IPOs Have Been Crushed in 2019. Why That’s Actually Good News for Stocks

Source: Barron’s

Here is By Eric Savitz:

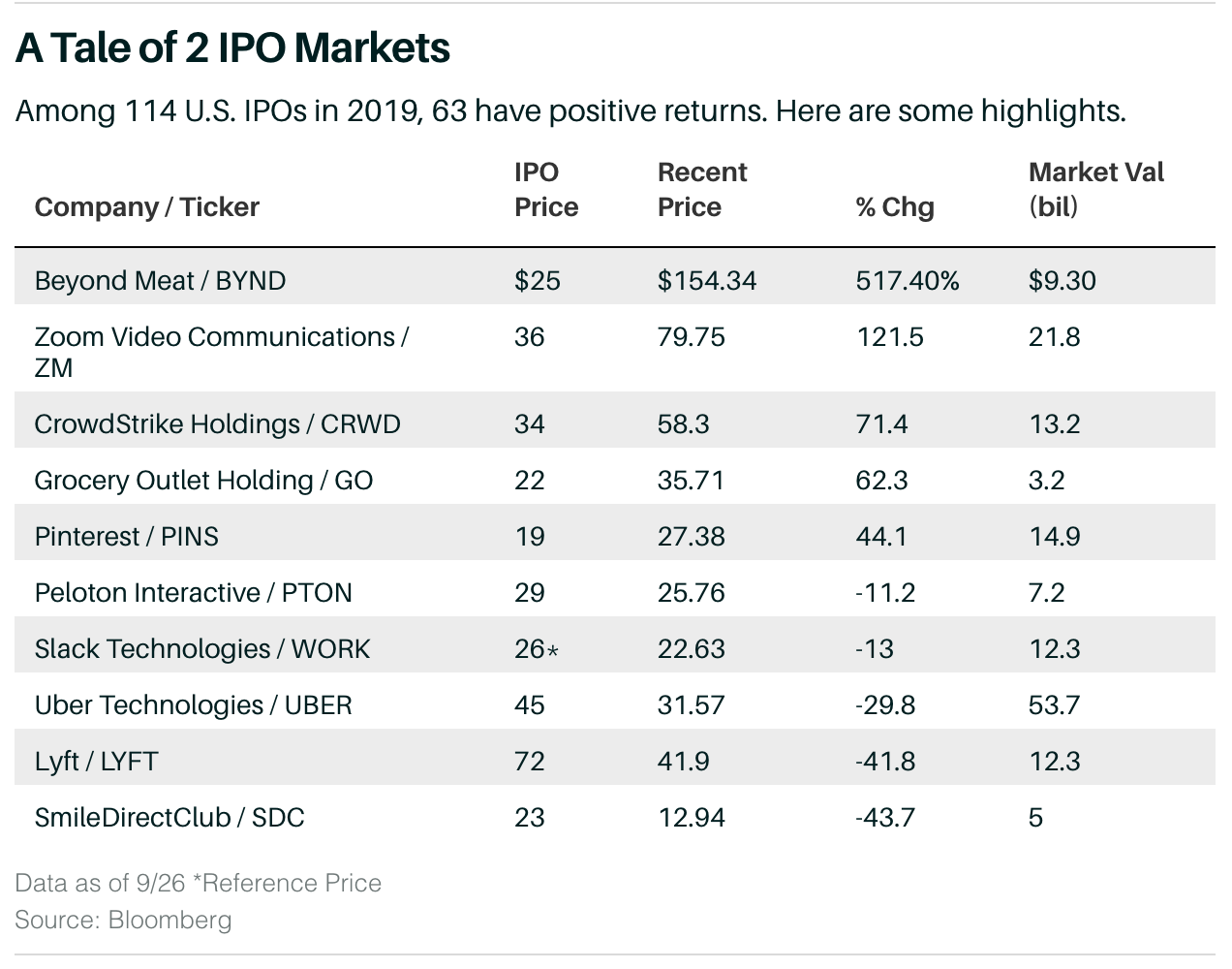

“All of a sudden, the initial public offering market is behaving rationally…”

“There is clear data to show that IPOs aren’t always efficient mechanisms for price discovery. From 1980 to 2018, the average first-day return after an IPO was 18%, according to Ritter. That underpricing amounted to $165 billion in proceeds left on the table, Ritter calculates. Theoretically those funds could have gone to company coffers if bankers had more accurately predicted value before pricing stocks.”

Go see the entire column here.