11.21.16

Why, if so much has improved in recent years relating to small business, are there fewer startup firms, comparatively? Forefront explores what’s improved, what hasn’t, and what’s possibly to come for Main Street firms.

(Editor’s Note: The definition of “small business” varies, and often 500 employees is used as the cutoff. Here, Forefront focuses on the smaller end of the scale.)

Though conditions for small businesses are hard to generalize because experiences vary greatly from firm to firm, Federal Reserve Bank of Cleveland experts say some data suggest an improving landscape for those businesses operating along Main Street.

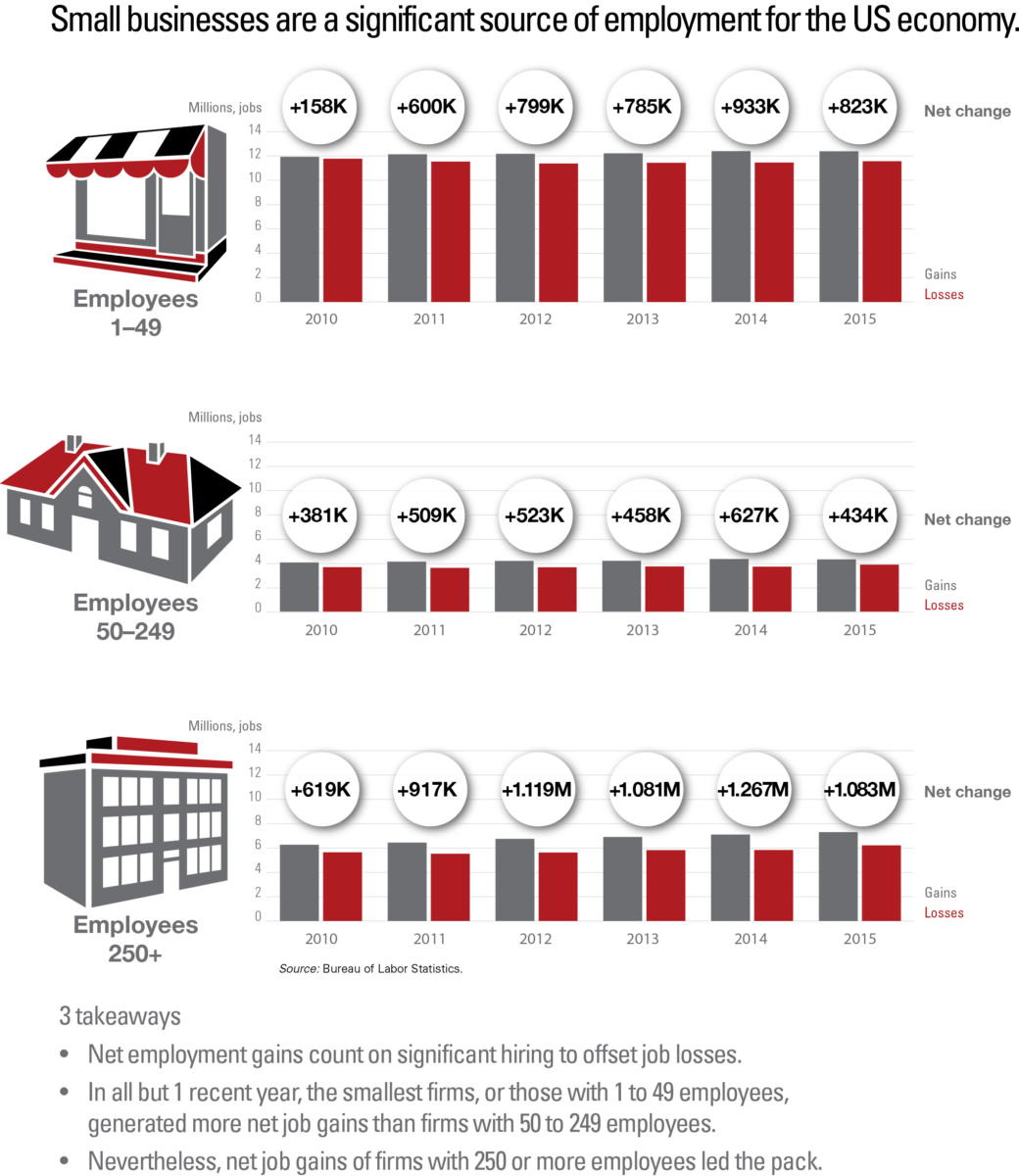

Small businesses, defined here as those with 1 to 49 employees, have added in the aggregate more net jobs in recent years than have firms with 50 to 249 employees, and bank lending in amounts of less than $1 million—which are typically lent to smaller enterprises—continues the year-over-year climb that began in 2013.

Mark Schweitzer, Federal Reserve Bank of Cleveland senior vice president in the External Outreach and Regional Analytics Department, described both developments during a presentation on the regional economic landscape for small businesses during an event at the Bank called Maximizing Supplier Inclusion. Held in mid-August, the event attracted the leaders of minority- and women-owned small businesses.

Following the event, Forefront delved into the state of small business with Schweitzer, Cleveland Fed senior policy analyst Ann Marie Wiersch, and Joset Wright-Lacy, president of the National Minority Supplier Development Council, who delivered the supplier inclusion event’s keynote address.

Every year from 2010 through 2015, small businesses added more jobs than they lost, according to data from the Bureau of Labor Statistics. In fact, in all but one of those years (2010), small businesses added 600,000 or more net jobs, eclipsing the net gains of mid-sized firms, defined here as those employing 50 to 249 people.

Net job gains, Schweitzer emphasizes, involve a tremendous amount of hiring because to achieve growth, firms need to more than offset reductions in jobs.

“The public often neglects to account for the fact that hiring is very different from net employment gains,” he explains. “We have very large hiring and very large reductions going on all of the time.

“Most of the new, net employment was at large firms, or firms with 250 or more employees,” Schweitzer notes of recent years. “Still, there are a lot of jobs being added in smaller businesses. It’s a vibrant and active part of our economy. Twenty percent of our jobs are in businesses with 1 to 49 employees.”

Most of the minority-owned businesses that Wright-Lacy’s organization represents, including Asian-, African American-, Hispanic- and Native American-owned enterprises, have an average of 25 employees.

Whether business is booming for them depends on whom you ask: “It’s a mixed bag,” she says.

“Small businesses are realizing there are opportunities in certain sectors,” Wright-Lacy adds. “Government is hot right now with some infrastructure projects. There’s also in-sourcing: Instead of taking things over to Southeast Asia, some corporations are bringing manufacturing back to the States. For small businesses that are in this space, that is a good trend.”

Minority-owned businesses, however, can find building relationships with corporate America to be difficult, Wright-Lacy notes.

“A challenge is finding the right person within the corporation that you can build a relationship with,” she says. “The business owner wants to have a relationship with the person making buying decisions.”

Recently, there’s been more pressure than usual for some businesses in the Fourth Federal Reserve District, which comprises Ohio, western Pennsylvania, the northern panhandle of West Virginia, and eastern Kentucky, because of the contraction in the energy and manufacturing industries, Schweitzer says, citing the District’s Beige Book findings.

As an example, the October 19, 2016, Beige Book report for the Fourth Federal Reserve District, which is the region the Cleveland Fed serves, noted, “Factors tempering output growth for other manufacturing industries include lower business fixed investment, the strong dollar, and weakness in the energy sector. Year-to-date production through August at District auto assembly plants fell about 6 percent when compared to that of the same time period during 2015.”

While auto plants and oil companies tend to be large, many smaller businesses support them.

‘A puzzling issue’

Newly opened firms and firms that are shut down account for a lot of employment activity.

