The 2010s Were an Economic Tragedy

Source: Slate

A regular source of fascination for me is trying to suss out causative events driving significant trends in the future, or to trace out causes of what occurred in the past. Not the big, dinosaur-killing meteor impacts that are so obvious after-the-fact; but rather, the smaller, lesser known events that quietly change how people see the world and how they behave within it.

My look at the causes of the Great Financial Crisis (and subsequent bailouts) tried this approach.

There are often smaller “one-offs” that slip by unnoticed: Factors that, on their own, were not expected to cause very much of anything, but when combined with other “inconsequential” elements, turned out to be very consequential indeed. Some are unintended consequences; others just random events. The most intriguing are those ideas that are thought to be well understood and innocuous, but which end up having enormous impact, far beyond what the original “small” event might have suggested.

A good example is the concept of “Austerity” in the aftermath of a financial crisis. The approach flew in the face of everything we already learned from Great Depression, Keynes, and after. It was both obvious and overlooked at the same time.

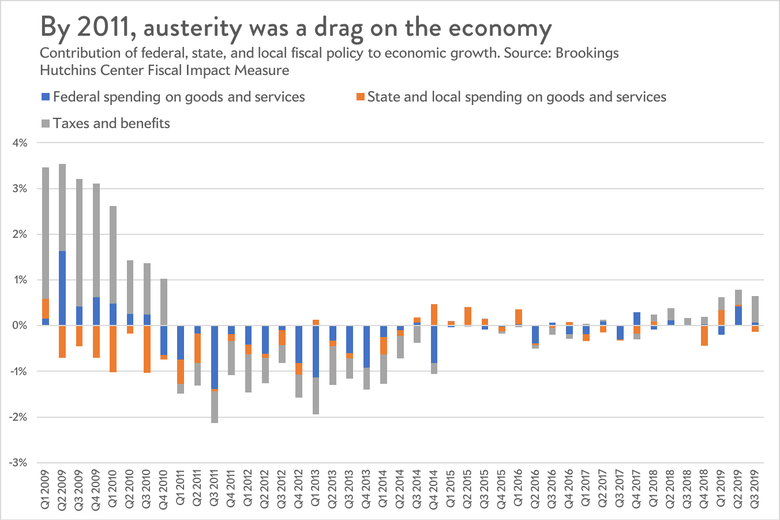

The response to the financial crisis by the people we’ve come to call Austerians worked to prevent the government from deploying the usual post-crisis stimulus playbook: Cutting taxes and increasing fiscal spending. This normally acts as a temporary substitute for depressed private sector household and business spending declines. The lack of a traditional Keynesian response created instead myriad bad results — slow job growth, weak retail sales, soft GDP, poor wage gains. Those conditions persisted for most the ensuing decade. These were ignored by many at the time, but for those understood what was occurring, the future damage was obvious.

“Austerity” was Merriam-Webster’s most searched word in 2010. It slowed the recovery; may have caused Brexit; curtailed state and local contributions to GDP; devastated Europe; led to instability and even violence.

The bigger picture is that all too often, it is not the big event that contains so much portent, but the reactions to that event. The significance of unintended consequences and poor decision-making processes get under-estimated as they conspire to create unfathomably bad results. The 21st century textbook examples of this were the reactions to 9/11 and the Great Financial Crisis — each of the bad decisions made took a tragedy and made it far worse than it ever needed to be.

It has been said about Watergate — and now the Ukraine scandal — that it was not the crime, but the cover up that got people into so much trouble. The event is a problem, but the reactions, over-reactions and bad decisions turned a small kitchen fire into a conflagration. So too is it with crises — while the events may be bad, it takes emotional and inappropriate reactions to make things much worse.

Let’s hope we learn the lessons from austerity in the USA, Europe and Japan in the 2010s. If only we as a species had the capacity to learn from our own mistakes.

Happy New Year.

Previously:

Why don’t bad ideas ever die? (December 22, 2012)

See also:

The Legacy of Destructive Austerity (NYT)

Selective deficit hysteria has done immense damage. (NYT)