Bruce Bartlett helped draft the 1981 tax cut while on the staff of Rep. Jack Kemp of New York. The Kemp-Roth tax bill was the basis for this legislation. He is the author of Reaganomics: Supply-Side Economics in Action, published in 1981.

~~~

Stymied by Congress’s failure to repeal Obamacare, President Trump hopes to get an easy legislative victory by turning again to the same well that Republicans have drunk from so often in the past—a big tax cut. All thoughts of fundamental tax reform appear to have been abandoned and the tax cut will simply add enormously to the deficit that Republicans railed against continuously when Barack Obama was in office.

Republicans will make grandiose claims for the growth effect of their tax cut—Treasury Secretary Steve Mnuchin has said there will be so much additional growth that federal revenues will not fall because the economic pie will be so much bigger.

We have heard such claims before and they proved to be groundless. Indeed, they are simply lies. The purpose of cutting taxes is not in fact to raise growth but to downsize government, which is an end in itself for Republicans, whether or not it raises growth. They believe there is only so much freedom to go around and when government gets bigger it necessarily comes at the expense of individual liberty. Therefore, cutting government is per se a good thing.

Republicans also believe in a theory called “starve-the-beast,” which posits that the only way to cut spending is to slash taxes first. It is precisely because tax cuts reduce revenue and raise the deficit that this works. Deficits, in the Republican mind, arise only because of spending, never because of tax cuts. Thus their response to higher deficits is always to cut spending.

This wasn’t always the case. Until the George W. Bush administration, Republicans were often willing to raise taxes and squelch tax cuts in the name of fiscal responsibility. Dwight Eisenhower opposed tax cuts, many Republican members of Congress voted against the Kennedy-Johnson tax cut, Richard Nixon extended the 10 percent Vietnam War surtax and signed into law the revenue-raising Tax Reform Act of 1969, Gerald Ford opposed a permanent tax cut in 1975, and Ronald Reagan supported 11 major tax increases after the 1981 tax cut that collectively took back 50 percent of the tax cut, and George H.W. Bush raised taxes in 1990.

As of 1988, the Economic Recovery Tax Act of 1981 reduced revenues by a total of $264.4 billion, according to Reagan’s last budget. Various tax increases took back $132.7 billion of that. I’ve always wondered how many Republicans who assert that higher growth from the tax cut paid for much of the cost of the tax cut are implicitly counting revenues from legislated tax increases in their calculations? It is my observation that few Republicans today know that Reagan ever raised taxes and most would be shocked to find out that he raised them a lot. The 1982 Tefra bill was the largest peacetime tax increase in American history, raising revenues by about 1 percent of the gross domestic product, according to a Treasury Department study (https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP81-Table2013.pdf).

Major Tax Legislation, 1981-88: Cumulative Impact as of 1988

| Legislation | Billions of Dollars |

| Tax Equity and Fiscal Responsibility Act | +57.3 |

| Highway Revenue Act of 1982 | +4.9 |

| Social Security Amendments of 1983 | +24.6 |

| Railroad Retirement Revenue Act of 1983 | +1.2 |

| Deficit Reduction Act of 1984 | +25.4 |

| Consolidated Omnibus Budget Reconciliation Act of 1985 | +2.9 |

| Omnibus Budget Reconciliation Act of 1986 | +2.4 |

| Superfund Amendments and Reauthorization Act of 1986 | +0.6 |

| Continuing Resolution for 1987 | +2.8 |

| Omnibus Budget Reconciliation Act of 1987 | +8.6 |

| Continuing Resolution for 1988 | +2.0 |

| Total tax increase | +132.7 |

Source: Budget of the United States Government, Fiscal Year 1990

I would not deny that the 1981 tax cut stimulated economic growth to some extent, but Republicans have a tendency to attribute all of the increase in growth after 1981 to the tax cut, when in fact much of it was the normal bounce back from the economic recession that began in July 1981 and ended in November 1982, according to the nonpartisan National Bureau of Economic Research.