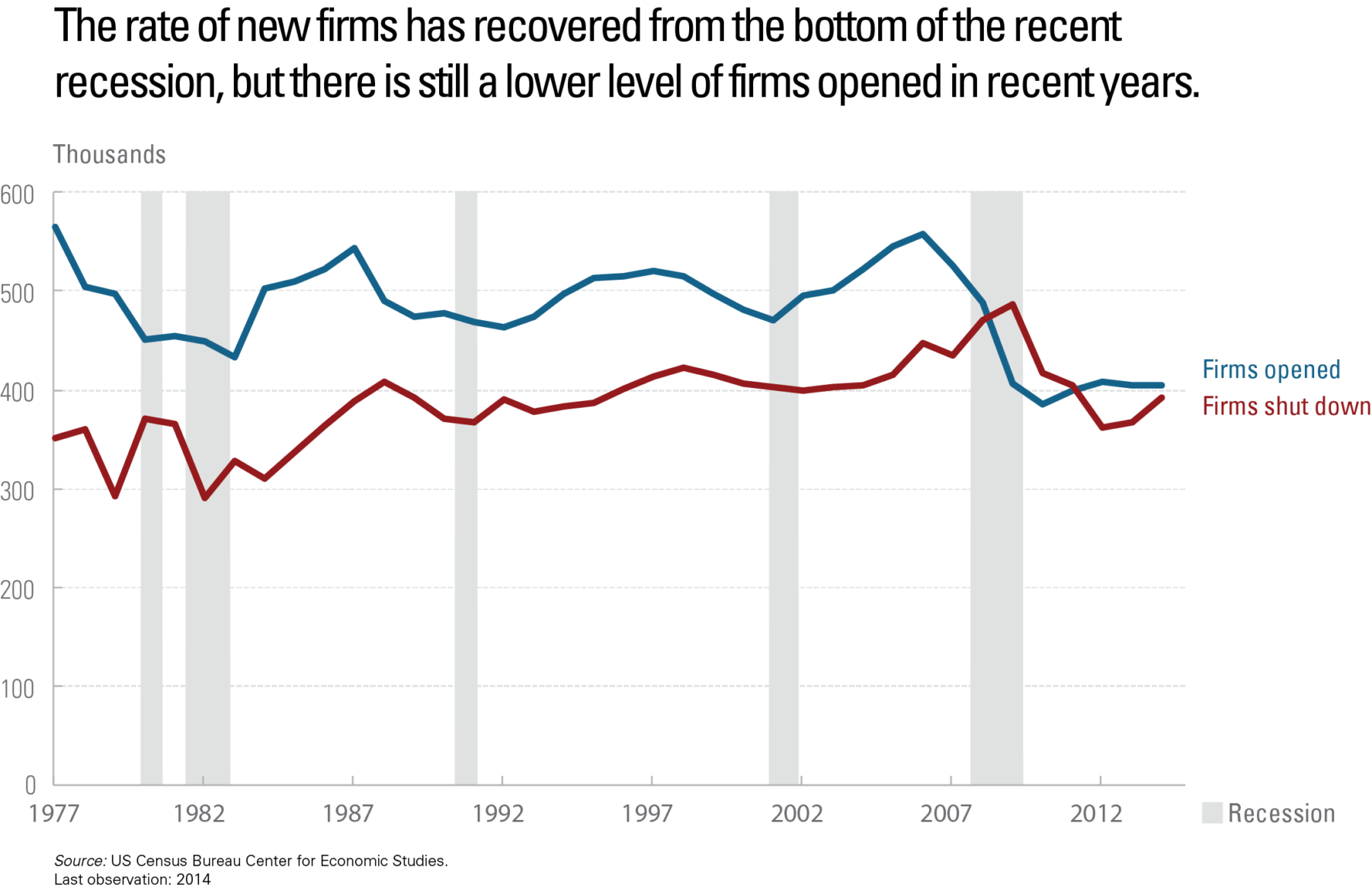

Though firm startup rates have recovered from the trough of the Great Recession, there’s been a “rather dramatic decline” in new firms in recent years, something Schweitzer calls “a puzzling issue.”

Startups contribute to fluidity for the US economy in which people move in and out of jobs, and that fluidity has been viewed as benefitting productivity and growth, Schweitzer adds. So whether the overall economy is becoming less dynamic because there are fewer startups is very important.

There are a number of potential reasons for the lower level of new firms in recent years. Schweitzer and contributing authors Scott Shane and Ian Hathaway concluded in a 2014 Economic Commentary that new establishments have been increasingly provided, not by new firms, but by the owners of existing businesses establishing new locations.

“If I have 2 locations, that can be more efficient than just 1,” Schweitzer says. “It does look like there’s been a tendency for firms including dental firms, law firms, and accounting firms to open up second locations, [and that] seems to be substituting for some of the new firm startups.”

Some researchers point to the regulatory environment. Both Cleveland Fed experts and Wright-Lacy cited financing hurdles, too.

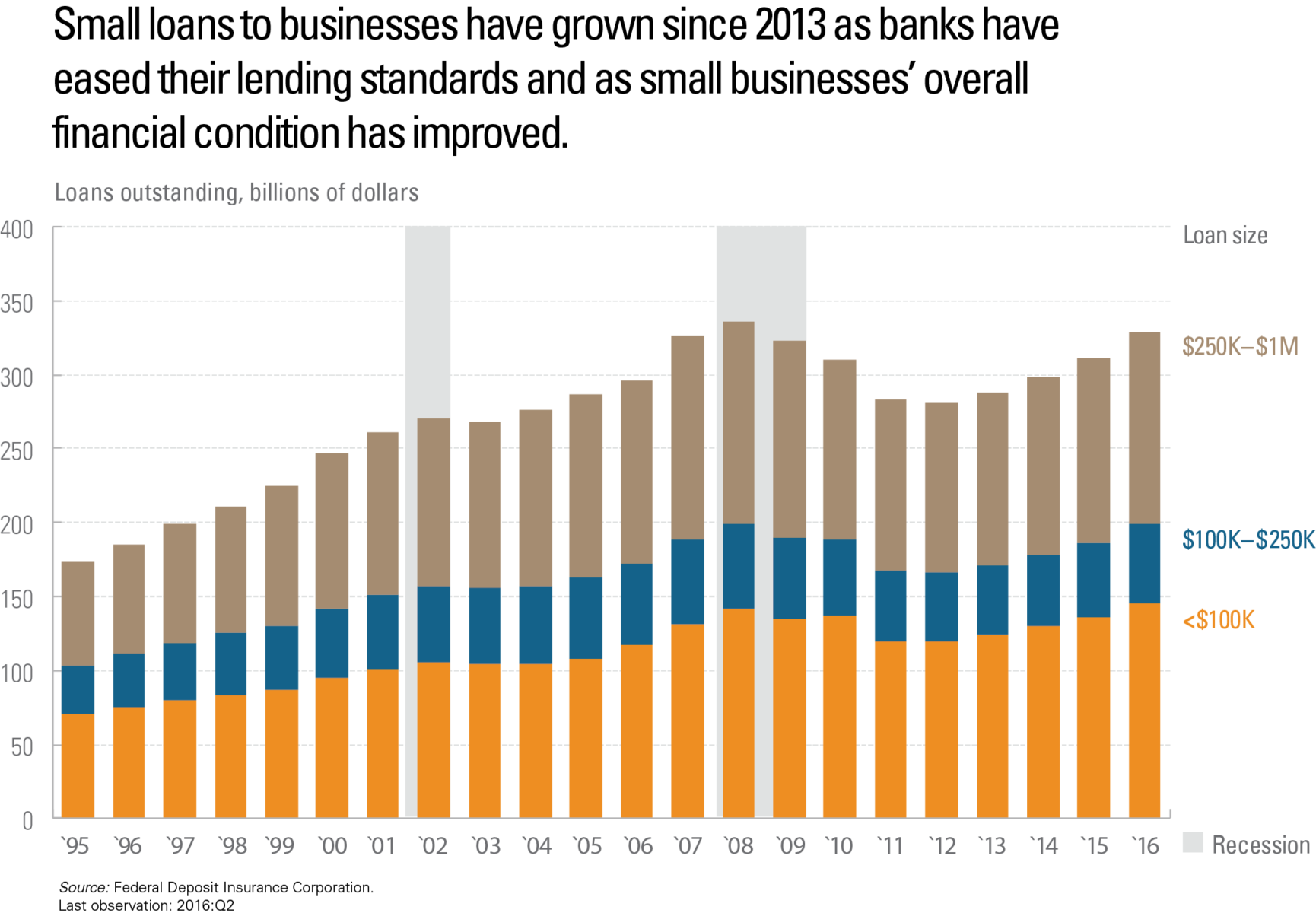

The outstanding dollar volume of bank commercial and industrial loans to small firms—defined here as loans of up to $1 million—has increased since 2013 but is still 2 percent below 2008 levels, according to data from the Federal Deposit Insurance Corporation.

Some bankers have indicated via the Federal Reserve’s Senior Loan Officer Opinion Survey that they’ve eased their C&I lending standards, with many citing more aggressive competition as an important reason for doing so. And, “small businesses are more creditworthy in the last several years,” says the Cleveland Fed’s Wiersch, whose work focuses primarily on small-business issues. “Businesses are getting stronger. There’s more demand for credit.”

But stronger demand for credit isn’t always met, and “there’s room to question whether the financial recovery in lending has been enough to support new startups,” Schweitzer says. “There are still startups that complain about their funding.”

Some of the other channels through which entrepreneurs could access funds, including the savings of friends and family and home equity lines, were depleted or constricted during the recession, Cleveland Fed experts say. And, notes Wiersch, a large number of small businesses became and remain reticent to take on debt or their balance sheets haven’t returned to what they were pre-recession.

The Small Business Credit Survey conducted in 2015 by 7 Federal Reserve Banks, including the Cleveland Fed, found that 6 years after the Great Recession’s end, smaller and newer firms report having a much more difficult time obtaining credit than do larger, more mature enterprises.

With so many credit products available from both banks and nonbank online lenders, small firms might also find it challenging to determine the option that is best for them.

“These businesses don’t necessarily have the financial expertise that a larger firm would have and might not have the same experience and understanding for borrowing,” Wiersch says. “They also lack the protections that a consumer would have. They’re kind of caught in the middle.”

Improvement expected

In opening his presentation at the Maximizing Supplier Inclusion event, Schweitzer stressed that he cares about small business and shared that his father owned a small software company.

Schweitzer expects relatively steady growth for small businesses in the near term. For one, the present regional pressures related to the energy sector should let up over time.

“I think it will generally be an improving picture,” he says. “The better growth environment has been supportive of growth in small businesses as well.”

Asked how public officials can positively impact the near term for small businesses, Wright-Lacy urged the closing of the gap between what regulations and laws for small-business contracting require and the enforcement of them. She also encourages offering more incentives to organizations for doing business with small businesses, including minority-owned firms, when possible.

Sum and substance: Small-business lending by banks continues to rise as do net job gains for small businesses, but business startups have been comparatively low for years.

What's been said:

Discussions found on the web: