@TBPInvictus here:

A recent column in the Washington Post – Consumer debt is at a record high. Haven’t we learned? – sounded the alarm on households’ revolving credit debt, which has just now modestly eclipsed its prior peak. The current level is about $1.02 trillion. BR addressed this earlier this year (Seeing a Debt Crisis That Isn’t Really There), but that does not mean everyone learned the basics of statistics and context.

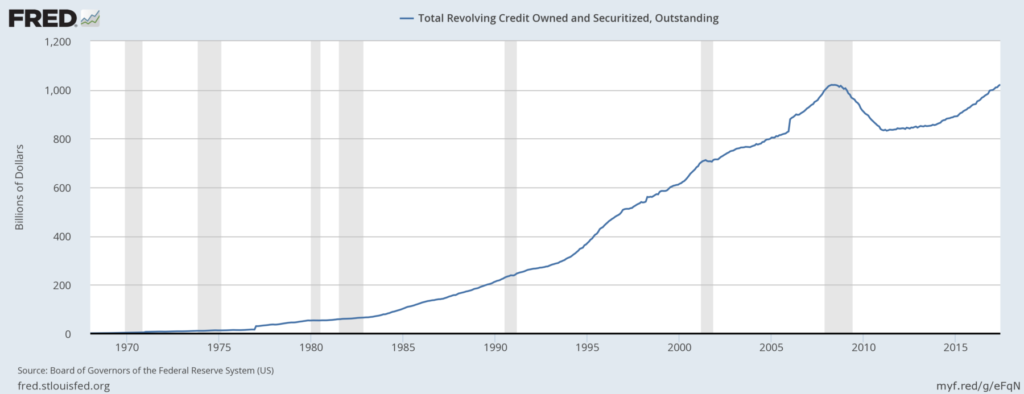

Have a look at this chart showing total revolving credit outstanding:

Writes the WaPo author:

“This should be a scary statistic. The last time the debt level was nearly this high was in 2008, when the U.S. economy was mired in a recession.”

The second sentence is true enough, but the first is maybe not so much. Context, as always, is critical. This is a classic example of as BR calls it, “Denominator Blindness.” By showing one number out of context to the important relevant other number, an author can create fear or outrage. The contextual number shows if we should really be deeply concerned.

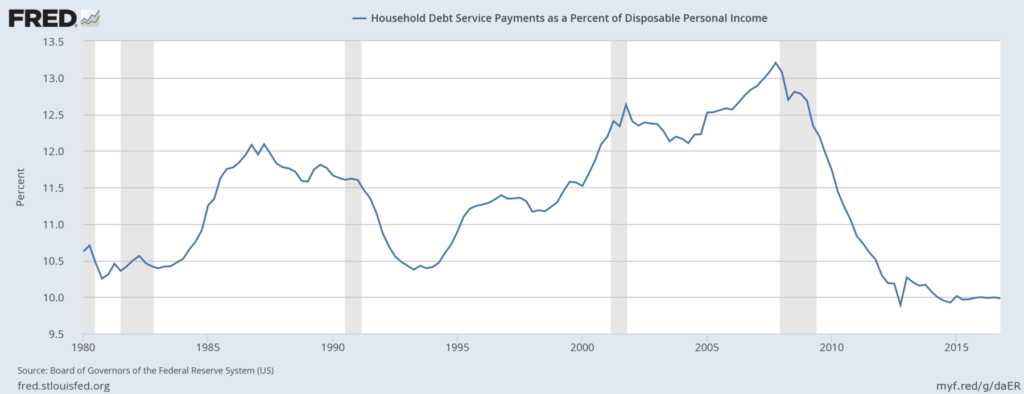

Let’s look, for example, at Household Debt Service Payments as a Percent of Disposable Personal Income – income being a key and necessary ingredient in servicing debt. Knowing debt levels in absence of income levels gives a big scary number, but does not give any context to the all important question: “Can Households service their debtloads?”

Behold:

Putting aside the myriad issues that caused the financial crisis — the column seems to want to lay the blame at the feet of consumers and their debt [BR here: the author discusses importance of having a cash cushion but failed to discuss the resetting teaser rates of the 2/28 type loans; after 24 months, they reset, sending amount needed to service the debt skyrocketing]; we see that this particular metric peaked at 13.2% in the fourth quarter of 2007, collapsed throughout and well beyond the recession, and now sits at just under 10%, where it’s been for some time, and which is a multi-decade low.

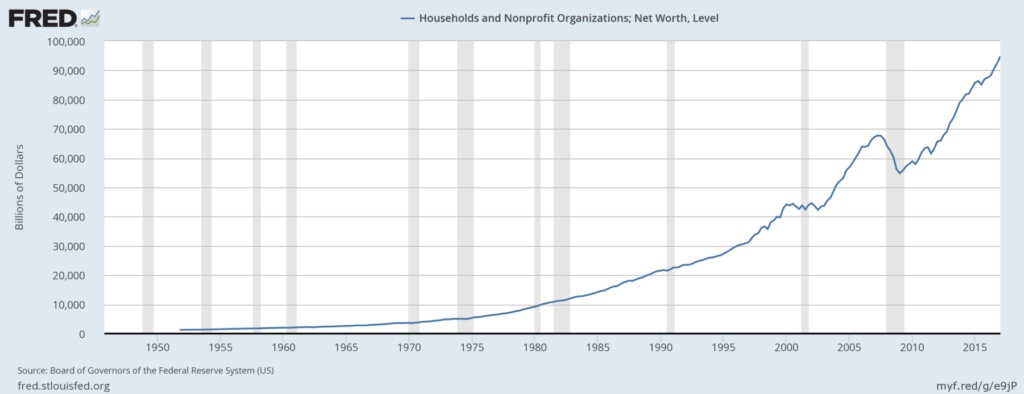

Another factor curiously omitted by Ms. Singletary is Americans’ net worth, which is some $25 trillion higher now than it was about a decade ago.

I’m not saying debt is good. I’m not saying debt is bad. I’m saying that we must have context and perspective when we look at levels in both economics and markets.

I’m reminded of the old joke about the baseball announcer who gives a partial score: Yankees: 7. A one-sided story doesn’t really tell you all you need to know to assess the situation, does it?

Source:

Consumer debt is at a record high. Haven’t we learned?

Michelle Singletary

Washington Post, August 12 2017

https://www.washingtonpost.com/business/us-consumer-debt-is-at-a-record-high-havent-we-learned/2017/08/11/5c7bee6e-7e13-11e7-a669-b400c5c7e1cc_story.html

Previously:

Seeing a Debt Crisis That Isn’t Really There

Yes, household borrowing has topped the old record reached right before the financial crisis. But that doesn’t mean a meltdown is coming.

Barry Ritholtz

Bloomberg, May 18, 2017

https://www.bloomberg.com/view/articles/2017-05-18/oh-no-not-another-debt-crisis

Don’t Suffer From Denominator Blindness

Barry Ritholtz

TBP, October 14, 2015

ritholtz.com/2015/10/dont-suffer-from-denominator-blindness/