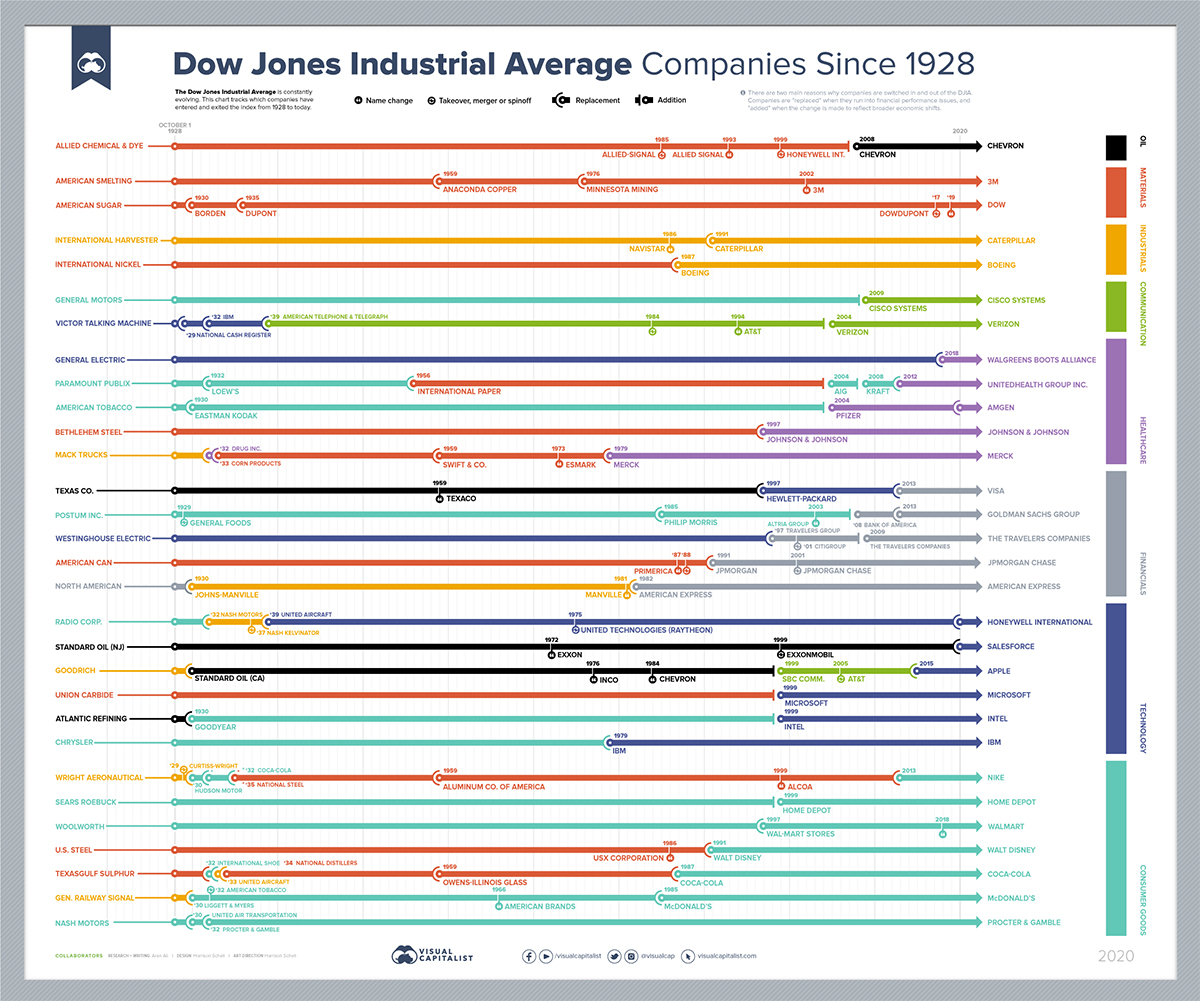

Every Company In and Out of the Dow Jones Industrial Average Since 1928

Source: Visual Capitalist

I hope you did not overlook an absolutely game-changing headline in this morning’s reads from Bloomberg Green: NextEra Now More Valuable Than Exxon as Clean Power Eclipses Oil:

“NextEra Energy Inc., the world’s biggest provider of wind and solar energy, is now more valuable than oil giant Exxon Mobil Corp., once the largest public company on Earth . . . The shift reflects a global energy transition that’s embracing clean energy and rejecting fossil fuels. NextEra has emerged as the world’s most valuable utility, largely by betting big on renewables, especially wind. Exxon has seen its fortunes shift in the other direction as electric vehicles become more widespread and the fight against climate change takes on more urgency.”

Renewables are a growth story; integrated oils are in decline.

To put some numbers on that: NextEra’s market value is $147.4 billion, higher than Exxon’s $142B or Chevron’s $145B.

The takeaway here is that nothing is permanent, everything is in flux and always subject to change.

Consider: Over the past century, there have been 93 changes in the composition of Dow Jones Industrial Average (DJIA). Not only that, but that the average tenure in the DJIA has been trending down for decades. And, it is accelerating: 63% of Dow changes occurred in the latter half of this 92 year sample period.

Heraclitus of Ephesus, a Greek philosopher who lived about 500 BCE, famously observed: “No man ever steps in the same river twice, for it’s not the same river and he’s not the same man.” That is a deep philosophical concept, best summed up for investors as “The Only Thing That Is Constant Is Change.”