The Rise of Shale Oil

Michael T. Owyang and Hannah G. Shell

St Louis Fed, Tuesday, May 15, 2018.

Technological advances that allow oil producers to extract crude oil from shale rock formations have reshaped the landscape of U.S. oil production over the last 10 years. Since 2008, shale oil production has increased from around 450,000 barrels per day (bpd) to over 5 million bpd and now accounts for more than half of total U.S. crude oil production.

This increase in production is unmatched on a global scale: In 2017, the U.S. became the largest oil-producing country with an average of 14.6 million barrels per day of crude oil, petroleum, and biofuels, 2 million barrels per day more than Saudi Arabia.

Shale oil production is different from traditional production in two key ways:

- Multiple wells can be drilled from one platform.

- It appears that shale oil production responds differently to changes in oil prices compared with traditional wells.

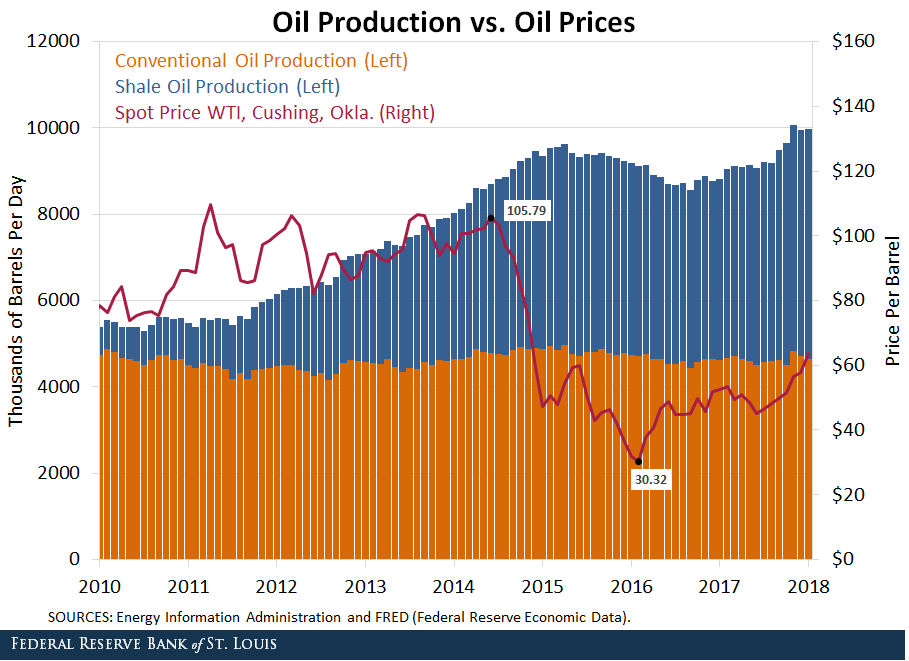

The figure shows both the spot price of oil (as measured by West Texas Intermediate at Cushing, Okla.) and the U.S. production of oil broken down by shale and conventional production.

Between June 2014 and February 2016, the price of WTI oil dropped from $105.79 to $30.32 (red line). At the time, the belief was that the precipitous drop in prices would lead oil-producing firms in the U.S. to cut back production in shale oil fields.

Oil Production

During the period, total oil production in the U.S. dropped from about 9.6 million bpd to about 8.6 million bpd (sum of blue and orange bars). Production has subsequently has recovered to about 10 million bpd—in part because of a strengthening global economy. However, one might ask how a sustained decline in oil prices would affect U.S. oil production that has become increasingly reliant on extraction from unconventional oil fields.

It turns out that extracting crude oil from unconventional wells is a significantly different operation than extracting from a conventional well. One can think of the oil extraction process as four steps from in-the-ground to market:

- Location

- Drilling

- Extraction

- Storage

Many people think that drilling and extraction are one in the same. However, the actual process allows the oil company to drill the well without extracting the oil. This allows the oil company to store the oil in the ground relatively cheaply.

Conventional Wells vs. Unconventional Wells

The difference between conventional wells and unconventional wells (such as shale oil wells) is nicely documented in a 2017 paper by Hilde Bjørnland, Frode Martin Nordvik and Maximilian Rohrer.1 In particular, they emphasized that the extraction process for unconventional wells—which involves stimulating the wells with water, sand and chemicals—can be undertaken a number of times during the life of the well.

On the other hand, once conventional wells are tapped and extraction is started, production cannot generally be stopped. This irreversibility means that the supply from an unconventional well is actually more responsive to future oil prices than the conventional well.

Matching Production with Prices

Why are unconventional wells more responsive? Because some crude oil can be left in the ground—essentially free storage—even after the well is first tapped. This feature—along with a few others outlined in the paper—allows oil companies to be more selective about when they tap the well.

Moreover, unconventional wells typically involve horizontal drilling, which allows producers to access previously inaccessible stores of oil. Conventional drilling requires oil wells to be drilled from the top down, limiting the potential supply.

Not surprisingly, the figure shows that the reduction in oil production between 2014 and 2016 was almost entirely driven by changes in the rate of shale oil production, while conventional production remained relatively steady.

Impact of Low Oil Prices on Unconventional Drilling

What does this mean for unconventional oil when oil prices are low? The nature of the operation enables companies to reduce extraction rates when prices dip and future prices are expected to be low. Moreover, when prices are high, companies can return to unconventional wells that have been previously tapped and resume extraction, albeit at a higher cost.

These features suggest that oil production may be restricted to a price band governed by the cost of unconventional oil extraction. When oil prices rise above the point where shale extraction becomes profitable, producers will start extracting from the shale wells.

If prices continue to increase above this point, shale production will continue to ramp up until prices reach the top of the band and production hits full capacity. If the price band theory is correct in practice, unconventional drilling may have a dampening effect on oil price spikes.

Notes and References

1 Bjørnland, Hilde; Nordvik, Frode Martin; and Rohrer, Maximilian. “Supply Flexibility in the Shale Patch: Evidence from North Dakota.” Norges Bank Working Paper No. 9, 2017.

Additional Resources

- On the Economy: 3 Possible Reasons Gas Prices Spiked Following Hurricane Harvey

- On the Economy: Oil Producing Countries and Repaying Debts

- On the Economy: Is OPEC Losing Its Ability to Influence Oil Prices?

~~~

This article is reprinted here with permission from the Federal Reserve Bank of St. Louis: Owyang and Shell, “The Rise of Shale Oil,” Federal Reserve Bank of St. Louis On The Economy Blog, May 2018. © 2018 by the Federal Reserve Bank of St. Louis. All views expressed herein are those of the author(s) and not necessarily those of the Federal Reserve Bank of St. Louis or the Federal Reserve System.