How to Become a 401(k) Millionaire

With a little planning and discipline, it’s actually not that hard.

Bloomberg, July 23, 2018

A Twitter-war broke out over 401ks, how much money you can contribute to them and whether a million dollars is a doable target.1

I don’t believe that sentence (above) has ever been written before.

I am always annoyed when I see bad dope on the internet (Fake News!), so I took my swipe at correcting the bad information at Bloomberg today. I did not want to make the personal, and instead focused on correcting what was erroneous.

A few items might be of use to those who are interested in this sort of thing:

This is the spread sheet we created (thanks, Mike!) to calculate the $1.5 million 401k that a) maxed out their 401k contributions and b) gained a modest 6% on a simple 60/40 portfolio; That is also the same spread sheet we used to see how that scaled if a company maxed out its match:

Feel free to download it and play with the numbers.

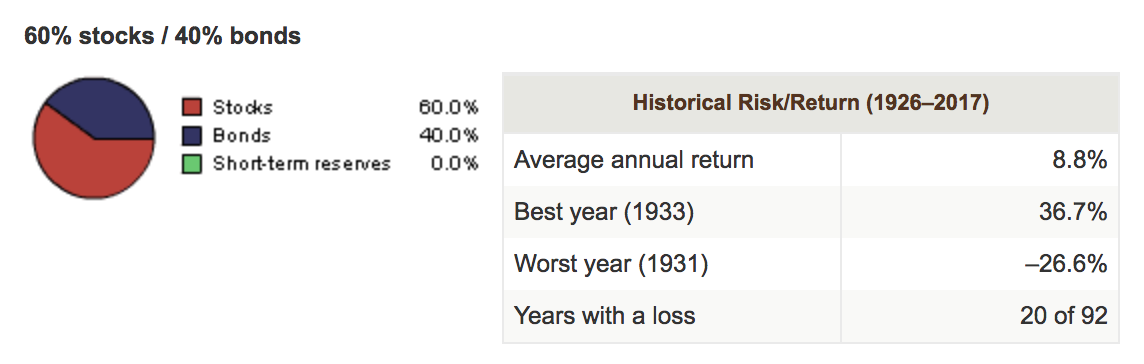

Note that Vanguard’s data suggests a 60/40 portfolio will return 8.8% over long periods of time:

About that trillion dollars: I reached out to several firms as to how many 401k accounts with a million dollars in them. I will update this page, then update the full column when it published here a week from today. But given how Fidelity’s 157,000 million dollar 401k’s, a million nationally is not that much of a reach.

The full column is published here.

_________

1. For a very interesting discussion on the role of Twitter as a peer review forum in asset management debates, see my colleague Josh Brown’s discussion, “I don’t think I would ever invest money with someone who isn’t on Twitter.”