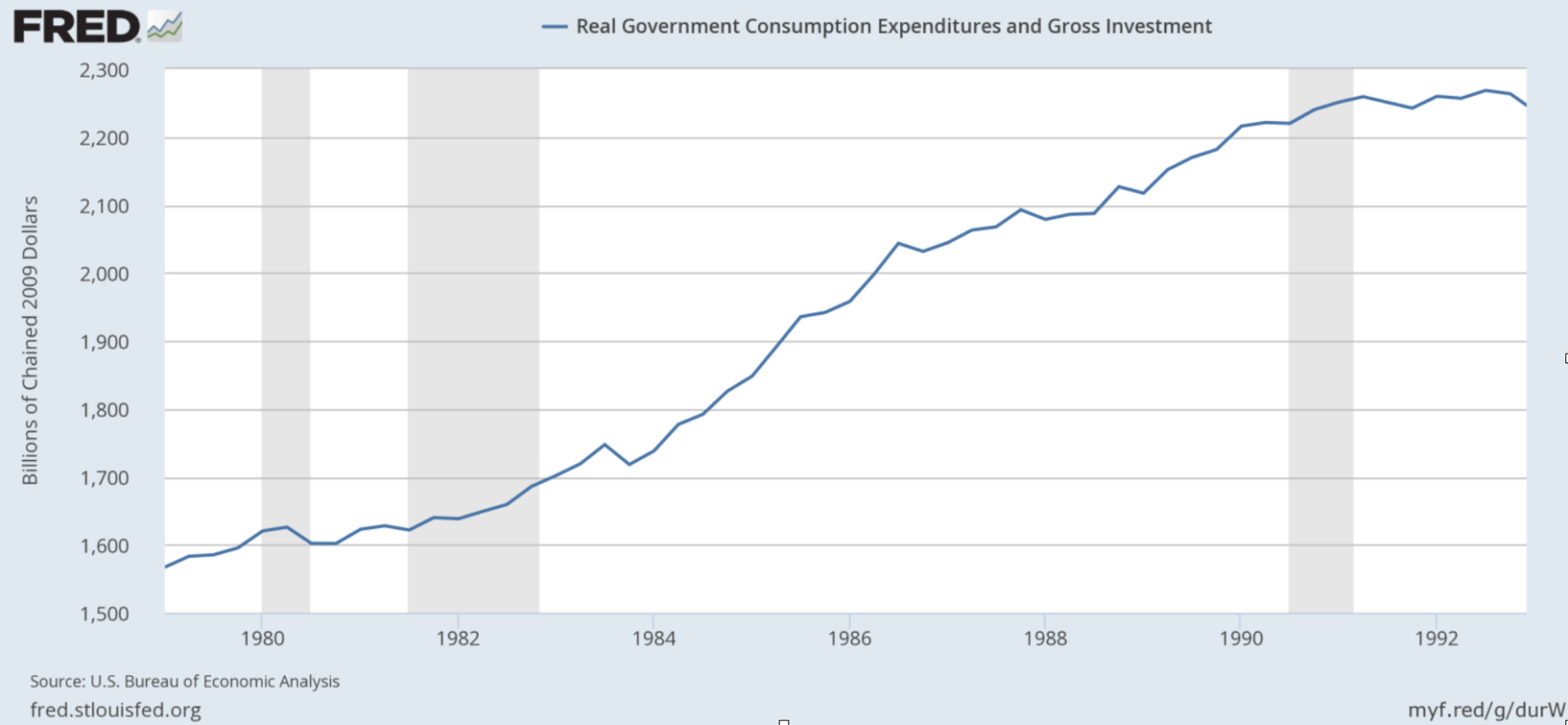

Moreover, much of the pickup in growth is attributable to two very important factors that seldom enter into the Republican story line. First is that Reagan’s defense buildup caused government spending for goods and services to rise sharply. Standard Keynesian theory, which all Republicans reject, predicted that this would provide a strong fiscal kick to the economy and it did.

