My end of week morning train WFH reads:

• The Covid Storm: Coronavirus Hit the U.S. Long Before We Knew: Months before travel bans and lockdowns, Americans were transmitting the virus across the country. (Wall Street Journal)

• Face masks: what the data say: The science supports that face coverings are saving lives during the coronavirus pandemic, and yet the debate trundles on. How much evidence is enough? (Nature)

• Nike was born on the track. Scandal and the pandemic may change its running business. With a long list of superstar athletes, deep coffers built largely on high-priced sneakers and a logo recognized around the world, no sports dynasty has been as consistently dominant as Nike. (Washington Post)

• The 50 Richest Americans Are Worth as Much as the Poorest 50% (165 Million) A look at U.S. wealth data through the first half of 2020 shows stark disparities by race, age and class. (Bloomberg)

• Investors Are Doing Fine as Their Own Money Managers: Everyone has access to low-cost do-it-yourself options, and more people are avoiding traditional pitfalls. (Bloomberg) but see also How Comfortable Are You Holding Stocks For 30 Years? The short-term ups and downs in the stock market garner all of our attention but true investors know long-term returns are the only ones that matter. (A Wealth of Common Sense)

• NextEra Now More Valuable Than Exxon as Clean Power Eclipses Oil: An amazing milestone: Clean tech firm NEE is now bigger than Exxon or Chevron, whose market caps have slumped more than 50% in 2020 as oil demand fell. Renewables are a growth story; integrated oils are in decline. (Green)

• Google’s Supreme Court faceoff with Oracle was a disaster for Google Supreme Court justices seem poised to allow copyrights on APIs. (Ars Technica)

• 7 Restaurant Trends I Don’t Miss As restaurants have reinvented themselves in the pandemic, some changes have been for the better. (Washington Post)

• Emily Oster’s Pandemic Parenting Guidance Is All About the Data Legions of fans are taking their cues from a hyper-rational, best-selling Brown University professor whose version of economics is keeping them sane. (Businessweek)

• Eddie Van Halen, the Shredder Supreme The guitarist, who died this week at 65, gleefully reinvented the rules of being a guitar hero — then bent them again and again. (New York Times) see also ‘Van Halen,’ ‘1984’ Return to the Charts as Van Halen Sales Soar 7,600% Song sales for Van Halen’s catalog jump 7,800%, while streams rise 660%. (Rolling Stone)

Be sure to check out our Masters in Business interview this weekend with Joel Greenblatt, whose Gotham Capital presided over an annualized return of 50% for a decade. His firm Gotham Asset Management manages a variety of funds that have beaten market indices . He is an adjunct professor at Columbia Business School, on value and special situation investing. His latest book is Common Sense: The Investor’s Guide to Equality, Opportunity, and Growth.

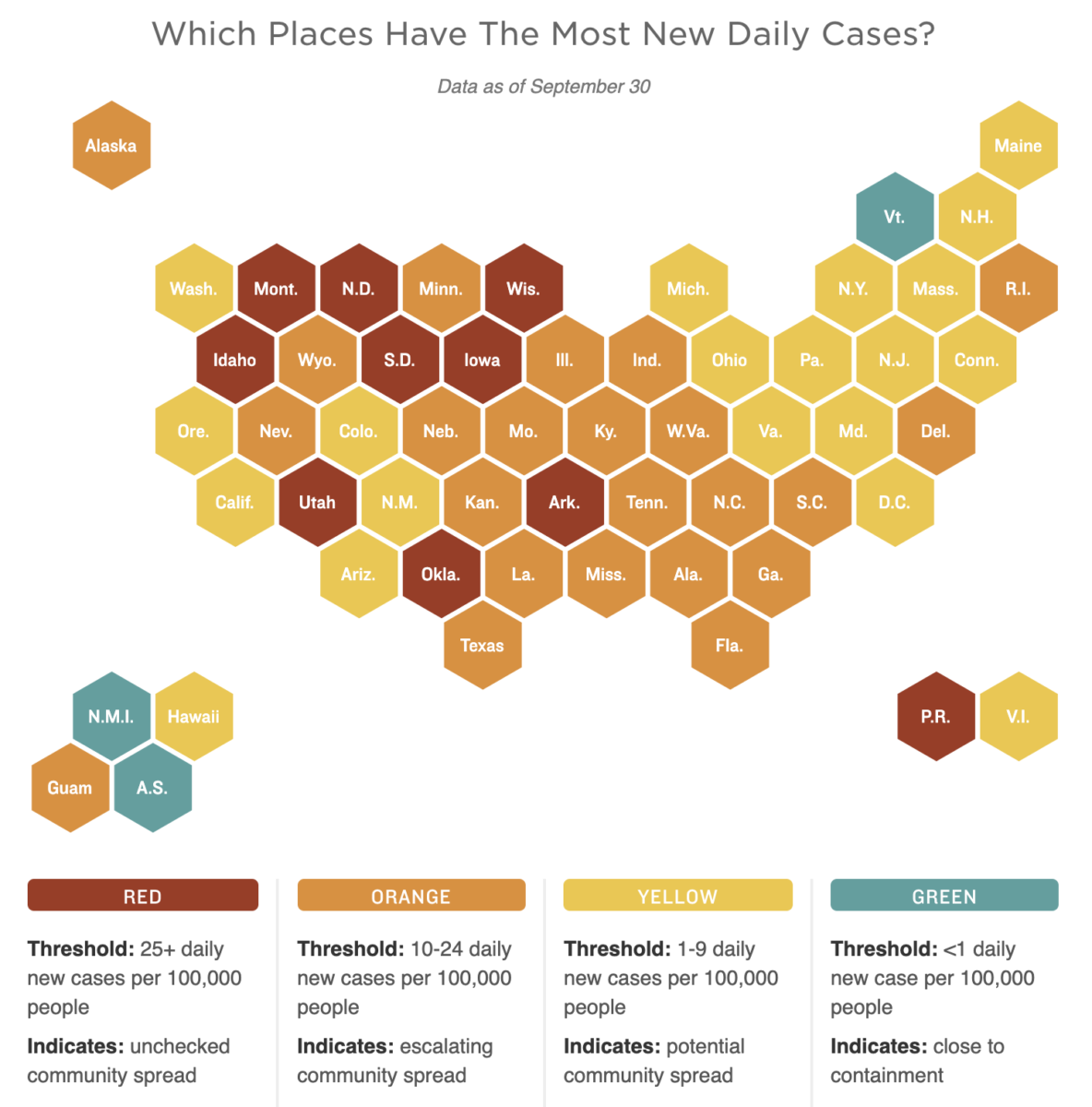

How Severe Is Your State’s Outbreak?

Source: NPR

Sign up for our reads-only mailing list here.