My back to work morning train WFH reads:

• Driving Over Air Travel, Takeout Over Cafes: Pandemic Shapes Consumption: Spending data reflect recent reopenings, with consumers cutting back on some online grocery purchases and flocking to hair salons and furniture stores. But they also spent on takeout and food delivery, and continued to splurge on home improvement and sporting goods. (Wall Street Journal)

• The Nifty Fifty and the Old Normal: What happened to “one decision” stocks is a tale as old at time. They got too far ahead of themselves and crashed even harder than the market at large during the bear market of 1973-1974. Here are the drawdowns for a handful of these names: (A Wealth of Common Sense)

• Here Are the 10 Best-Performing Tech Stocks in the First Half. Software isn’t simply eating the world. Software is saving the world—and buoying portfolios like no other sector of the economy. During the first half of 2020, the Nasdaq 100 rallied almost 17%, sprinting past the S&P 500 index, which fell 4%. The numbers look even better for a broader basket of tech companies. (Barron’s)

• Why Investors Have Learned to Love Wind and Solar Power: Renewable energy has become cheap and now offers investors utility-like returns (Wall Street Journal)

• The Department of Labor Attempts to Throttle ESG Investing. If the DOL’s proposal is approved, it would not destroy ESG investing in the United States. Nonetheless, the DOL supervises $9 trillion in assets–about 30% of the value of the U.S. stock market. That would be a painfully large marketplace for ESG managers to forgo. What’s more, the DOL’s action could conceivably spark similar measures by other regulators. (Morningstar)

• How Well Has Socially Responsible Investing Performed? SRI funds have consistently ranked around the middle of their peer groups (Charles Schwab)

• Networks of self-driving trucks are becoming a reality in the US: The self-driving truck company TuSimple is laying the groundwork for a futuristic autonomous freight industry. (Vox)

• While Washington Dithers, States Put Infrastructure Spending on Ice. With no federal aid in sight, local governments are canceling construction projects. (Businessweek)

• Hemorrhaging advertisers, Facebook launches PR blitz: Advertisers have continued to abandon the platform. In the last three days, 103 more companies have said they are suspending advertising on the platform in July. The group includes Starbucks, Ford, GM, Clorox, Reebok, Adidas, Best Buy, Clif Bar, Chobani, and Denny’s. (Popular Information)

• Washington Redskins owner Daniel Snyder no longer has a choice: The battle over the team’s name has reached its endgame: Change the name or watch one of the most valuable organizations in sports get reduced to financial impotence. (Washington Post)

Be sure to check out our Masters in Business July Fourth holiday weekend interview with Robin King, Chief Executive Officer for the Navy SEAL Foundation, a 501(c)(3) national nonprofit organization that provides critical support and assistance to the Naval Special Warfare (NSW) community and its families.

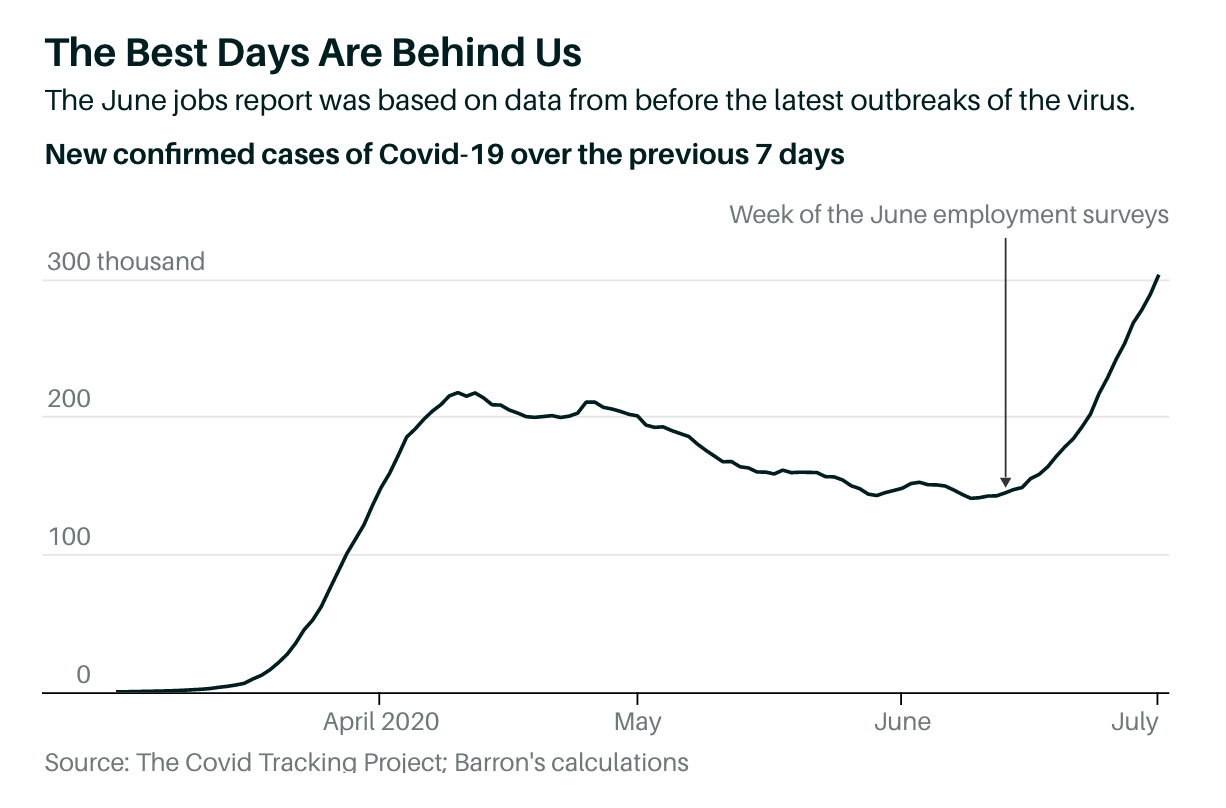

That Spike in the Job Market Looks a Bit Flimsy. Here’s Why.

Source: Barron’s

Sign up for our reads-only mailing list here.