My mid-week morning train WFH reads:

• The S&P 500 Grows Ever More Concentrated: Does this bode well for small-value stocks? (Morningstar)

• Residential real estate is a solid a portfolio diversifier: Look what happened to home prices when the coronavirus sent stocks into a bear market (Marketwatch)

• Should Universities Spend More From Their Endowments? During the virus-driven recession, universities are wrestling with whether they should dip deeper into their endowments. The short answer seems to be no. (Chief Investment Officer)

• Frackers Are in Crisis, Endangering America’s Energy Renaissance: Even before the pandemic, West Texas was reeling and Wall Street was running out of patience with the industry. (Businessweek)

• In Electric Car Market, It’s Tesla and a Jumbled Field of Also-Rans: Most traditional carmakers are struggling to produce and market electric vehicles even as Tesla sells hundreds of thousands of its luxury models (New York Times)

• Winning Streak of Big Cities Fades With 2020 Crises: Coronavirus, anger over policing and strained budgets pack triple punch in cities like New York, Los Angeles and Boston, but don’t count cities out (Wall Street Journal)

• The Future of Our Food Supply: From grocery stores and online delivery to farms and restaurants, how and where we get our food may never look the same. (Citylab)

• Fact-check of viral climate misinformation removed from Facebook: Facebook does not treat climate misinformation the same as coronavirus misinformation because “climate change is not an urgent problem.” (Heated) see also How Facebook Handles Climate Disinformation: Exempting opinion articles from fact-checking amounts to a huge loophole for climate change deniers. (New York Times)

• Does the Lincoln Project have a secret agenda? The answer is surprising: Are Lincoln Project Republicans converts, temporary allies of convenience, or ideological Trojan horse virus? (Washington Post)

• How the Rays Became MLB’s Outliers by Finding MLB’s Outliers: How do you explain Tampa Bay’s unconventional rise to prominence? Start with the story of pitcher Peter Fairbanks. (Sports Illustrated)

Be sure to check out our Masters in Business interview this past weekend with Martin Franklin of Mariposa Capital. Franklin is credited with successfully reviving the use of SPACs, or blank check companies, as public vehicles for long term M&A.

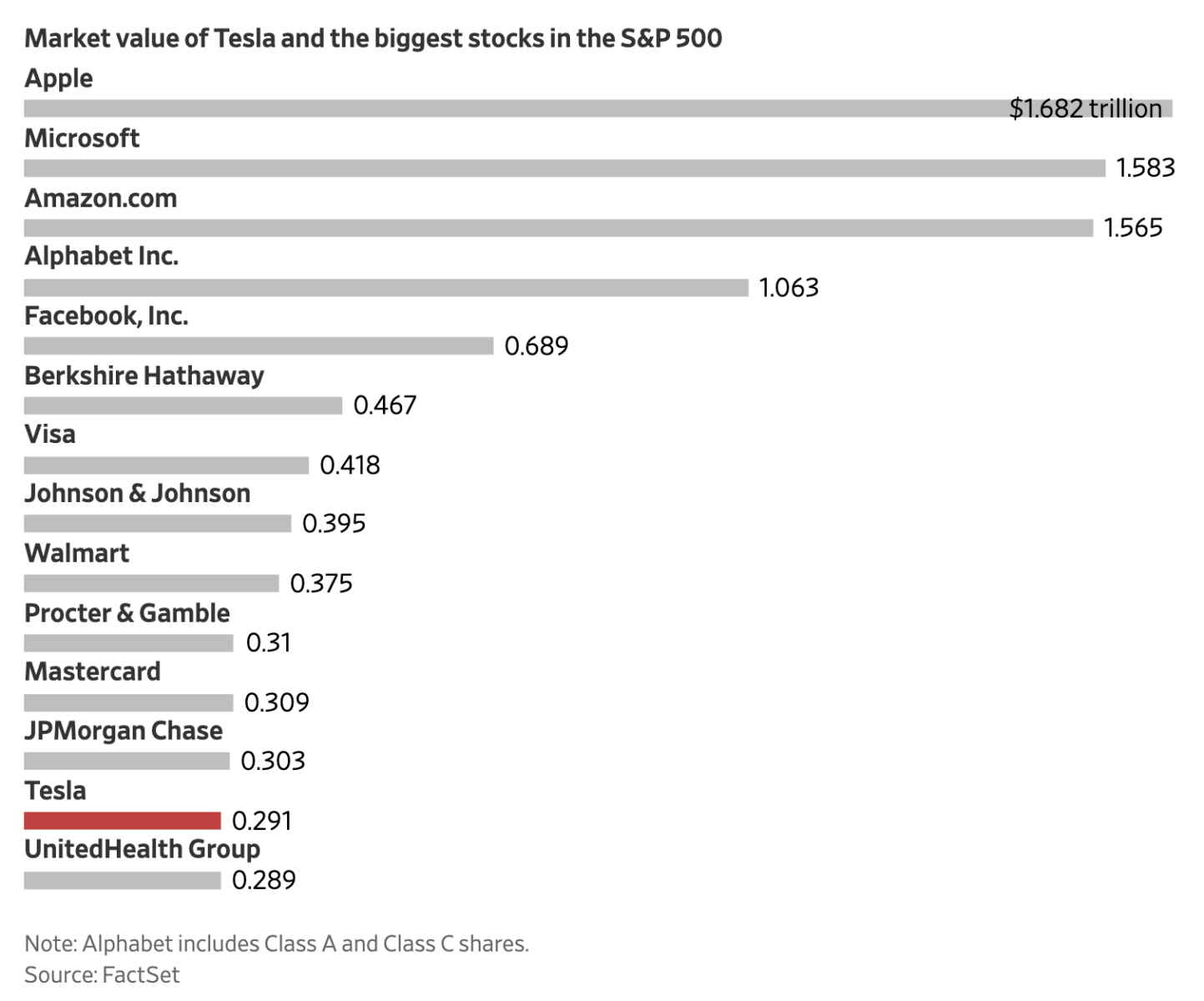

Tesla Knocks on S&P 500’s Door

Source: WSJ

Sign up for our reads-only mailing list here.