This is both frightening and interesting:

Americans as it stands are drastically undersaved for retirement. Only a third of employees contribute to a 401(k) plan, and that’s if their employers even offer such an account (only 14% actually do, according to U.S. Census Bureau researchers). The typical working-age American couple only has $5,000 saved for retirement according to an analysis of the Federal Reserve’s 2013 Survey of Consumer Finances done last year, and not many baby boomers are financially prepared for retirement just yet.

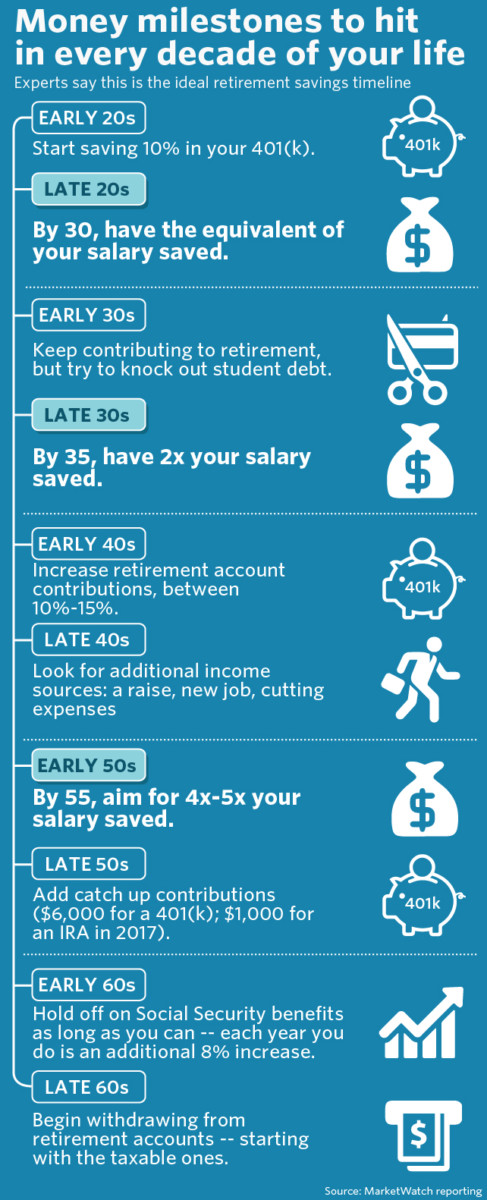

I cannot swear to these milestones and recommendations — Who could possibly have at 30 saved up half of their annual salary? — but it’s a thought provoking exercxise to look at the full arc of time of a saver by decade regardless:

Source: MarketWatch