when simplicity is as successful—but it requires mental strength to avoid the allure of a more ‘sophisticated process’ (Read Full Article)

- We’re unsatisfied with our personal returns; instead, we envy others’ stock performances or experience FOMO (the fear of missing out) (Read Full Article)

- While prices show an accurate account of what’s going on it’s not nearly as interesting to the media as speculating over the causes as that’s more opinion based (Read Full Article)

Mike:

- As Benjamin Disraeli—Prime minister of the United Kingdom (twice)—once said, “There are three kinds of lies: lies, damned lies, and statistics” (Read Full Article)

- Don’t give up on your strategy even if it’s unpopular to others and riskier bets seem more exciting (Read Full Article)

- If you consider technical analysis as a useful tool for evaluating risk rather than an attempt to predict the future, it can work favorably for you as an investor (Read Full Article)

- Take heart that GDP has little correlation with stock market returns—only 10% of GDP is made up by what pushes stocks; earnings (Read Full Article)

- Annual returns chart for the S&P 500 shows the return has only been close to the ‘average’ three times in 90 years, so don’t base short-term expectations on long-term past averages (Read Full Article)

Ben:

- With information in vast supply nowadays you have to be extra smart and examine beyond the surface of evidential data (Read Full Article)

- Charlatans will change the rules if their performance isn’t up to scratch and alter their strategies, maybe after a time of underperformance—increasing risk to your portfolio, rather than mitigating it (Read Full Article)

- Overconfidence and ‘smarts’ can be a dangerous combination for investing (Read Full Article)

- Whatever your political stance you should never let politics weigh in on your financial decisions (Read Full Article)

- Time is the best investment you can spend money on; your family is the most important asset you have (Read Full Article)

Outstanding!