Succinct Summations for the week ending February 28th, 2020:

Positives:

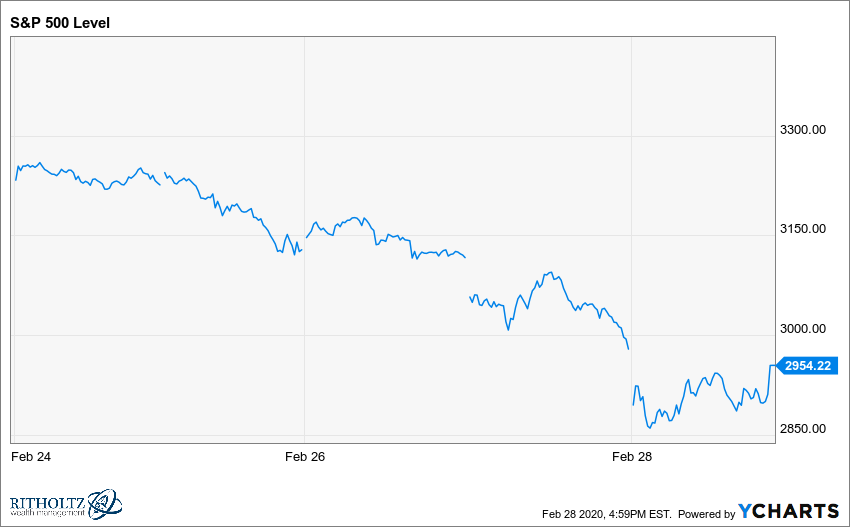

1. Orderly 10% repricing of markets has yet to turn into full blown panic.

2. New home sales rose 764k m/o/m, above the expected 710k.

3. FHFA House Price Index rose 0.6% m/o/m, above the expected increase of 0.3%.

4. Home mortgage apps rose 6.0% w/o/w, above the previous decrease of 3.0%.

5. Pending home sales rose 5.2% w/o/w, above the expected increase of 2.2%.

6. State Street Investor confidence index came in at 77.9, above the previous 75.4.

Negatives:

1. Worst week since 2008 as markets shed >10%;

2. Its amateur hour: Neither POTUS nor the skeletal staff CDC are prepared to respond to a global pandemic;

3. Durable goods orders fell 0.2% w/o/w, below the previous increase of 2.9%.

4. Jobless claims rose 8k w/o/w from 211k to 219k.

5. Home refinance apps fell 1.0% w/o/w, after the previous decrease of 8.0%;

6. Wholesale inventories fell 0.2% w/o/w, below the expected increase of 0.1%.

Thanks, Matt!