Urban Carmel writes at the Fat Pitch blog. I love his take on news:

“The irony of equity investing is this: if you knew nothing about the stock market and did not follow any financial news, you have probably made a very handsome return on your investment, but if you tried to be a little bit smarter and read any commentary from experienced managers, you probably performed poorly.”

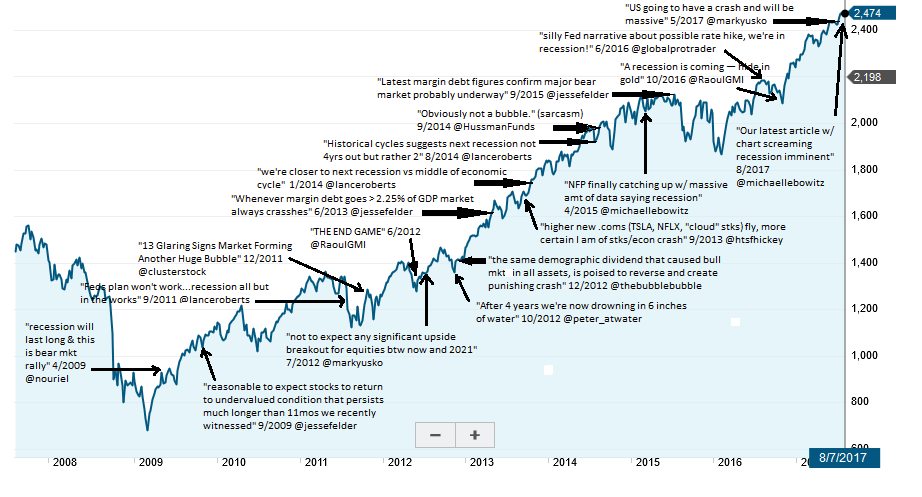

Man, is this a great chart:

Source: Fat Pitch

More:

“The human mind has a tendency to assess risk based on prominent events that are easily remembered. The 1987 crash, the tech bubble, the financial crisis and the flash crash in 2010 are all events that are easily recalled. The mind automatically assigns a high probability to prominent (but rare) events. It ignores the more important “base rate” probability that better informs decisions. The fact that the stock market rises in 76% of all years, that it gains an average of 7.5% per year and that annual falls greater than 20% occur less than 5% of the time, are ignored in decision making. The mind interprets every 10% correction as the beginning of something much worse, even though a 10% fall is a typical, annual occurrence during bull markets.”

Great stuff, Urban!

Previously:

Lose the News

Barry Ritholtz

TheStreet.com (Apprenticed Investor) 06/16/05

ritholtz.com/2005/06/apprenticed-investor-lose-the-news-2/

Gradual Improvements Go Unnoticed (March 20, 2017)

Reduce the noise levels in your investment process

Barry Ritholtz

Washington Post, November 1, 2013

https://www.washingtonpost.com/business/reduce-the-noise-levels-in-your-investment-process/2013/10/31/69441cc0-3e93-11e3-b6a9-da62c264f40e_story.html

What You’re Hearing Is Market Noise

Much of what you hear about financial markets is noise that often is seductive, but wrong.

Bloomberg, April 9, 2014.

Read With Caution When There’s Money at Stake

Know your authors, their biases and their tracks records.

Barry Ritholtz

Bloomberg, April 12, 2017.

https://www.bloomberg.com/view/articles/2017-04-12/read-with-caution-when-there-s-money-at-stake

More Signal, Less Noise (October 25, 2013)

More Noise, Less Signal (October 29, 2013)

What's been said:

Discussions found on the web: