I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want to see the other side of the argument. Bulls should especially seek out bearish data and arguments (the same for bears seeking bullish data).

From Torsten Sløk, Deutsche Bank:

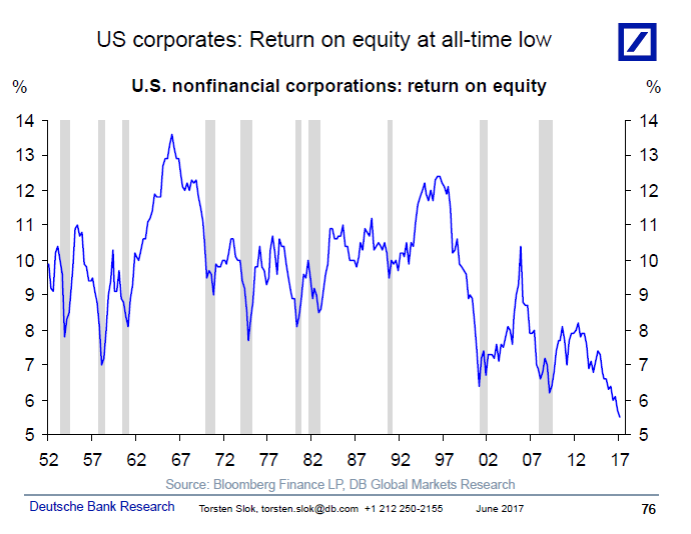

The all-time highs we are seeing in equity valuations is having a significant impact on corporates. One distinct feature of this rally is the steady decline in the return on equity, as seen in the flow of funds data. Return on equity in corporate America is currently at the lowest level since World War II, see chart below.

Source: Deutsche Bank Research