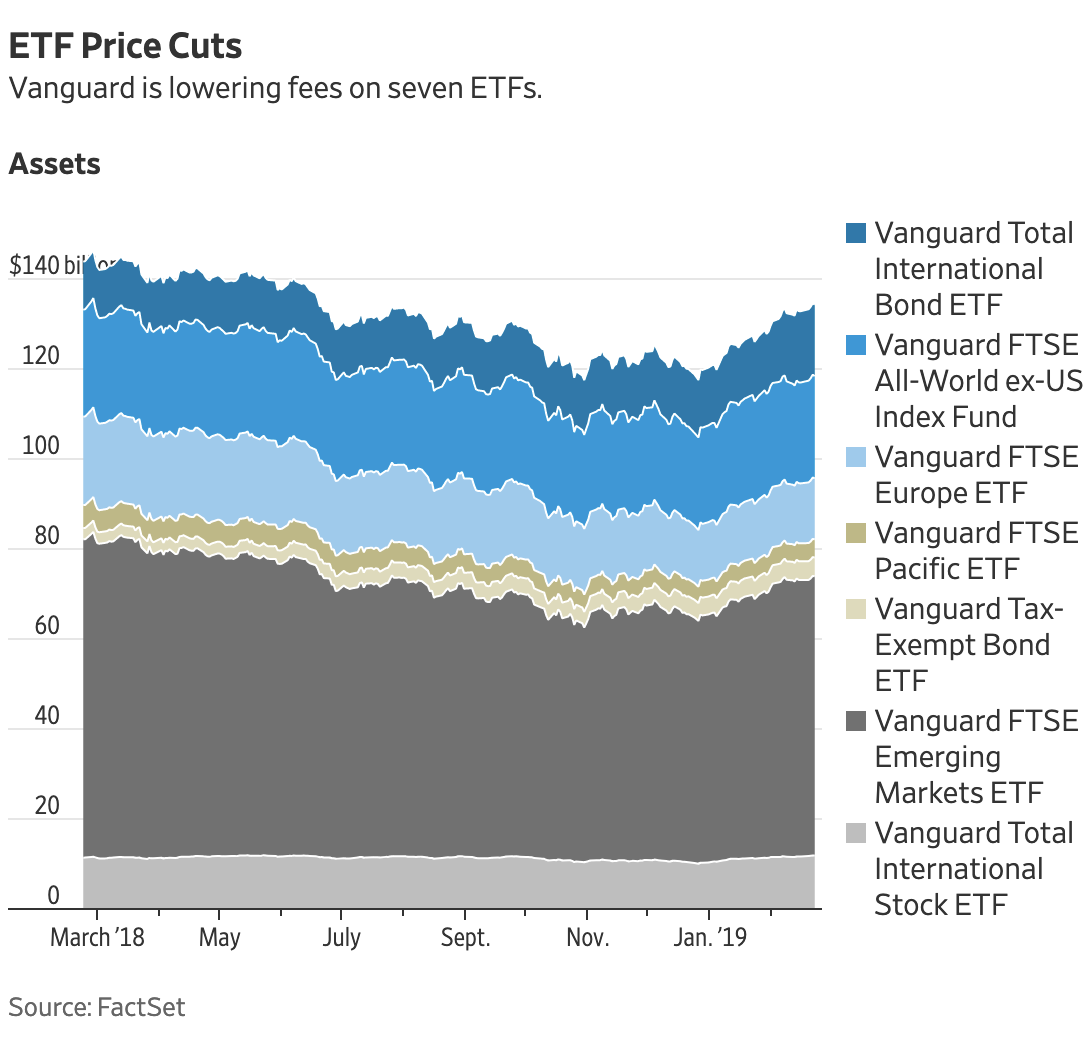

Fees are coming down on 10 Vanguard ETFs $(175 billion aum)

Source: Wall Street Journal

My friend Asjylyn notes the fee wars continue:

“Vanguard Group is cutting management fees on 10 exchange-traded funds, the latest money manager to trim fees on a host of investment products.

The ETFs, with combined assets of $176 billion, include funds that invest in international stocks and bonds. The biggest is the $63 billion Vanguard FTSE Emerging Markets ETF, which will cost $12 a year for every $10,000 invested. That is down from $14, making it cheaper than a competing ETF from BlackRock Inc.’s iShares Core lineup. In addition, 43 Vanguard mutual funds are also reducing fees.”

LOL punchline: My thesis that the “Race to Zero is Over,” barely out for a week, is already showing cracks. But the broader concept — low fees are in Vanguard’s DNA, but are a marketing cost to Schwab and Fidelity — remains fully in effect.

Source:

Vanguard Ups the Ante in an ETF Race to Zero

Asjylyn Loder

WSJ, Feb. 26, 2019

https://www.wsj.com/articles/vanguard-ups-the-ante-in-an-etf-race-to-zero-11551184467

Previously:

Wall Street Learns That Giving Stuff Away Is Boring

Barry Ritholtz

Bloomberg, February 21, 2019

https://bloom.bg/2Ni3Z9m