Source: Distribution Channels for Mutual Funds Retail Sales

Today’s discussion is a little “inside baseball,” but stay with me on this.

Imagine going to your doctor, who diagnoses you with a treatable disease. He prescribes a drug, and sends you on your way.

You find out later that the meds he prescribed are part of a limited group of drugs that the pharmaceutical companies have arranged to pay his office a fee (“kickback”) for each prescription he writes. Worse still, these drugs are less effective, and have greater side effects than other drugs that don’t. Oh, and these cost 5 times as much as drug that do not pay a kickback for prescribing them.

You’d be pretty angry, right?

Doctors, of course, cannot do this — but big wire houses can and do this with the mutual funds and exchange traded funds (ETF) they offer. And, it is all perfectly legal.

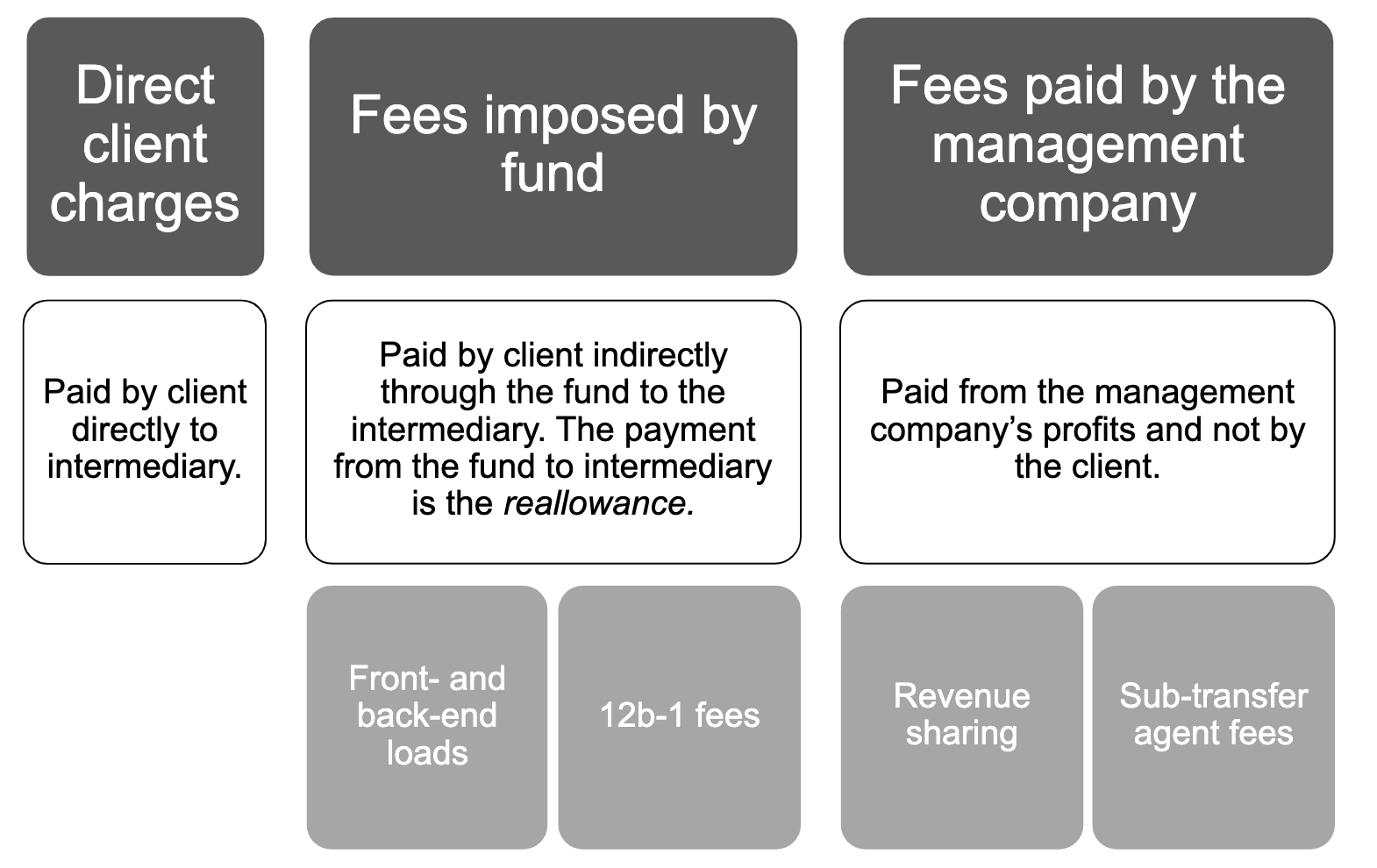

Broker Dealers and Custodians work with Mutual Fund companies, allowing them to participate with their advisors and/or clients for a fee. (Arguably, the most egregious portion of these fees are variable annuities, with kickbacks of 100 bps or more). Those fees are passed along to the investor as part of the total cost (trading, expense ratios, etc.).

According to a survey done by Cerulli Associates:

“From 2015–2020, average strategic market costs for distribution teams in the wirehouse channel rose 64% to reach more than $600,000. At the same time, the largest broker/dealers (B/Ds) have been paring back the number of investment products allowed on their platforms.”

That’s a giant increase. The Fund industry, watching margins fall in the midst of a brutal price war, seems to have had enough of this. As fee compression continues, a response has been formulating: “Nearly all (90%) of distribution executives plan to increase their resource allocation to serving independent RIAs while one-third plan on decreasing their allocation to the wirehouses,” according to Cerulli. Note “independent RIAs” are all fee based fiduciaries who do not accept this sort of fee.

Vanguard Group is one of the firms that refuses to pay to play; BlackRock seems to do very little of it.

Hence, two of the least expensive fund families are not represented on a lot of platforms. I don’t understand how anyone can claim to be a fiduciary and yet still limit what investors can buy, not based on the quality of the product but rather, the kickbacks the fund families pay.

This is an issue worth watching as mutual funds shift their distribution and marketing in the current challenging environment.

More on this in the coming weeks . . .

Sources:

Asset Managers Realign Distribution Resources to Optimize Strategic Marketing Costs (Cerulli Associates, September 2020)

As Wirehouses Ramp Up Costs, Shops Turn to RIAs, (Ignites, September 15, 2020)

Revenue Sharing examples:

Edward Jones, Revenue Sharing Disclosure

Morgan Stanley: Revenue-Sharing Fund Families