My Two-for-Tuesday morning train WFH reads:

• The 2020 comeback to record highs resembles storied market revivals of the past: The S&P 500 is up 50% over 100 trading days, taking it to the edge of a record high, making this rally the strongest in history and, by some interpretations, ending the shortest bear market ever. (CNBC) see also How Externalities Affect Systems: In each of these cases in the past, when externalities hit, markets would wobble. Often, they would create a spike in fear that led to a sell off, fast and hard. But then, the markets would normalize, and simply resume their prior trend. (The Big Picture)

• How Many Funds Outperformed in 2016, 2017, 2018, and 2019? Less Than 13%: Persistence is largely a myth, study shows. (Institutional Investor)

• The Hardest Investing Questions to Answer: Since nothing works all the time, you have to be willing to bet that the good times won’t last forever but neither will the bad times (A Wealth of Common Sense) see also Six Things You’re Doing Wrong When Buying Stocks on Your Own: Avoid these amateur mistakes before you sink all your money into the market. (Bloomberg)

• The Recession Is About to Slam Cities. Not Just the Blue-State Ones: Those with budgets that rely heavily on tourism, sales taxes or direct state assistance will face particular distress.. (New York Times)

• Home Depot Braced for Covid Pain—Then Americans Remodeled: After lobbying to be open, the big box scrambled to meet demand. Old benchmarks don’t apply, says CEO Craig Menear: ‘None of that has a correlation anymore.’ (Wall Street Journal) see also FHA Mortgage Delinquencies Reach a Record: Led by New Jersey, with the biggest increase in overall late-payment rate as forbearance protecting many borrowers from foreclosure expires. (Bloomberg)

• Sidewalk Infrastructure is looking to build roads specifically for autonomous cars: Starting in Michigan, Cavnue will be working with partners including Ford, GM, Argo AI, Arrival, BMW, Honda, Toyota, TuSimple and Waymo on standards to develop the physical and digital infrastructure needed to move connected and autonomous cars out of pilot projects and onto America’s highways, freeways, interstates and city streets (TechCrunch)

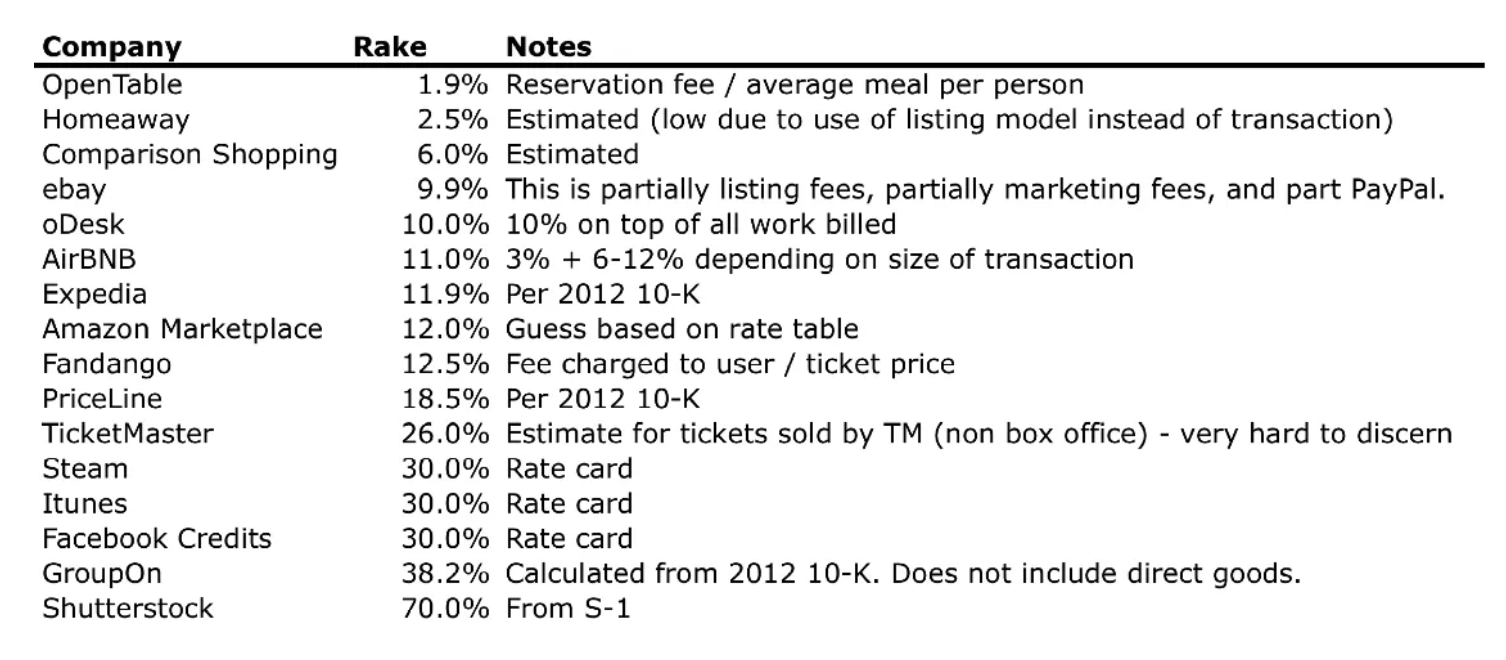

• A Rake Too Far: Optimal Platform Pricing Strategy (Above the Crowd)

• The great tech decoupling is here: Longstanding threats from both the U.S. and China to claw apart the two countries’ interdependent tech economies are finally giving way to reality. (Axios) see also What if Facebook goes down? Ethical and legal considerations for the demise of big tech: Society is becoming increasingly dependent on data-rich, “Big Tech” platforms and social networks, such as Facebook and Google. But what happens to our data when these companies close or fail? (Internet Policy Review)

• How To Vote In The 2020 Election: Click on your state in the map to see a lot of the information you need in order to cast a ballot this fall — by whatever method you choose (FiveThirtyEight) see also How to Vote SAFELY in Person: The claim that mail in votes are fraudulent is false, but the attempt to illegally prevent them is very real. The solution to this is to safely cast your ballot in person. You can do that easily. (The Big Picture)

• Connect With Art—Safely and Outdoors—During the Covid-19 Pandemic: Located in New York’s idyllic Hudson Valley, Storm King is a sprawling outdoor museum that hosts both large-scale sculptures and site-specific commissions. City residents yearning for both the great outdoors and a dose of world-class art make regular pilgrimages to the museum, which is celebrating its 60th anniversary season this year. (Barron’s)

Be sure to check out our Masters in Business interview this weekend with Claudia Sahm, former Section Chief at the Board of Governors of the Federal Reserve System, and Senior Economist at the Council of Economic Advisers for the Obama Administration.

A Rake Too Far: Optimal Platform Pricing Strategy

Source: Above the Crowd

Sign up for our reads-only mailing list here.