5 Rules to Help Avoid Investing Disaster

It’s actually not that hard.

Bloomberg, February 8, 2018.

A basic rule of life is to avoid being a guinea pig in other people’s experiments. This is an inviolable rule of technology: consumers should always leave 1.0 of anything to the early adopters. All car fanatics know that any brand-new vehicle model will come with bugs, quirks and design issues that tend to get corrected in the second year of production. And anytime finance creates a new product — from CDOs to ETNs to ICOs — smart investors know to give these novel trading vehicles a wide berth until proven safe and effective in a variety of market and economic conditions.

Which brings us to the most recent shiny Wall Street toy to blow up: inverse volatility products. Consider the Credit Suisse Velocity Shares Inverse VIX ETN. The prospectus for this product has a so-called termination clause, and Credit Suisse has said it will redeem the ETN later this month. What was worth $1.5 billion last week has now rung down the curtain and joined the choir invisible,declined by roughly 95 percent. The best explanation I have seen to date on the inverse volatility trade is here.

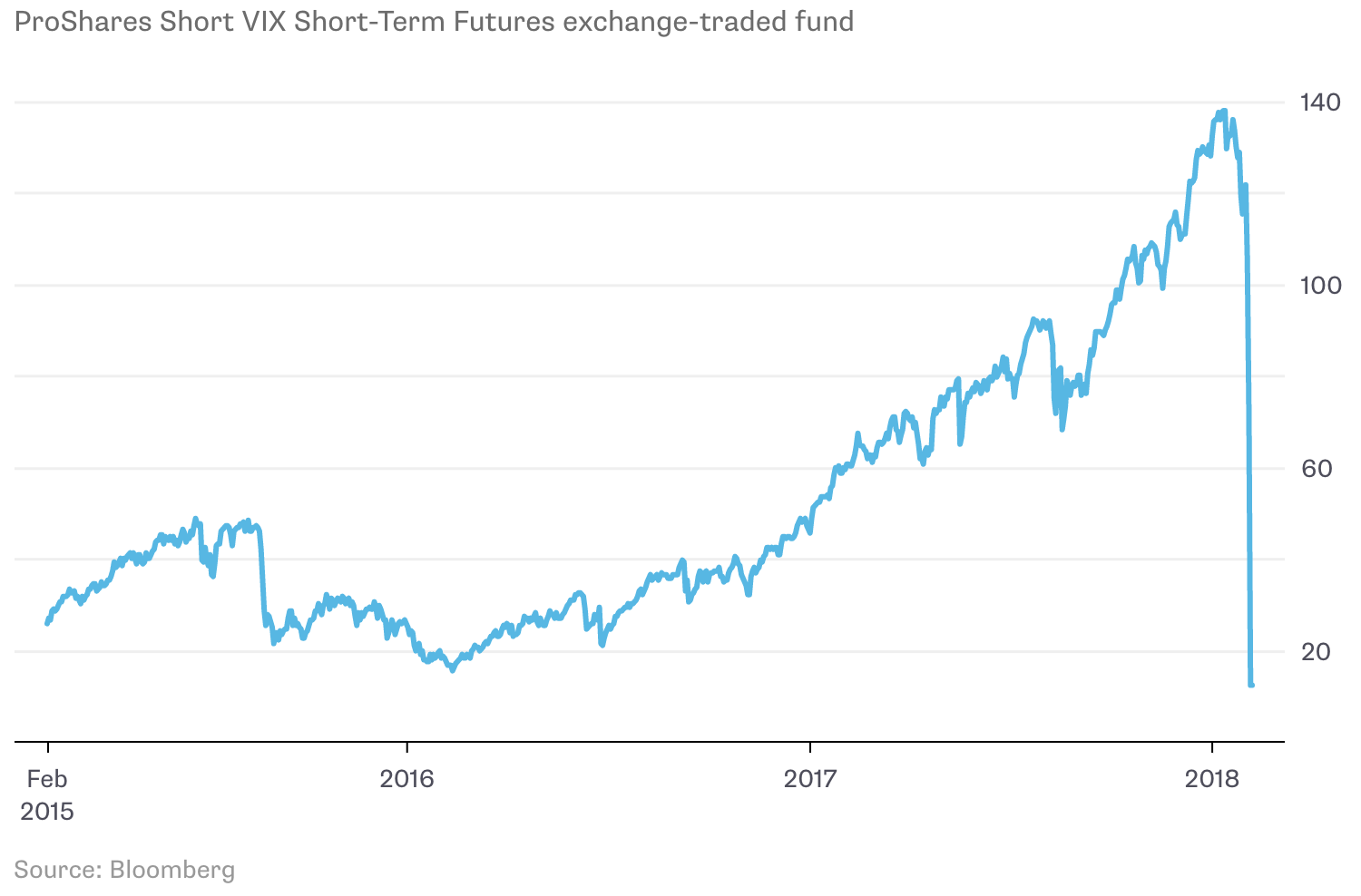

See the chart below for what happened to those who played a version of this bet:

Cliff Dive

Events such as this are opportunities to remind investors of some basic rules. So, without further delays, let’s delve into what lessons investors should have gleaned from the past week’s debacle.

No. 1. Avoid New Products: It bears repeating — all new and untested financial products should be avoided for a full market/economic cycle. Wait for a recession and recovery, a bull and bear market cycle before buying any new Wall Street offering. There is no downside to waiting a few years; the upside is missing the disasters that seem to occur on a regular basis. Whether it is securitized subprime mortgages, or inverse volatility notes, prudence is essential. There is no cost to waiting.

In case you have not yet figured this out, Wall Street designs products to pay itself, not for your advantage. Given everything that has happened since 1999, I can’t believe people have forgotten this already.