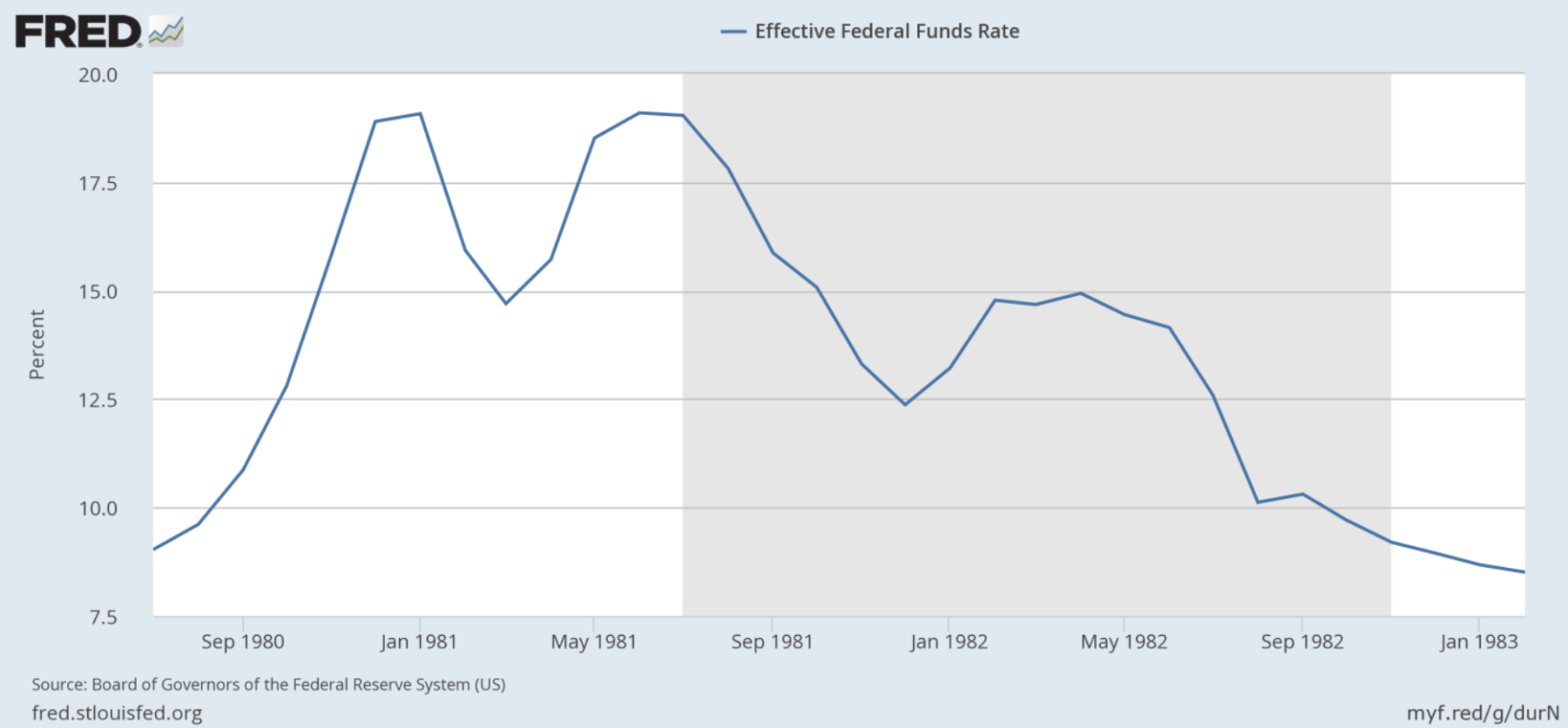

The second factor which added powerfully to economic growth in the 1980s was the sharp cut in interest rates by the Federal Reserve. As the chart shows, the federal funds rate, which is set by the Fed, was close to 20 percent when Reagan took office. Inflation was very high and the Fed believed that higher interest rates would reduce it. But as the economy slipped into recession, the Fed reduced rates by more than 50 percent, from 19 percent in July 1981 to 9 percent in November 1982.

Some Republicans may believe that the experience of the George W. Bush administration makes a better case for the stimulative effect of a tax cut. But who remembers a booming economy during the Bush years? The economy was dismal, which is why Bush kept proposing one tax cut after another. There was a big tax cut in 2001, followed by another in 2002 and another in 2003, 2004, 2006 and 2 in 2008.

It’s worth remembering that the conservative Heritage Foundation made exactly the same argument about the 2001 tax cut that Secretary Mnuchin is making today. It issued a report on April 27, 2001 forecasting that by 2011, federal revenues would be higher with the tax cut than they would have been without it, due to higher economic growth, greater investment, and lower unemployment. In fact, real G.D.P. growth was half of what Heritage predicted and the unemployment rate was 50 percent higher. It predicted that federal revenues would equal $3.3 trillion in 2011 including the effect of the tax cut; revenues actually were $1 trillion less, $2.3 trillion.

Some Republicans have argued that the 2001 tax cut didn’t really reflect their economic principles. The 2003 tax cut, which was targeted more at raising investment is a better test of their ideas, they say. The key element was a reduction in the tax rate on dividends and capital gains to 15 percent. Its purpose was to encourage corporations to pay out more dividends, which would raise individual incomes and growth.

Numerous studies have shown that there was no increase in dividend payouts following the 2003 tax cut.

- A survey of financial executives found a modest increase in dividend payments that was mainly driven by improved cash flow, rather than tax effects. There was, in fact, a much larger increase in share repurchases even though their tax treatment was unchanged.

- A 2008 study found no impact of the Bush tax cuts on the aggregate stock market. U.S. stocks didn’t outperform foreign stocks or those unaffected by the dividend tax cuts, such as Real Estate Investment Trusts. Stocks paying no dividends enjoyed excess returns during the study period, suggesting that non-tax forces were driving the stock market.

- A 2011 study found that because the dividend tax cut was temporary – all the Bush tax cuts were scheduled to expire at the end of 2010 because of the budget rules necessary to get them enacted – they actually caused aggregate investment to fall. A more recent study found zero change in investment. This result was confirmed in a Federal Reserve staff study earlier this month.

- A 2013 study found that the payout ratio did not rise after the 2003 tax cut, share repurchases rose more rapidly than dividend payouts, dividend payouts by Reits increased even though they did not qualify for lower taxes, and what increase in dividends did take place was consistent with estimates made in 2002, before the tax cut was even contemplated.

In 2010 and 2012, the Congressional Research Service studied the potential effect of allowing all the Bush tax cuts to expire on schedule. (They were extended for two years in late 2010.) It found that there was unlikely to be any major negative impact on the economy because the tax cuts had no positive effect in the first place. In fact, the economy performed more poorly following the Bush tax cuts than it did in the higher-tax era of the 1990s following the 1993 tax increase. The C.R.S. produced the following table as evidence.

Economic Indicators Before and After the Tax Cuts for Expansion Years

(annual average)

| Indicator | 1993-2000 | 2003-2007 |

| GDP Growth | 3.9% | 2.7% |

| Median Real Household Income Growth | 1.7% | 0.6% |

| Private Employment Growth | 2.7% | 1.2% |

| Weekly Hours Worked | 34.4 | 33.8 |

| Employment-Population Ratio | 63.4% | 62.7% |

| Unemployment Rate | 5.2% | 5.2% |

| Personal Savings as % of Disposable Income | 4.6% | 2.6% |

| Business Investment Growth | 10.3% | 5.6% |

| Labor Productivity Growth | 2.0% | 2.2% |

Source: Congressional Research Service

In 2012, the Congressional Budget Office did an accounting of fiscal policy during the George W. Bush administration. It concluded that the Bush tax cuts reduced revenues by $3.5 trillion. At the end of the administration in 2009, even Republican economists had little if anything good to say about the Bush tax cuts, according to reports in the New York Times and Washington Post.

In my opinion, the case for a tax cut right now is very weak. In any event, it’s insane to be slashing revenues at the same time the Trump administration is demanding vast budget cuts that will cripple the government and tear gaping holes in the social safety net, all in the name of reducing deficits.

There is a stronger case for revenue-neutral tax reform—cut tax rates, but pay for it by eliminating tax expenditures and loopholes. But this will involve heavy lifting—the Tax Reform Act of 1986 took two and a half years to enact. It appears that Mr. Trump has no appetite for such a long-term effort or any idea where to begin, judging by his public comments about taxation. It looks as if he is aiming for an easy victory, a feather in his cap after failing to enact any of the measures he promised in his first 100 days.

Trump may be right that the Republican Congress will once again abandon any semblance of concern for the budget deficit and enact yet another budget-busting tax cut. But no one should be under any illusion that it will do much to raise economic growth or reduce unemployment—certainly not enough for the tax cut to pay for itself. That is a fairy tale at best and a rank lie at worst.