ATM: Aswath Damodaran on the LifeCycles of Companies

At The Money: At the Money: Learning Lifecycles of Companies. (August 21, 2024) The Magnificent Seven, the Nifty Fifty,...

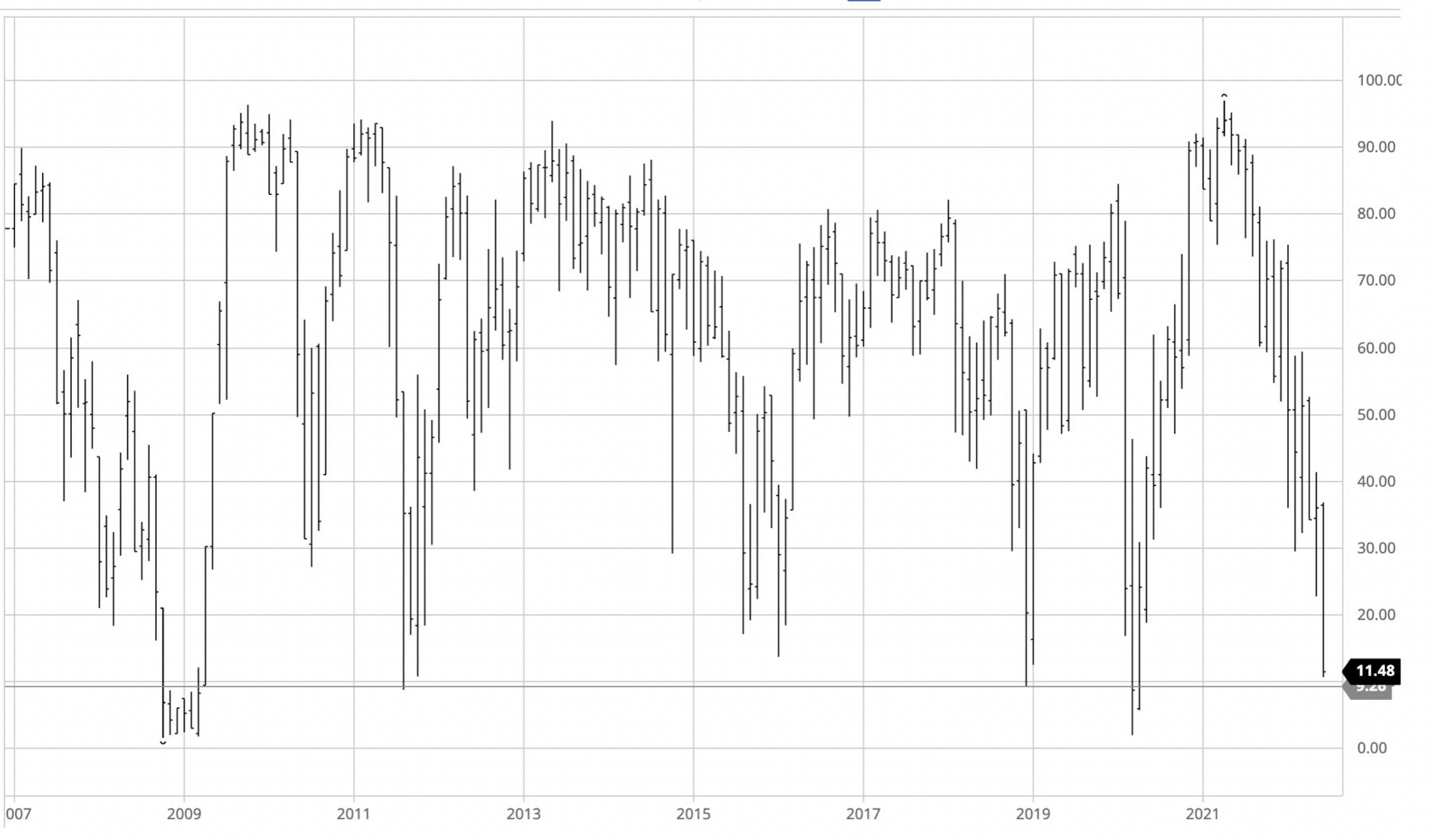

Percentage of S&P 500 Stocks Above Their 200-Day Moving Average We now enter the most challenging part of the bear market:...

Percentage of S&P 500 Stocks Above Their 200-Day Moving Average We now enter the most challenging part of the bear market:...

Tomorrow, I am giving a webinar presentation at Princeton’s Bendheim Center for Finance at 12:30pm. The topic is...

Tomorrow, I am giving a webinar presentation at Princeton’s Bendheim Center for Finance at 12:30pm. The topic is...

