Source: Bipartisan Policy Center

From Bipartisan Policy Center:

Among other things, the BPC analysis finds:

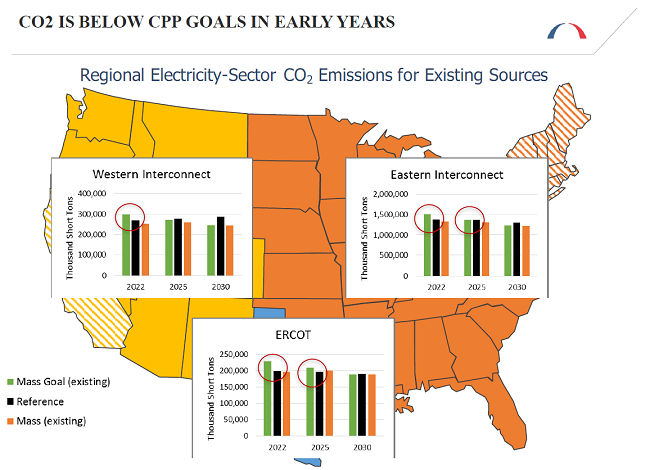

- State energy policies, falling natural gas prices, and the extension of federal tax incentives for renewables mean many states are currently on track to comply with the CPP in the early years.

- Even in the midst of these complementary trends, the CPP is expected to drive additional CO2 reductions and investments in clean energy.

- While various CPP policy options benefit existing nuclear generation, mass-based policy with banking and coverage of both new and existing units is significantly more effective at delaying premature nuclear retirements that are economically threatened by low natural gas prices.

- Using emissions trading and expanding trading regions over larger areas could help to offset uncertainty and mitigate impacts from unforeseen events, such as unexpected outages, a range of potential technology futures, and extreme weather such as droughts.

- While individual state results vary, broad adoption of mass-based trading is expected to result in lower cost and, if new units are covered, lower cumulative CO2 emissions, than broad adoption of rate-based trading.

- Under the CPP, additional energy efficiency tends to smooth the transition in generation and capacity mix by delaying both coal retirements and new natural gas builds.

- While the potential for shifting emissions to uncovered units is dependent on assumptions and varies by state, low compliance costs and expectations about future CO2 constraints tend to diminish the risk.