My Two-for-Tuesday morning train WFH reads:

• This version of Warren Buffett (Reformed Broker) see also Warren Buffett’s Peek Into the Financial Abyss (Institutional Investor)

• Internal Chinese report warns Beijing faces Tiananmen-like global backlash over virus (Reuters)

• In many ways, stockmarkets have been extraordinary in 2020 (Economist) but see also Airlines Got the Sweetest Coronavirus Bailout Around (Bloomberg)

• The Economic Recovery Rests on Getting Consumers to Spend. It Won’t Be Easy. (Barron’s)

• Covid Aid Scams and Dodgy Deals Could Have Been Avoided: Lack of federal leadership turns contracting for supplies into the Wild West. (Bloomberg) see also The Paycheck Protection Program, Meant to Prevent Mass Layoffs, Missed Its Target (ProMarket)

• Ultra-Rich Families With Cash on Hand Pile Into Private Debt (Bloomberg)

• Sweden says its coronavirus approach has worked. The numbers suggest a different story (CNN) see also No, Sweden Isn’t a Miracle Coronavirus Model (Bloomberg)

• How the coronavirus undid Florida Gov. Ron DeSantis (Yahoo News)

• Reopening states will cause 233,000 more people to die from coronavirus, according to Wharton model (Yahoo Finance) see also As Washington stumbled, governors stepped to the forefront (Washington Post)

• How to Entertain Kids at Home? They Have 34 Suggestions (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Jim Chanos, famed short seller and founder Kynikos Associates. Chanos helped to expose a number of financial frauds, most famously Enron, Baldwin-United, and Drexel Burnham.

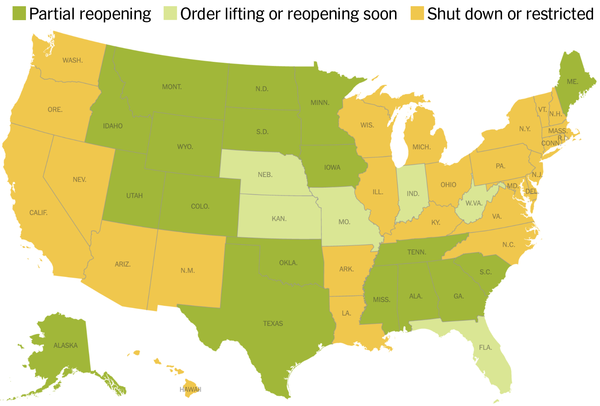

Open or closed?

Source: New York Times