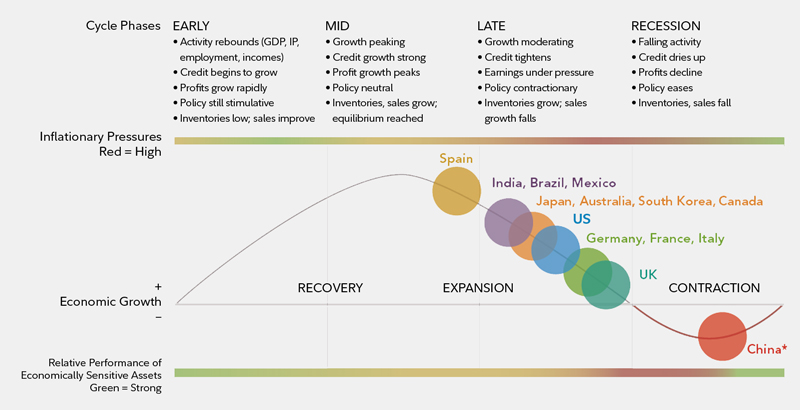

Source: Fidelity How to Manage Your Investments Late in a Cycle Nobody knows for sure whether equities will keep rising or for how...

Source: Fidelity How to Manage Your Investments Late in a Cycle Nobody knows for sure whether equities will keep rising or for how...

How to Manage Your Investments Late in a Cycle Nobody knows for sure whether equities will keep rising or for how long, but knowing a...

How to Manage Your Investments Late in a Cycle Nobody knows for sure whether equities will keep rising or for how long, but knowing a...

It took about a billion years for life – single cell organisms — to develop on planet earth. Another 500 million years led...

It took about a billion years for life – single cell organisms — to develop on planet earth. Another 500 million years led...

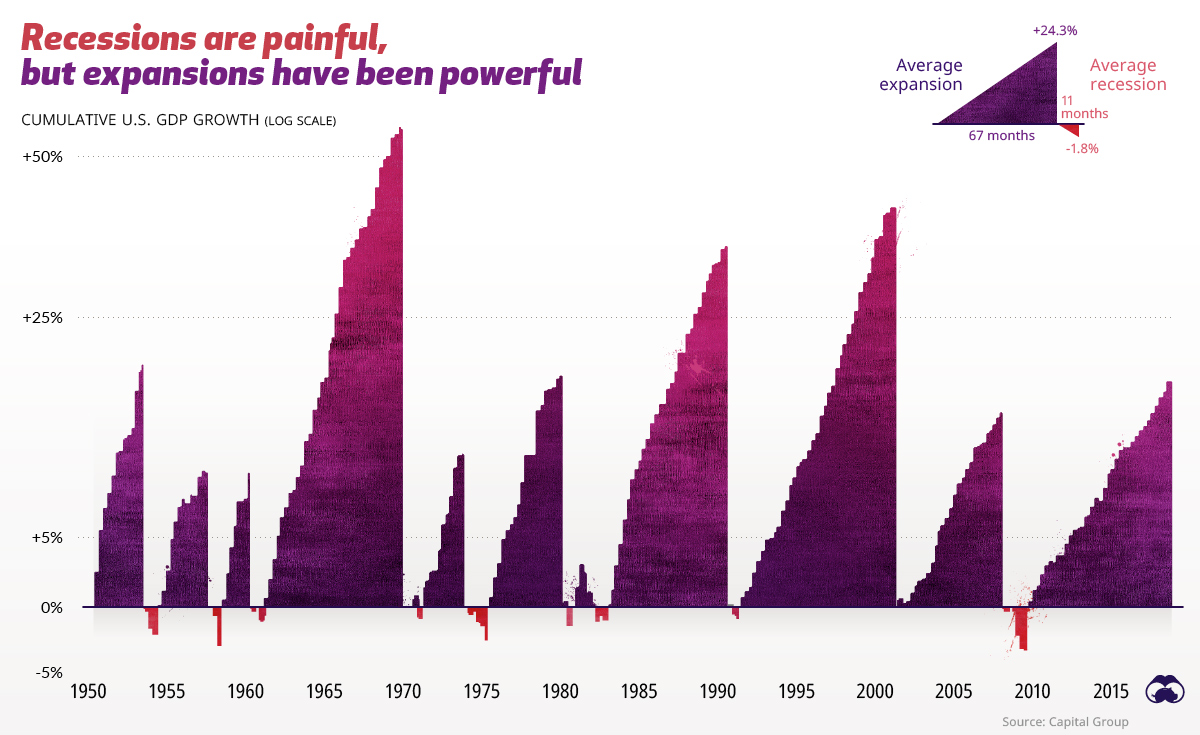

Everything You Need to Know About Recessions Source: Visual Capitalist Persuasive guide to what recessions look like via...

Everything You Need to Know About Recessions Source: Visual Capitalist Persuasive guide to what recessions look like via...

Get subscriber-only insights and news delivered by Barry every two weeks.