My morning train WFH reads:

• Dear IRR: It’s Not You, It’s Me. An investor’s defense of a maligned metric. (Institutional Investor)

• China Has a Few Things to Teach the U.S. Economy Fiscal austerity is a relic of the past. Time to spend. (Bloomberg)

• What Famed Economist Robert Shiller Sees in ‘Vexing’ Stock Market Rebound: The “vexing” stock market recovery may be partly explained by the tech and telecom booster of working from home (healthcare, technology, and the communication-services sectors), as well as low interest rates. (Institutional Investor)

• How Much Retirement Savings Is Enough? Why Couples May Disagree Women have good reason to be more anxious about the size of a nest egg (Wall Street Journal)

• Will a vaccine stop Covid? Even if it’s effective, the logistics of delivering it are monumental (UnHerd) see also Big Drop In COVID-19 Death Rates: A sharp drop in mortality among hospitalized COVID-19 patients suggest physicians are getting better at helping patients survive their illness (NPR)

• Farmers Stick With Trump, Despite Trade-War Pain: Bankruptcies are up pre-pandemic; Suicides skyrocketing. The feedback loop from partisan ideological decision making has never been faster – and the ramifications have never been more dire. (Wall Street Journal)

• How to Break the Hold of Conspiracy Theories The big lesson of 2020 is that everything keeps getting more dishonest. (New York Times)

• What the FCC can and can’t do to Section 230 Trump wants the FCC to help him rewrite Section 230, the law that protects the internet as we know it. But the agency isn’t that powerful. (Vox)

• A Pioneering Appetite The story of America’s first culinary celebrity: James Andrews Beard was 310 pounds of blazing appetite—for money, for applause, for butter, for more butter. He dreamed of a life in theater, but instead invented the television cooking program and the gourmet hamburger. (American Scholar)

• Sacha Baron Cohen: This Time He’s Serious Reviving his Borat character and playing the political activist Abbie Hoffman, the actor feels he “had to ring the alarm bell and say that democracy is in peril this year.” (New York Times)

Be sure to check out our Masters in Business interview this weekend with Ray Dalio, founder and Chairman of Bridgewater Associates, the world’s largest hedge fund. His latest book, The Changing World Order: Why Nations Succeed and Fail, will be published January 12, 2021.

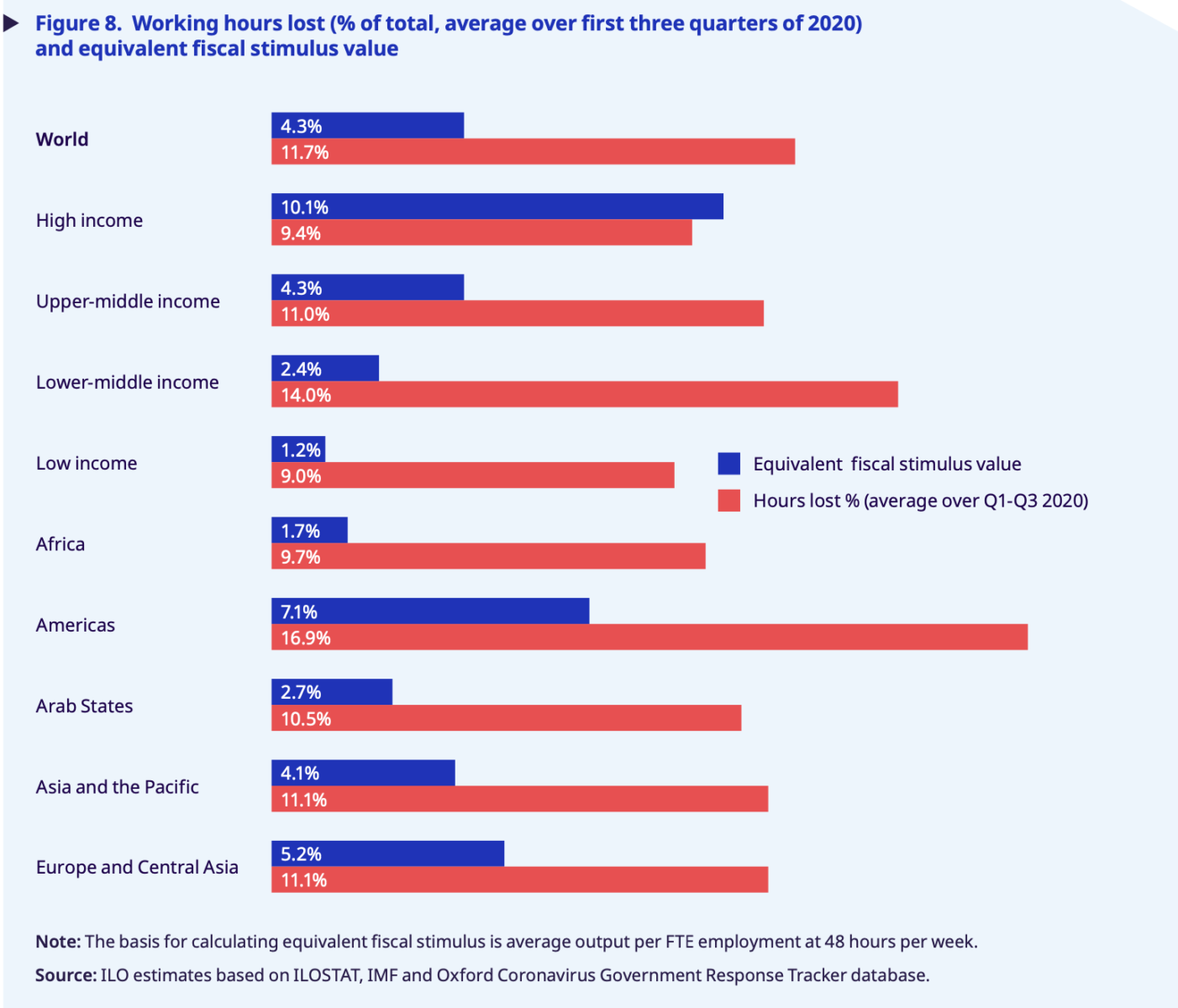

Stimulus packages don’t go far enough

Source: International Labour Organization via World Economic Forum

Sign up for our reads-only mailing list here.