No. 2: Too many investors never learn from history. We shouldn’t be surprised that extended market gains lead to complacency. The past few years of placid trading created an environment where selling volatility short — betting things would stay calm — was a quick and profitable trade. But a collective and costly form of amnesia led investors to forget about simple mean reversion. Eventually, volatility returned, as it always does. When it did, the trade went south fast. A few billion dollars were lost, leading to forced liquidations, and a reminder that traders must sell what they can, not what they want to in order to raise cash. Lots of that likely was in U.S. equities, in particular the SPDR S&P 500 ETF. That selloff created a $2 trillion downdraft.

No. 3: Never buy anything you don’t understand. I was shocked to learn that some retail portfolios were festooned with VIX products. I suspect that older, more conservative investors had no idea what sort of ticking time-bomb was put into their retirement accounts. I doubt any were aware of the exorbitant risk in these products.

Brokers and investment advisers who bought these on behalf of clients can now look forward to making up these losses from their own pockets — or litigation. As Warren Buffett warned, “Risk comes from not knowing what you’re doing.” That seemed to be the case here.

No. 4: Beware of institutional products repackaged for retail. Really? This again? I have previously discussed why selling complex sophisticated products (see rule No. 3 above) to individual investors is a bad idea. First, it is both unsuitable for them, as they (and their advisers) lack the skill and/or temperament to manage the risk. Second, it serves no valid purpose in their portfolios. Stuff like this turns retail clients as Muppets; it’s sold only to earn a commission.

No. 5: Greater returns always come with greater risk. Shorting volatility was a high-risk, high-return trade; it tripled during the past 18 or so months. But high expected returns (all things being equal) always come with greater risk. Whether its greater yield for fixed income or better performance for equities, this is a cardinal rule of investing. Expecting otherwise is seeking the mythical free lunch, which time and again leads to disaster.

Although there were many losers in this event, there were also a handful of winners. Advocates of long-term investing and passive indexing came out ahead. The argument for fund companies like Blackrock Inc. and Vanguard Group Inc. for most investors looks more compelling than ever.

Originally: 5 Rules to Help Avoid Investing Disaster