My mid-week morning train reads:

• A Misplaced Faith in the Power of Central Banks: Monetary policy tools are ill-suited and almost out of ammunition, but fiscal policy has plenty of firepower. (Wall Street Journal)

• Why US Stocks Remain the Brawniest in the World (CIO)

• The Market Is Bullying The Fed: Jeffrey Sherman, Deputy Chief Investment Officer at DoubleLine, expects the Federal Reserve to give in to the pressure from Wall Street. (The Market)

• Private Equity Firms’ Incestuous New Strategy (Institutional Investor)

• 5 ways advice will change in the next 10 years (Evidence-Based Advisers)

• How To Buy A House Like Warren Buffett (Forbes)

• Jack Welch the number-whisperer (FT Alphaville)

• Take One Last Look at the (Many) Plastic Bags of New York (New York Times)

• Epidemics Reveal the Truth About the Societies They Hit (The Atlantic) see also ‘You don’t want to go to war with a president’: How Dr. Anthony Fauci is navigating the coronavirus outbreak in the Trump era. (Politico)

• Paige Bueckers Is the Future of Basketball (Bleacher Report)

Be sure to check out our Masters in Business interview this weekend with Danielle DiMartino Booth, founder of Quill Intelligence, a research and analytics firm, and author of Fed Up: An Insider’s Take on Why the Federal Reserve is Bad for America.

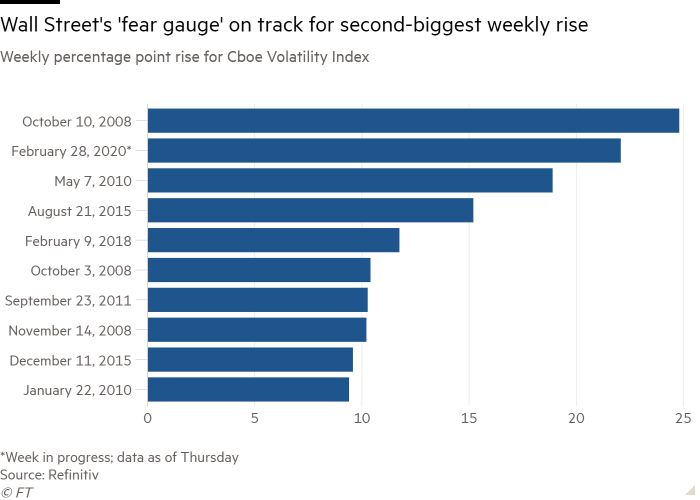

Volatility index hits highest level since 2011

Source: Financial Times

Sign up for our reads-only mailing list here.