Welcome to August! Kick it off with our Thursday morning train reads:

• Here’s what it takes to weather a major bear market and then buy stocks on the cheap (Marketwatch)

• Sure, Hedge Funds Are Charging Less, but There’s a Catch (Chief Investment Officer)

• Siegel: Have Stock Buybacks Gone Too Far? (Knowledge@Wharton) see also How Stock Buybacks Undermine Healthy Capitalism (Worth)

• This Is the Beginning of the End of the Beef Industry: Alt meat isn’t going to stay alt for long, and cattle are looking more and more like stranded assets (Outside)

• Make It Last: Fintech Firm Solves Number One Retirement Fear—Outliving Your Money (Forbes)

• To Fix Its Housing Crunch, One U.S. City Takes Aim at the Single-Family Home (Businessweek)

• UK’s first supermarket designed by public health experts launches (Evening Standard)

• A Prince’s $500 Billion Desert Dream: Flying Cars, Robot Dinosaurs and a Giant Artificial Moon (Wall Street Journal)

• Apple contractors ‘regularly hear confidential details’ on Siri recordings (The Guardian)

• Pamela Adlon’s Better Things is not a riff on the antihero show so much as it is an antidote to it. (LongReads)

Be sure to check out our Masters in Business interview this weekend with Rajiv Jain, Chairman and Chief Investment Officer of GQG Partners, with $24 billion in AUM. Jain was 2012 Morningstar International Manager of the Year.

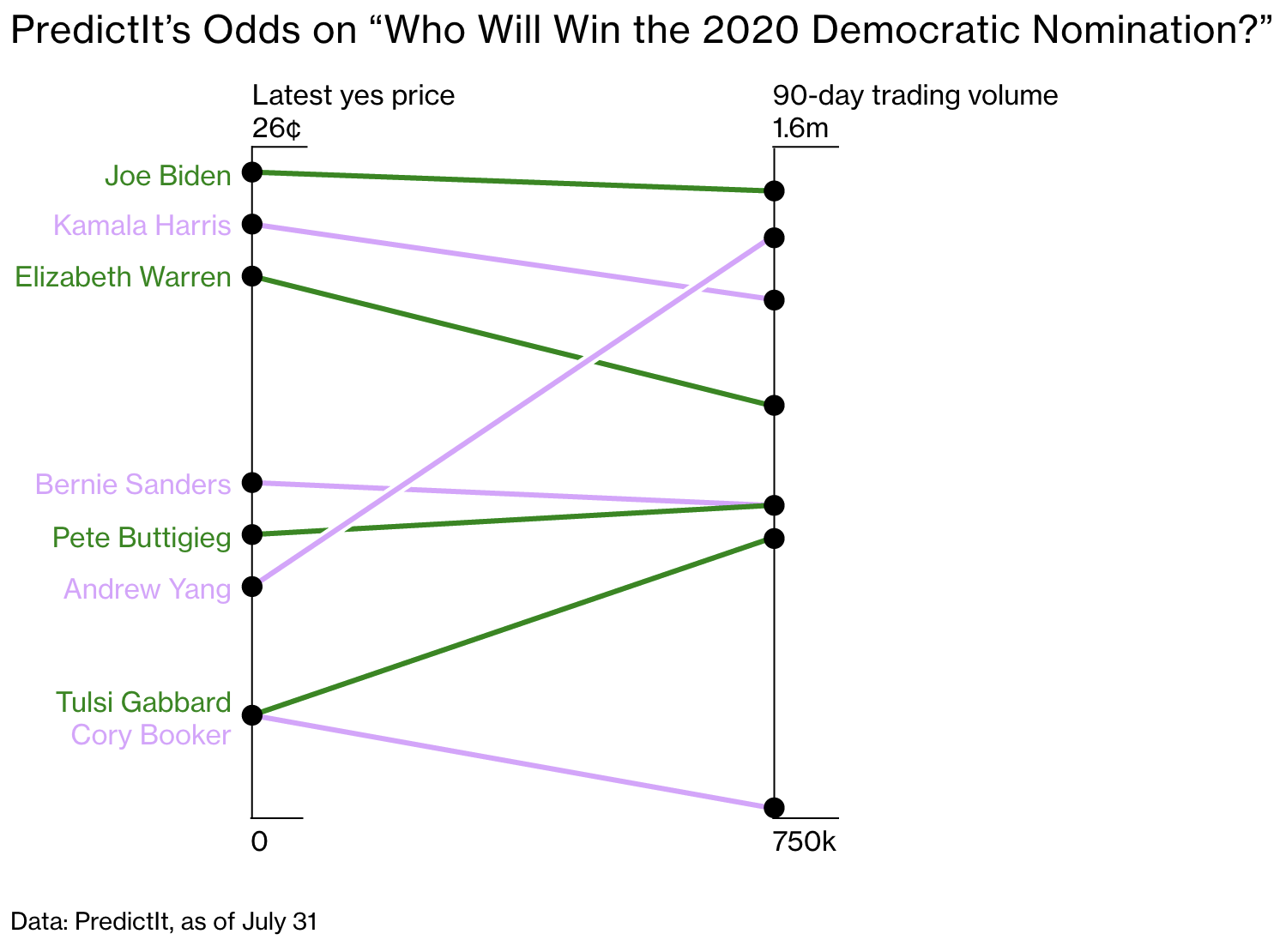

PredictIt Owns the Market for 2020 Presidential Election Betting

Source: Bloomberg

Sign up for our reads-only mailing list here.