Do market prices generally reflect all available information? Or are they prone to bubbles?

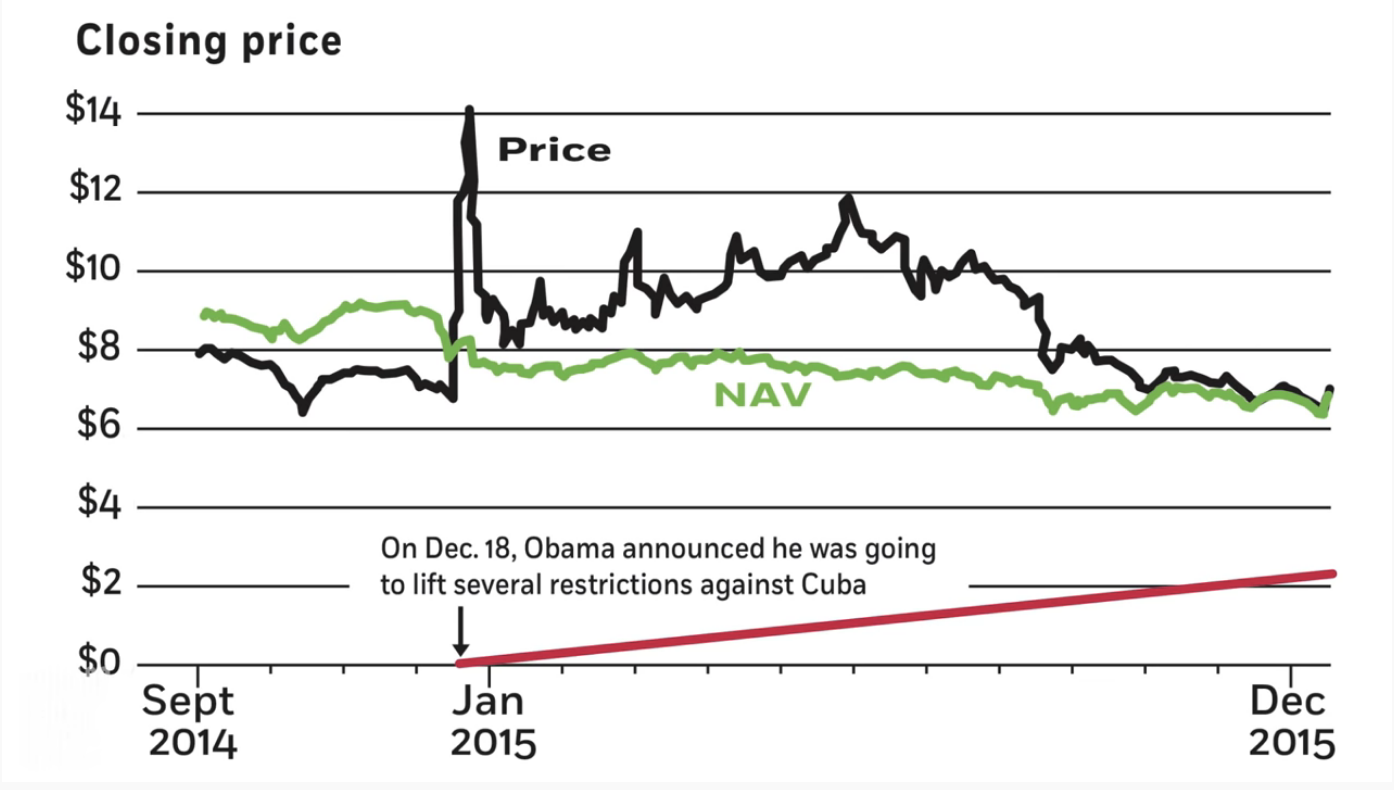

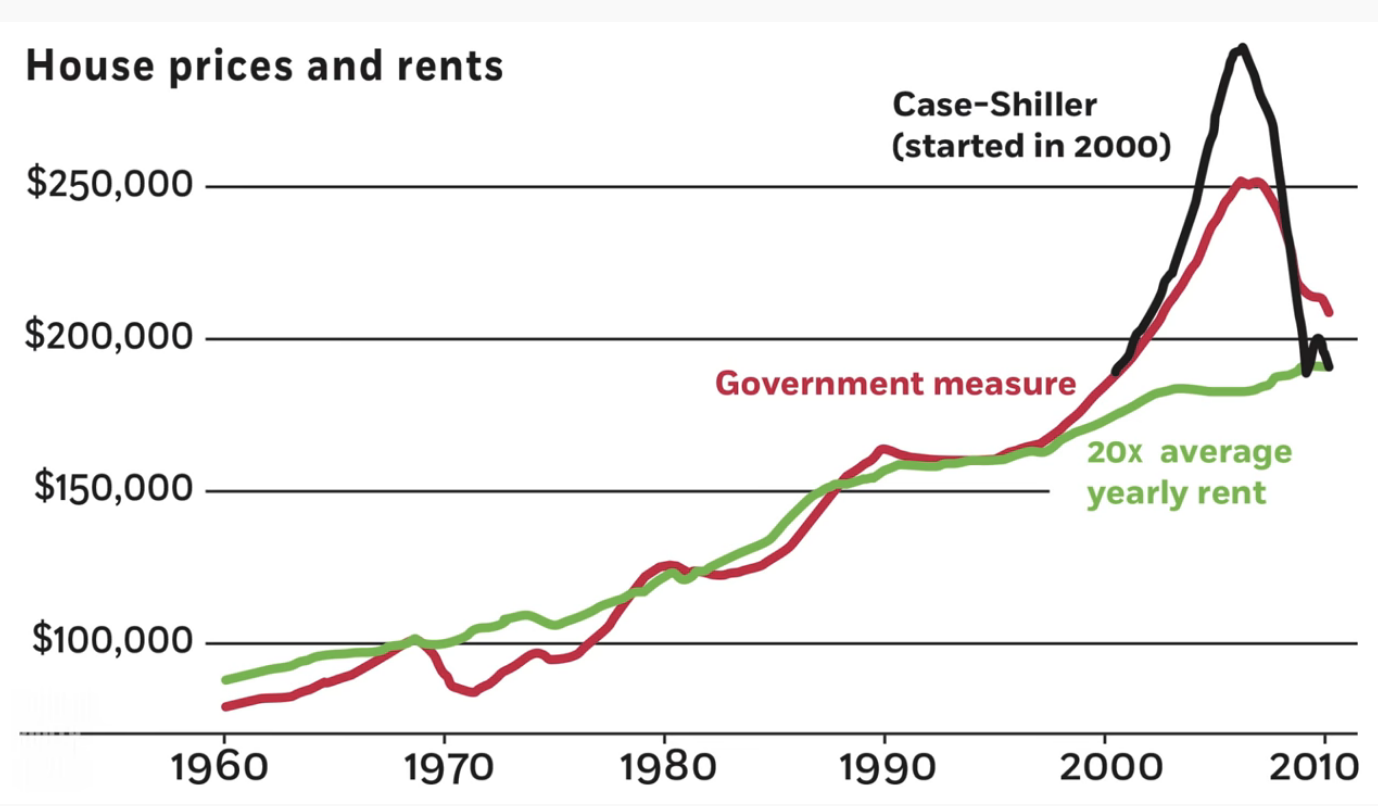

On this episode of The Big Question, two members of the Chicago Booth faculty—Nobel laureates Eugene F. Fama and Richard H. Thaler discuss how markets behave (and misbehave). Along the way they discuss value stocks versus growth stocks, the existence of economic bubbles, and the curious case of the CUBA Fund.

Are markets efficient?

Recorded Jun 30, 2016