My back to work morning train WFH reads:

• Money Managers Bracing for Upheaval With Stocks Near Record: Some of the biggest money managers are vexed by the same paradox troubling everyone else: Stocks are near an all-time high, but the world still seems to be falling apart (Bloomberg) see also The Median S&P Stock Has Never Been More Expensive: The S&P’s latest record has reignited a longstanding debate about how much attention investors should pay to valuations (Wall Street Journal)

• A Love Letter to the Fed From the Adoring Stock Market:1 Dear Fed, Hey there! It’s me, the stock market. I know it’s weird to write you like this, but I felt like I needed to drop a quick thank-you note for everything you’ve done for me this year. (Businessweek)

• Bets against US stocks drop to 15-year low as market rallies: Short positions in US stocks have dropped to their lowest level in more than a decade, as this year’s record-breaking rally inflicts big losses on investors seeking to profit from declining share prices. (Financial Times)

• The Tricky Challenge of Measuring Governance: The often-overlooked part of ESG, how companies are managed, demands diligence and good sense, not easy to bring off. (CIO)

• Urban Exiles Are Fueling a Suburban Housing Boom Across the U.S. Low mortgage rates and the emerging Covid-era lifestyle spark a surge in demand in California’s Inland Empire and other bedroom communities. (Businessweek)

• The Economic Recovery That Isn’t: Then came the virus. The president’s terrible handling of the crisis directly translated into the enormous problems we now face: an economy in its worst crisis since the Great Depression. (New York Times)

• Fighting Anti-Vaccine Pseudoscience, One Viral Video at a Time: The fight against vaccine misinformation has taken on new urgency during the current pandemic. Life won’t return to normal unless an overwhelming majority of people develop some measure of immunity to the novel coronavirus, which essentially means either sufficient numbers get a vaccine or get the disease and develop antibodies, even as many more victims die along the way (Businessweek)

• Why Steve Cohen should be able to make Mets fans happy and buy the team: Steve Cohen is known for many things: Billionaire, hedge-fund trader and owner of a $1 billion art collection that features sculptures and paintings by the likes of Picasso and Jeff Koons. He may soon be something even more illustrious: Owner of the Mets. (NY Post)

• If a Dunk Echoes Across an Empty Gym, Is It Still Must-See TV? Fans have long been prized by leagues for their big spending on tickets and overpriced beer. Now, amid the pandemic, spectators deserve appreciation for making sports entertaining. (New York Times)

• The Only Thing ‘The Simpsons’ Predicted Is Our Stupidity: According to the internet, ‘The Simpsons’ has predicted everything from 9/11 to Trump. But we failed to heed its most dire warnings. (Vice)

Be sure to check out our Masters in Business interview this weekend with Mandell Crawley, head of Private Wealth Management for Morgan Stanley, which manages more than $1 trillion in assets under management.

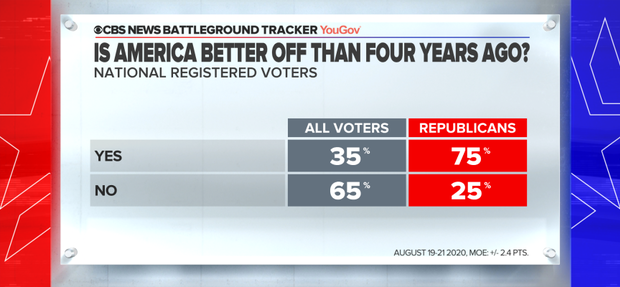

Republicans see U.S. as better off now than 4 years ago; Democrats do not

Source: CBS

Sign up for our reads-only mailing list here.

____________

1. Unlike many others, I don’t believe the Fed deserves as much credit for the market rally that so many other believe. However, this column reflects a belief that many people have, and because of that, I included in in our morning reads as a sample of widespread consensus.