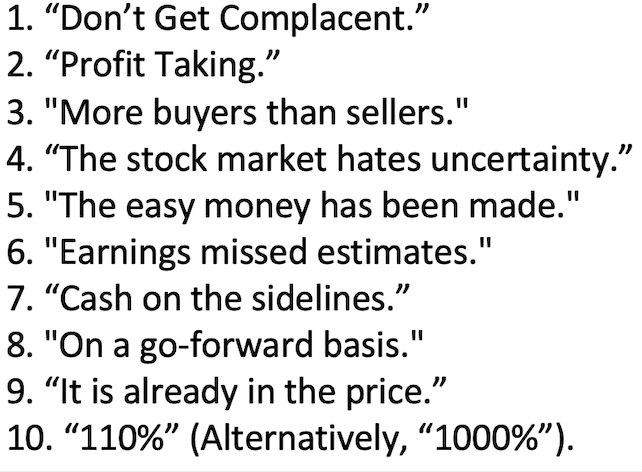

The 10 Most Useless Phrases in Financial Markets

Catchy slogans are not only no substitute for critical analysis, they are often wrong.

Bloomberg, September 23, 2020

It has been more than a year since we last visited the question of annoying financial clichés. I recently asked the Twitterati their least favorite finance phrases, and I was shocked at the overwhelming response. Why does this matter? Useless finance phrases have a pernicious effect on our psyche, leading us to blindly accept ideas that should instead receive critical analysis. It’s not just that catchy phrases are no substitute for actual thinking, they are often wrong.

Once again, let’s consider a new batch of the most meaningless phrases in finance:

1. “Don’t Get Complacent.” What, exactly, should an investor do with this bit of advice? How does a lack of complacency manifest itself in an investment portfolio? Should the recipients of this advice liquidate some or all of their holdings? Or should they merely be on the lookout for some heretofore unknown risk – as they always should?

“Don’t have a smug or uncritical satisfaction with oneself or one’s achievements” makes for a nice sentiment in a high school valedictorian speech or a college paper on Epicurean philosophy, but it is not what street types describe as “actionable advice.”

As someone who is in the advice business, I like to offer specific and identifiable actions, as in “buy this and sell that.” To be fair, something like “Hey, you have had a great run during this rally. Be careful about getting overconfident” is not the worst advice one could get – it’s just squishy and hard to express in a trade.

~~~

I originally published this at Bloomberg, September 23, 2020. All of my Bloomberg columns can be found here and here.