A Programming Note: Starting next week, Ritholtz’s Reads will have a new home at The Big Picture. In order to continue to receive your morning train reads every day in your inbox, please sign up for the reads-only mailing list here.

~~~

My end of week morning train reads:

• Nomads travel to America’s Walmarts to stock Amazon’s shelves (The Verge)

• Research: Index-Fund Firms Gain Power, but Fall Short in Stewardship (Wall Street Journal)

• Classic Porsche, Rolls-Royce, and Ferrari Models Are Losing Steam: You can’t sell an old man’s car to a young man (Bloomberg)

• The Private Equity Funds Selling for More Than They’re Worth (Institutional Investor) `

• Good Information Alone Won’t Drive Financial Well-Being (UCLA Anderson Review)

• Forget robo-taxis: it’s e-bikes that are reshaping urban transport (Financial Times)

• How “stalkerware” apps are letting abusive partners spy on their victims (MIT Technology Review)

• Raising the American Weakling (Nautilus)

• The Universe Speaks in Numbers review – should we believe in a ‘theory of everything’? (The Guardian)

• The 2019 MLB Moneyball Report: Without salary caps and league parity, MLB is the professional sport most closely resembling a free market where, in theory, you get what you pay for. (Worth)

Be sure to check out our Masters in Business interview this weekend with Scott Kupor, managing partner at Andreessen Horowitz, and author of the new book, Secrets of Sand Hill Road: Venture Capital and How to Get It.

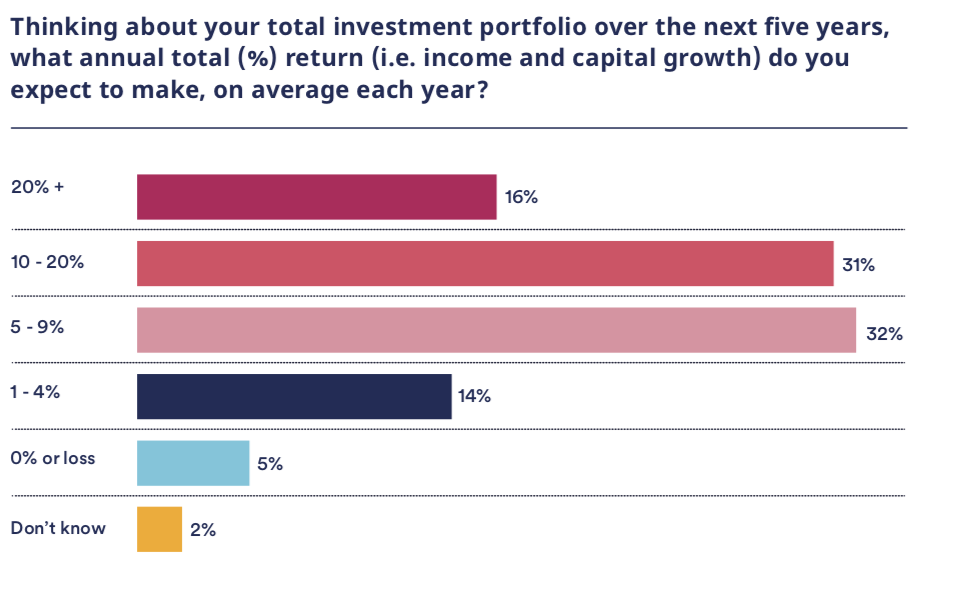

Investor behavior: do people have control of their personal finances?

Source: Schorders via Mike Batnick