My mid-week morning train WFH reads:

• Government Bonds Have Given Us So Much: Do they have anything left to give? The recent fall in cash and bond yields for those developed countries that still had positive yields has left government bonds in a position where they cannot provide two of the basic investment services they have traditionally provided in portfolios – meaningful income and a hedge against an economic disaster. This leaves almost all investment portfolios with both a lower expected return and more risk in the event of a depression-like event than they used to have. (GMO)

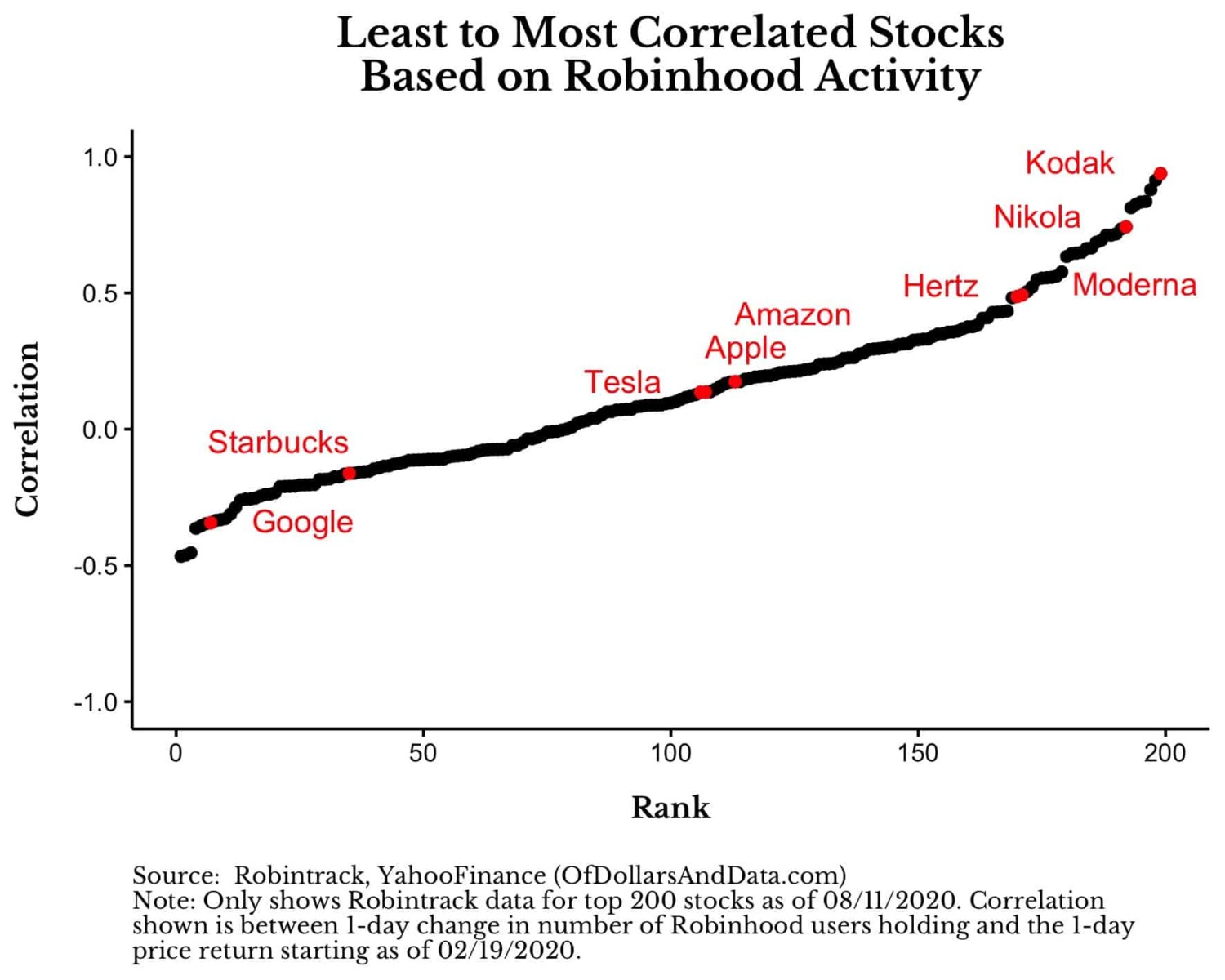

• Individual-Investor Boom Reshapes U.S. Stock Market: Free trading apps, a bull market and Covid-19 lockdowns fuel a surge in mom-and-pop trading. New data show how individual-trading boom may be reshaping the stock market. (Wall Street Journal) but see No, Robinhood Traders Aren’t Affecting the Stock Market: Popularity on Robinhood is not predictive of price changes, but it is predictive of what will make the headlines. (Of Dollars and Data)

• Trump Plan to Block Green 401(k)s Stirs Fund Industry Fury: Fidelity Investments says the Labor Department proposal isn’t “well grounded or supported.” The world’s largest asset managers are speaking out against a Trump administration plan that would make it more difficult for them to incorporate environmental, social and governance factors when making investment decisions, a move that could limit green investing in 401(k) plans. (Green)

• The Secret Adjustment Factor Tesla Uses to Get Its Big EPA Range Numbers: How Tesla puts distance between itself and the competition while still playing by the EPA’s rules. (Car & Driver)

• Want to Be a Landlord? Consider This First: Rental properties can be lucrative, but it’s not exactly easy money. Should you be a landlord? That’s a question some middle-class young people may be asking themselves lately. As Millennials ease into early middle age, those with a bit of money saved up will be looking to park it somewhere. But they should be fully aware of what they’re getting themselves into. (Bloomberg)

• New York City’s Offices Are Empty. How to Gamble on a Recovery. The pandemic hit New York harder than almost any other major city in the world, and while Gotham has gotten the virus under control, its economy has been ravaged. The slow relaxation of formerly strict lockdown rules on businesses like restaurants hasn’t helped; nor has the reluctance of big employers to bring workers back to the office. (Barron’s)

• Apple’s move to make advertising harder on iOS 14 is part of a trend: Facebook is only the latest developer to feel the squeeze. Starting with iOS 14, which will ship this fall, Apple will begin requiring that developers show you a warning that they are collecting your IDFA, and you’ll have to opt in to sharing it. Some large percentage of users can be expected to say “no thanks.” (The Verge)

• Amazon Drivers Are Hanging Smartphones in Trees to Get More Work: A strange phenomenon has emerged near Amazon.com Inc. delivery stations and Whole Foods stores in the Chicago suburbs: smartphones dangling from trees. Contract delivery drivers are putting them there to get a jump on rivals seeking orders, according to people familiar with the matter. (Bloomberg)

• Red Mirage: Dem group warns of apparent Trump Election Day landslide. A top Democratic data and analytics firm told “Axios on HBO” it’s highly likely that President Trump will appear to have won — potentially in a landslide — on election night, even if he ultimately loses when all the votes are counted. (Axios)

• Studying the creativity and intelligence of the octopus: It’s one of the most bizarre creatures on Earth, and not just because it looks so different. The octopus can camouflage itself in a flash; squeeze its entire body through a one-inch hole; and their brains? That’s right, an octopus has one large central brain, and eight mini-brains, one in each arm. (CBS News)

Be sure to check out our Masters in Business interview this weekend with Salim Ramji, Head of iShares Index and ETFs for BlackRock, Ramji’s division manages over $4 trillion of Blackrock’s $7.1 trillion in assets.

No, Robinhood Traders Aren’t Affecting the Stock Market

Sources: Of Dollars and Data

Sign up for our reads-only mailing list here.